Experian 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

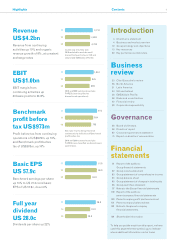

Highlights Contents 1

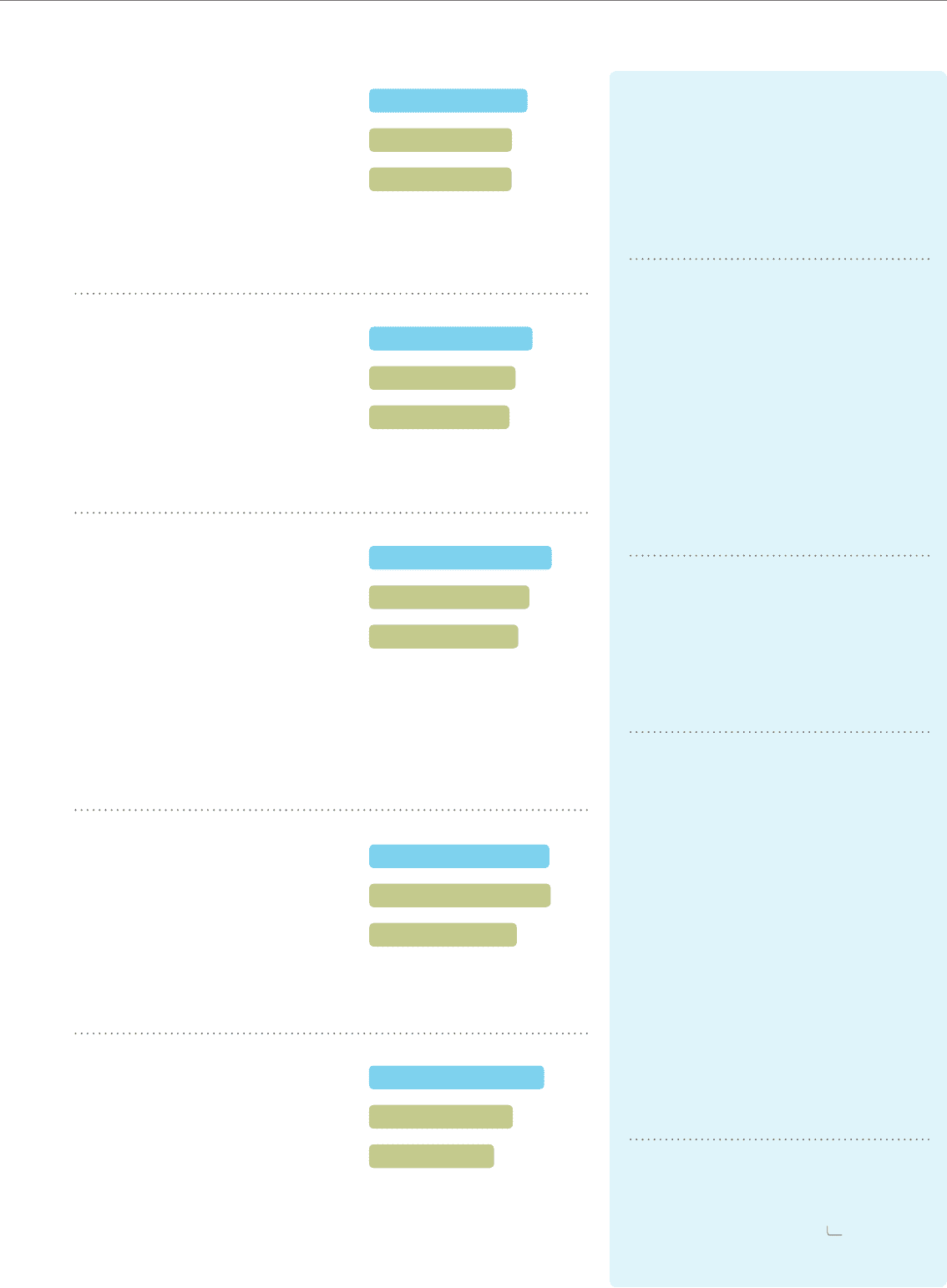

Full year

dividend

US 28.0c

Dividends per share up 22%

28.0

23.0

20.0

09

10

11

Continuing activities only.

2010 restated to exclude small

discontinuing activities in UK and

Ireland and EMEA/Asia Pacific.

3,803

10

3,79009

4,21411

Revenue

US$4.2bn

Revenue from continuing

activities up 10% and organic

revenue growth of 8%, at constant

exchange rates

2010 and 2009 restated to exclude

FARES (now classified as

discontinued operations).

1,044

935

896

09

10

11

EBIT

US$1.0bn

EBIT margin from

continuing activities up

30 basis points to 24.8%

See note 7 to the Group financial

statements for definition of Benchmark

profit before tax.

2010 and 2009 restated to exclude

FARES (now classified as discontinued

operations).

854

973

795

09

10

11

Benchmark

profit before

tax US$973m

Profit before tax from continuing

operations of US$679m, up 13%,

and Benchmark profit before

tax of US$973m, up 14%

57.9

59.0

48.0

09

10

11

Basic EPS

US 57.9c

Benchmark earnings per share

up 10% to US 70.0c and basic

EPS of US 57.9c, down 2%

Introduction

3 Chairman’s statement

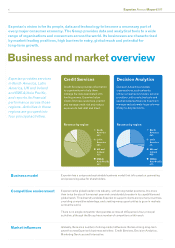

4 Business and market overview

10 Group strategy and objectives

13 Key resources

20 Key performance indicators

Business

review

23 Chief Executive’s review

28 North America

31 Latin America

33 UK and Ireland

36 EMEA/Asia Pacific

38 Risks and uncertainties

42 Financial review

50 Corporate responsibility

Governance

56 Board of directors

58 Directors’ report

62 Corporate governance statement

74 Report on directors’ remuneration

Financial

statements

91 Report of the auditors:

Group financial statements

92 Group income statement

93 Group statement of comprehensive income

94 Group balance sheet

95 Group statement of changes in total equity

96 Group cash flow statement

97 Notes to the Group financial statements

149 Report of the auditors:

parent company financial statements

150 Parent company profit and loss account

151 Parent company balance sheet

152 Notes to the parent company

financial statements

159 Shareholder information

To help you get the most from this report, we have

used this page reference symbol,

00

, to indicate

where additional information can be found.