Experian 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements 137

34. Retirement benet assets and obligations

(a) Retirement benet arrangements

(i) Funded pension arrangements

The Group operates dened benet and dened contribution pension plans in a number of countries. A dened benet pension plan denes an

amount of pension benet that an employee will receive on retirement, usually dependent on one or more factors such as age, years of service

and compensation. A dened contribution pension plan denes the amount of contributions that are paid by the Group into an independently

administered fund.

The Group’s principal dened benet plan is the Experian Pension Scheme which provides benets for certain UK employees but was closed

to new entrants in the year ended 31 March 2009. The Group provides a dened contribution plan, the Experian Money Purchase Pension Plan,

to other eligible UK employees. Both plans are governed by trust deeds which ensure that their nances and governance are independent from

those of the Group. In North America and Latin America, benets are determined in accordance with local practice and regulations and funding

is provided accordingly. There are no other material funded pension arrangements.

The Experian Pension Scheme has rules which specify the benets to be paid and is nanced accordingly. A full actuarial funding valuation

of this plan is carried out every three years with interim reviews in the intervening years. The latest full valuation was carried out as at 31 March

2010 by independent, qualied actuaries, Towers Watson Limited, using the projected unit credit method. Under this method of valuation the

current service cost will increase as members approach retirement due to the ageing active membership of the plan. There was a surplus at the

date of the 2010 full actuarial valuation and accordingly no decit repayment contributions are currently required. The next full valuation will be

carried out as at 31 March 2013. As indicated below, the scheme has been affected by the requirement of the UK Government that the Consumer

Prices Index (the ‘CPI’) rather than the Retail Prices Index (the ‘RPI’) be used as the ination measure for determining the minimum pension

increases to be applied to statutory index-linked features of retirement benets.

(ii) Unfunded pension arrangements

The Group has had unfunded pension arrangements in place for a number of years designed to ensure that certain directors and senior

managers in the UK who are affected by the earnings cap are placed in broadly the same position as those who are not. Additionally there are

unfunded arrangements for one current director of the Company and certain former directors and employees of Experian Finance plc. The Group

also has in place arrangements which secure certain of these unfunded arrangements in the UK by granting charges to an independent trustee

over independently managed portfolios of marketable securities owned by the Group. The amount of assets so charged is adjusted periodically

to keep the ratio of assets charged to the discounted value of the accrued benets secured as close as possible to the corresponding ratio in

the Experian Pension Scheme. The total value of such assets at 31 March 2011 was US$36m (2010: US$32m) and these are reported as available

for sale nancial assets (note 30). Further details of the pension arrangements for directors appear in the audited part of the report on directors’

remuneration.

(iii) Post-retirement healthcare arrangements

The Group operates plans which provide post-retirement healthcare benets to certain retired employees and their dependant relatives.

The principal plan relates to former employees in the UK and, under this plan, the Group has undertaken to meet the cost of post-retirement

healthcare for all eligible former employees who retired prior to 1 April 1994 and their dependants.

(b) Retirement benet assets and obligations - disclosures

The disclosures required by IAS 19 ‘Employee benets’, which relate to the Group’s UK dened benet pension arrangements and post-

retirement healthcare obligations only, are as follows:

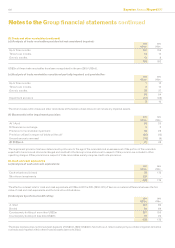

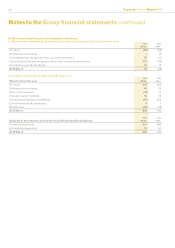

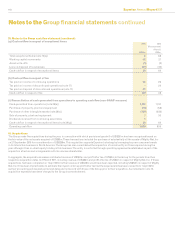

(i) Retirement benet assets/(obligations) recognised in the Group balance sheet 2011

US$m

2010

US$m

Retirement benet assets/(obligations) - funded plans:

Fair value of funded plans' assets 913 822

Present value of funded plans’ liabilities (807) (860)

Surplus in the funded plans 106 -

Decit in the funded plans - (38)

Retirement benet obligations - unfunded plans:

Present value of unfunded pension obligations (39) (36)

Liability for post-retirement healthcare (12) (14)

Retirement benet obligations - unfunded plans (51) (50)

Net retirement benet assets/(obligations) 55 (88)