Experian 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2011

34

Interactive

Total and organic revenue growth at

constant exchange rates, was 10%.

Growth in Interactive was driven by

increased membership revenue and

enhanced retention for retail credit

products (CreditExpert).

Financial review

For the UK and Ireland, EBIT from

continuing activities was US$213m, up 5%

at constant exchange rates. EBIT margin

expanded by 80 basis points to 28.9%,

principally reflecting positive operating

leverage in Marketing Services, which

offset negative mix in Credit Services.

Social, ethical and environmental

performance

The UK and Ireland region is very active

in the community and again won awards

from the national charity Business in the

Community (BITC). One of these was to

John Peace, Chairman of Experian and a

champion of community involvement, who

was awarded ‘The Prince’s Ambassador

Award’ by the Prince of Wales. The

region achieved a decrease in its carbon

footprint, which included a 5% reduction

in emissions by the data centre. It also

gained the Carbon Trust Standard and

recertification for ISO14001.

UK and Ireland continued

Ensuring that Experian continues

to have the ‘best data’

The quality and depth of Experian’s data resources has long been a cornerstone

of its success, nowhere more so than in the UK, where the Group has operated

the leading credit bureau for almost three decades. During the past year, Experian

in the UK has been investing in a major new database infrastructure to reinforce

its reputation for having the best data in the market place.

At the core of this investment is a move from siloed data, where information is

stored by category, to person-centric data, where information is maintained

against the individual using a unique personal identification number or PIN.

It enables data to be retrieved more quickly, while also ensuring a more complete

picture of the individual using the full breadth of Experian’s data sources.

Delphi for Customer Management, which allows Experian clients to monitor the

risk profile of their credit customers, was amongst the first products to benefit

from the new infrastructure. The time taken to process client files has now been

reduced by 80% and, just as importantly, the vital information used to make

customer decisions has increased by up to 5%.

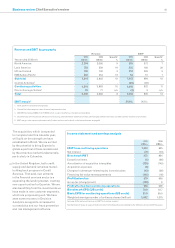

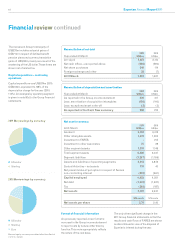

Year ended 31 March

2011

US$m

2010

US$m

Total

growth1

%

Organic

growth1

%

Revenue

Credit Services 225 234 (2) (2)

Decision Analytics 175 175 2 2

Marketing Services 218 212 4 3

Interactive 118 109 10 10

Total – continuing activities 736 730 3 2

Discontinuing activities2 11 62 n/a

Total UK and Ireland 747 792 (4)

EBIT

Continuing activities 213 205 5

Discontinuing activities2 (1) 7 n/a

Total UK and Ireland 212 212 1

EBIT margin328.9% 28.1%

1 Growth at constant exchange rates

2 Discontinuing activities include UK account processing, some UK hosted database activities, UK mortgage software

activities and other smaller discontinuing activities

3 EBIT margin is for continuing business only

2011 Revenue by activity1

Credit Services 30%

Decision Analytics 24%

Marketing Services 30%

Interactive 16%

1 Excludes discontinuing activities