Experian 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2011

Risks and uncertainties continued

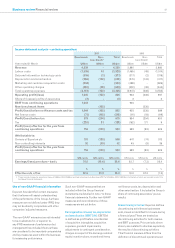

Risk area Potential impact Mitigation strategies

Product/service or

technology obsolescence

Related strategy:

• Drive profitable growth

• Optimise capital efficiency

>Without the timely introduction of new or

enhanced products and services, the Group’s

offerings will become technologically or

commercially obsolete over time. Without

continued investments in our technology

infrastructure, the Group may not be able to

support changes in the way our businesses

and clients use and purchase information.

In either case, revenue and operating

results would suffer. Refer to the business

and market overview section of this report

for some examples of how business units

are delivering innovative solutions.

>Product innovation is a key driver of growth

for Experian in all our markets and we have

continued to invest strongly in new data

sources and new analytical products,

together with the platforms that support

their worldwide delivery. Over 10% of Group

revenues come from products developed

during just the past five years. In addition,

nearly 20% of our global costs are in IT and

data. Detailed competitive and market analyses

are performed which provide the foundation

of a rigorous product and services investment

identification and selection process.

Interruptions in business

processes or systems

Related strategy:

• Optimise capital efficiency

• Drive profitable growth

>The Group’s ability to provide reliable

services largely depends on the efficient and

uninterrupted operation of our computer

network systems, data and call centres, as well

as maintaining sufficient staffing levels. System

or network interruptions, or the significant

reduction in key staff or management resulting

from a pandemic outbreak, could delay

and disrupt our ability to develop, deliver or

maintain our products and services, causing

harm to our business and reputation and

resulting in loss of clients or revenue.

>The Group has strict standards, procedures

and training schemes for physical security.

Comprehensive business continuity plans

and incident management programmes

are maintained to minimise business and

operational disruptions including pandemic

incidents. The Group maintains full duplication

of all information contained in databases

and runs back-up data centres. Support

arrangements, strict standards, procedures

and training schemes for business continuity

have been established with third party

vendors. The Group also monitors potential

pandemic threats and adjusts action plans.

Dependence on recruitment

and retention of highly

skilled personnel

Related strategy:

• Focus on data and analytics

• Drive profitable growth

>The ability of the Group to meet the demands of

the market and compete effectively with other

IT suppliers is, to a large extent, dependent on

the skills, experience and performance of its

personnel. Demand is high for individuals with

appropriate knowledge and experience in the

IT and business services market. The inability

to attract, motivate or retain key talent could

have a serious consequence on the Group’s

ability to service client commitments and grow

our business. Please refer to the key resources

section of this report for further information

on how Experian is investing in its people.

>Effective recruitment programmes are

ongoing across all business areas, as

well as personal and career development

initiatives. Talent identification and

development programmes have been

implemented and are reviewed annually.

Compensation and benefits programmes are

competitive and also regularly reviewed.

Other risks

Risk area Potential impact Mitigation strategies

Exposure to consolidation

among clients and markets

Related strategy:

• Drive profitable growth

>The financial services, mortgage, retail and

telecommunications industries are intensely

competitive and have been subject to

consolidation in recent years. Consolidation

in these and other industries could result

in reductions in the Group’s revenue

and profits through price compression

from combined service agreements or

through a reduced number of clients.

>No single client accounts for more than 2%

of the Group’s revenue, which reduces the

probability of this potential risk having a

significant impact on the Group’s business.

In addition, the Group continues to expand

in other market segments such as the public

sector, telecoms, utilities and healthcare, as

well as invest in a wide range of counter-cyclical

products and solutions, across all relevant

business lines. Refer to the key performance

indicators section of this report for additional

information on Experian’s revenue dependency

on the top 20 clients and percentage of revenue

from verticals other than financial services.

40