Experian 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 Experian Annual Report 2011

Report on directors’ remuneration continued

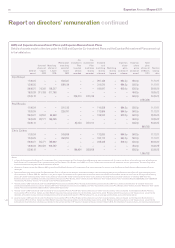

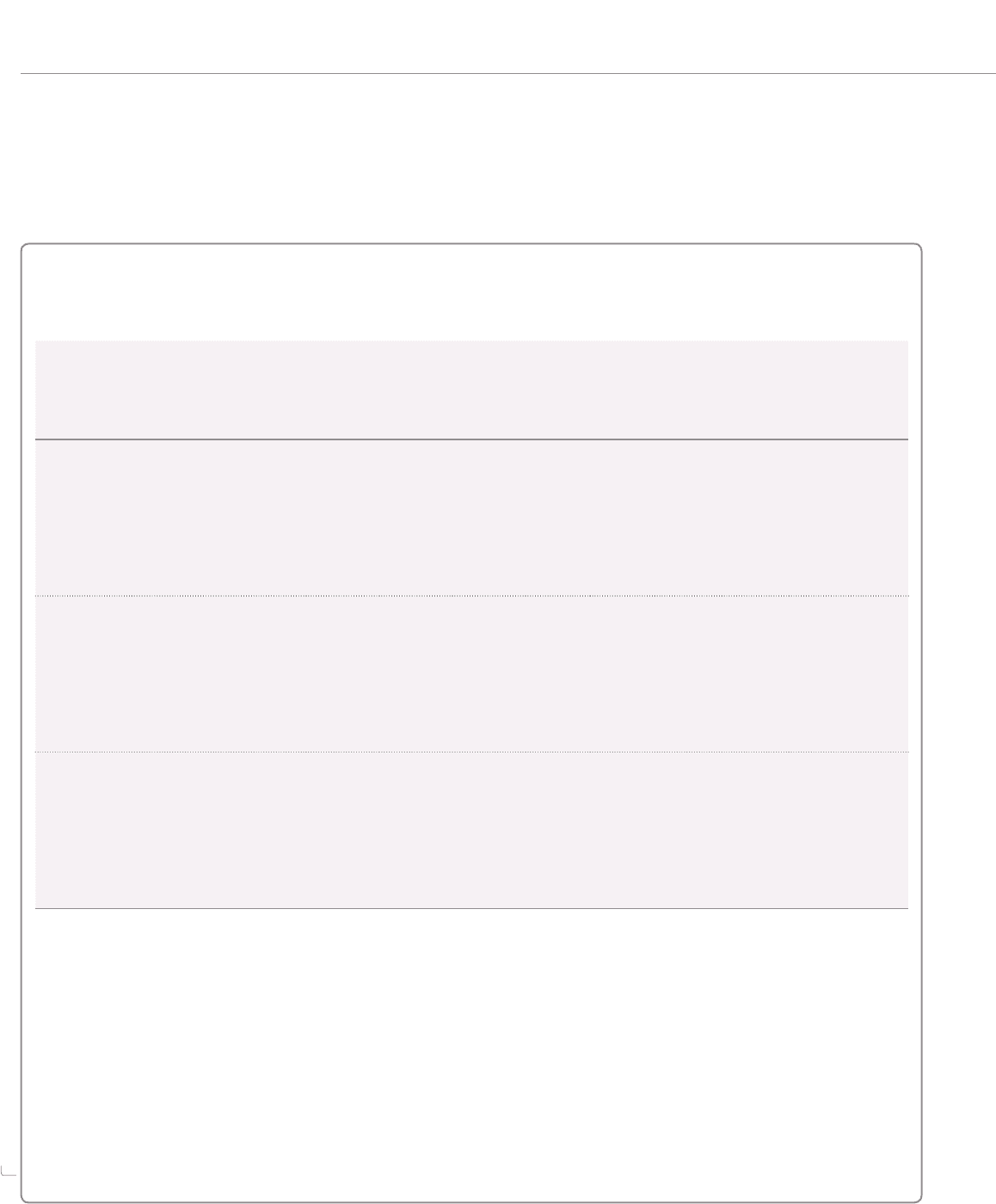

GUS and Experian Co-investment Plans and Experian Reinvestment Plans

Details of awards made to directors under the GUS and Experian Co-investment Plans and the Experian Reinvestment Plans are set out

in the table below.

Date of

award

Invested

shares at

1 April

2010

Matching

shares at

1 April

2010

Reinvested

matching

award at

1 April

2010

Co-

investment

Plan

invested

shares

awarded

Co-

investment

Plan

matching

shares

awarded

Invested

and

matching

shares

released

Matching

shares

lapsed

Experian

share

price

on date of

release

Experian

share

price

on date of

award

Total

plan

shares at

31 March

2011

Normal

vesting

date

Don Robert

11.06.04 – – 594,337 – – 297,168 – 684.5p 560.0p 11.10.11

13.06.05 – – 629,139 – – 314,570 – 684.5p 560.0p 11.10.11

29.06.07 74,340 106,307 – – – 180,647 – 602.0p 630.0p 29.06.10

18.06.09 311,768 311,768 – – – – – – 464.0p 18.06.12

03.06.10 – – – 306,374 612,748 – – – 636.0p 03.06.13

2,154,396

Paul Brooks

11.06.04 – – 221,136 – – 110,568 – 684.5p 560.0p 11.10.11

13.06.05 – – 225,791 – – 112,896 – 684.5p 560.0p 11.10.11

29.06.07 44,544 63,999 – – – 108,543 – 602.0p 630.0p 29.06.10

18.06.09 99,177 168,098 – – – – – – 463.3p 18.06.12

03.06.10 – – – 83,033 287,014 – – – 636.0p 03.06.13

860,785

Chris Callero

11.06.04 – – 345,869 – – 172,935 – 684.5p 560.0p 11.10.11

13.06.05 – – 384,224 – – 192,112 – 684.5p 560.0p 11.10.11

29.06.07 85,777 122,662 – – – 208,439 – 602.0p 630.0p 29.06.10

18.06.09 200,422 200,422 – – – – – – 464.0p 18.06.12

03.06.10 – – – 196,954 393,908 – – – 636.0p 03.06.13

1,356,752

Notes:

1 In line with the rules of the Experian Co-investment Plan, invested shares for Paul Brooks from 2009 onwards were purchased with his bonus net of tax. In line with the rules of the Experian

North America Co-investment Plan, invested shares for Don Robert, Paul Brooks (until 2007) and Chris Callero were calculated with reference to their gross bonus. The matching share

awards are based on the gross value of the bonus deferred.

2 Awards to directors under the 2004 and 2005 cycles of the GUS North America Co-investment Plan were reinvested in awards under the Experian North America Reinvestment Plan at

demerger.

3 Release of matching shares under the Reinvestment Plan is subject to the retention of reinvested shares, continued employment and a performance condition with a performance period

which ended on 31 March 2009. As detailed in last year's report, the outcome of this performance condition was such that 92% of the shares subject to it will vest on the applicable vesting

dates. 25% of the matching shares which vest subject to time and 50% of the matching shares which vest subject to the performance condition vested on 11 October 2010 when the

Experian share price was 684.5p. Dividend equivalents were paid to Paul Brooks, Chris Callero, and Don Robert on their vested shares. They received £101,229, US$286,562, and US$480,214

respectively. No further awards will be made under the Reinvestment Plan.

4 Awards made in 2007 were made under the GUS North America Co-investment Plan. Vesting of the matching awards made in 2007 was subject to the retention of invested shares and

continued employment and occurred on 29 June 2010 when the Experian share price was 602.0p. Dividend equivalents were paid to Paul Brooks, Chris Callero and Don Robert on their vested

shares. They received £39,944, US$128,190 and US$111,098 respectively.

5 Awards made in 2009 were made under the Experian Co-investment Plan to Paul Brooks (at the share price at which invested shares were purchased) and the Experian North America

Co-investment Plan to Chris Callero and Don Robert (based on the average share price for the three days prior to grant). Release of matching shares under these plans is subject to the

retention of invested shares, continued employment and the achievement of growth in PBT of at least 3% p.a. on average over the three-year performance period.

6 Awards made in 2010 were made under the Experian Co-investment Plan to Paul Brooks (at the share price at which invested shares were purchased) and the Experian North America

Co-investment Plan to Chris Callero and Don Robert (based on the average share price for the three days prior to grant). Release of matching shares under these plans is subject to the

achievement of performance conditions as detailed in the section entitled ‘CIP awards in respect of the year ended 31 March 2010’, the retention of invested shares and continued employment.

78