Experian 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Risks and uncertainties

Risk factors

The following information sets out the risk factors which the Group believes could cause its future results to differ materially from expected

results. However, other factors could also adversely affect the Group’s results and so the factors discussed below should not be considered

to be a complete set of all potential risks and uncertainties.

The Group’s approach to identifying, assessing, managing and reporting risks is formalised in its risk management framework described in

this section. Risks that the Group faces are critically evaluated throughout the year and synthesised in the year’s report. Product/service or

technology obsolescence has been added as a principal risk in recognition of innovation being integral to Experian’s success.

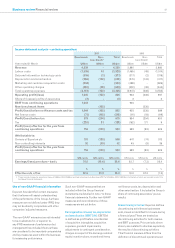

Principal risks

Risk area Potential impact Mitigation strategies

Loss or inappropriate usage

of data

Related strategy:

• Focus on data and analytics

>The Group’s business requires the appropriate

and secure utilisation of consumer and other

sensitive information by its business units or its

third party partners. Internet-based electronic

commerce requires the secure transmission of

confidential information over public networks,

and several of our products are accessed

through the internet. Security breaches in

connection with maintaining data and the

delivery of our products and services could

harm our reputation, business and operating

results. Please refer to the key resources

overview section of this report for further

information on how data is considered to be the

foundation of Experian’s value proposition.

>The Group has established rigorous

information security policies, standards,

procedures, and recruitment and training

schemes, which are embedded throughout

its business operations. The Group also

screens new third party partners carefully

and conducts targeted audits on their

operations. Continued investments

are made in IT security infrastructure,

including the significant use of data and

communications encryption technology.

Dependence upon third

parties to provide data and

certain operational services

Related strategy:

• Focus on data and analytics

• Optimise capital efficiency

>The Group’s business model is dependent

upon third parties to provide data and certain

operational services, the loss of which

could significantly impact the quality of and

demand for our products. Similarly, if one or

more of our outsource providers, including

third parties with whom we have strategic

relationships, were to experience financial or

operational difficulties, their services to us

would suffer or they may no longer be able

to provide services to us at all, significantly

impacting delivery of our products or services.

>The Group’s legal, regulatory and government

affairs departments work closely with

senior management to adopt strategies to

help secure and maintain access to public

and private information. The Group’s

global strategic sourcing department

works closely with senior management

to select and negotiate agreements with

strategic suppliers based on criteria such

as delivery assurance and reliability.

Exposure to legislation or

regulatory reforms

Related strategy:

• Focus on data and analytics

>Legislative, regulatory and judicial systems

in the countries in which the Group operates

are responding to changing societal attitudes

about how commercial entities collect, manage,

aggregate, use, exchange and sell data. Some

proposed changes may adversely affect the

Group’s ability to undertake these activities in

a cost effective manner. The growing ubiquity

of the internet drives public concerns about

how consumer information is collected and

used for marketing, risk management and

fraud detection. These concerns may result

in new laws, regulations and enforcement

practices, or pressure upon industries to adopt

new self-regulation. In addition, the Group is

subject to changes in specific countries’ tax

laws. Our future effective tax rates could be

adversely affected by changes in tax laws.

>The Group’s legal, regulatory and government

affairs departments work closely with senior

management to adopt strategies and educate

lawmakers, regulators, consumer and privacy

advocates, industry trade groups and other

stakeholders in the public policy debate. This

includes negotiating, advocating and promoting

new industry self-regulatory standards, when

appropriate, to address consumer concerns

about privacy and information sharing. In

addition, the Group retains internal and

external tax professionals that monitor the

likelihood of future tax changes. These risks

are generally outside the control of the Group.

Regulatory compliance

Related strategy:

• Focus on data and analytics

>The Group’s businesses must comply with

federal, regional, provincial, state and other

jurisdictional regulations and best practice.

These include rules that authorise and

prescribe credit reporting protocols, as well as

general information privacy, anti-corruption

and information security requirements.

Non-compliance could lead to penalties,

increased prudential requirements, enforced

suspension of operations or, in extreme cases,

withdrawal of authorisations to operate.

>To the best of Experian’s knowledge, the

Group is in compliance with data protection

requirements in each jurisdiction in

which it operates. The Group’s regulatory

compliance departments work closely

with the businesses to adopt strategies to

help ensure compliance with jurisdictional

regulations and identified business ethics

which includes active monitoring of its

collection and use of personal data. Risk based

procedures have been developed to ensure

compliance with the UK Bribery Act 2010.

39