Experian 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2011

26

Chief Executive’s review continued

Marketing Services delivered growth,

with recovery in telecommunications

and utilities helping to offset slower

decision-making in the public

sector segment, while at Interactive,

enhancements to our offer are

delivering greater value to consumers.

We continue to build scale across

EMEA/Asia Pacic, which accounted

for US$0.5bn of Group revenue in the

year. We are seeing strong demand

for our Decision Analytics products,

and feel we are well placed to benet

from rising credit penetration across

emerging markets in Europe, such

as Turkey and Russia. Meanwhile in

Marketing Services, we are beneting

from the investments we have made

to expand our global footprint, which

allows us to grow our business

locally in regional markets as well as

to grow our relationships alongside

multinational organisations. These

factors have more than offset weak

conditions in our more established

bureau markets.

Strategic progress

We made progress during the nancial

year against our ve strategic goals to:

l Extend our global lead in credit

information and analytics;

l Create successful businesses in new

customer segments;

l Build large-scale operations in major

emerging consumer economies;

l Become the global leader in digital

marketing services; and

l Become the most trusted consumer

brand for credit information and identity

protection services.

During the year, we invested in a

series of initiatives through our global

growth programme aimed at achieving

these goals. We are pleased with

our progress and, collectively, these

initiatives contributed 2% to organic

revenue growth in the year, which is in

line with our previous expectations.

The top contributing initiatives were

fraud prevention, consumer protection

products, and the telecommunications,

utilities and SME segments.

Our growth focus means that we

continue to deliver against our strategic

metrics, with 29% of Group revenue

now arising from outside the US and

the UK, 67% from non-nancial verticals

and over 10% generated from product

innovations in the past ve years.

Investment to support growth during

FY11 included approximately 200 basis

points of margin, US$374m by way

of capital expenditure and US$301m

through acquisitions.

For FY12, we will continue to invest to

deliver premium growth on a sustained

basis, both organically and through

selective acquisition opportunities.

Some examples of the growth initiatives

we are pursuing include:

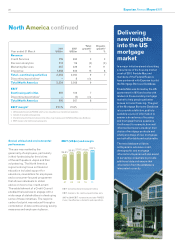

l New technology, as we develop

new platforms and release new

versions of existing software,

bringing new functionality to clients

and supporting cost-effective

expansion in new geographies;

l Completion of the Computec

acquisition and integration into our

Latin America region;

l Organic bureau expansion, in particular

bureau builds in India and Australia;

l Business information development, as

we expand our product range and invest

in new sources of data;

l Multi-channel digital marketing, as

we expand and develop our market

position, for example in the social

media and mobile delivery channels;

and

l Further investment in client service

quality and sales excellence.

In support of these and other initiatives,

we anticipate continued investment

through the income statement in FY12

and capital expenditure in the range of

US$410m to US$440m during that year.

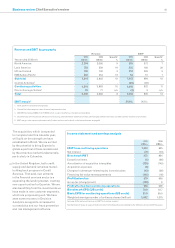

Net debt

Net debt in the year was reduced by

US$126m to US$1,501m at 31 March

2011. EBIT conversion into operating

cash ow was 98%, exceeding our

target of 90% conversion. The reduction

in net debt was after funding net share

purchases of US$349m, consistent

with the previously announced buyback

programme, which has been completed.

At 31 March 2011, the adjusted net

debt to EBITDA gearing ratio was 1.8

times, including the current value of the

Serasa put option of US$870m.

Debt funding

During the year, we completed an 18

month programme to renance our

borrowing facilities, spread debt

maturities and diversify sources of

funding. This included the arrangement

of new ve-year committed revolving

credit facilities totalling US$1,700m with

thirteen leading banks, and the issue in

January 2011 of £400m 4.75% bonds

due 2018, swapped into US dollars.

Following this, our expectation is that

net interest expense will be in the range

of US$65m to US$75m for the year

ending 31 March 2012.

Capital strategy

We remain committed to a prudent but

efcient balance sheet consistent with

our desire to retain a strong investment

grade credit rating. Our target gearing

ratio is 1.75 to 2.0 times, calculated as

net debt adjusted for the current value

of the put option over the minority

shares in Serasa, divided by EBITDA.

36

10