Experian 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2011

46

Credit risk is managed by:

•Dealing only with banks and financial

institutions with strong credit ratings,

within limits set for each organisation;

and

•Close control of dealing activity with

counterparty positions monitored

regularly.

Liquidity risk is managed by:

•Long-term committed facilities to ensure

that sufficient funds are available for

operations and planned expansion; and

•Monitoring of rolling forecasts of

projected cash flows to ensure that

adequate undrawn committed facilities

are available.

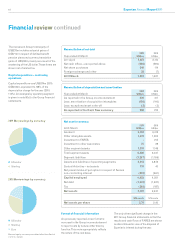

Capital risk management

The objectives in managing capital are:

•To safeguard the ability to continue as a

going concern in order to provide returns

for shareholders and benefits for other

stakeholders; and

•To maintain an optimal capital structure

and cost of capital.

Experian remains committed to:

•A prudent but efficient balance sheet;

and

•A target gearing ratio of 1.75 to 2.0 times

EBITDA, consistent with a desire to

retain a strong investment grade credit

rating.

In order to maintain or adjust the capital

structure, Experian may adjust the amount

of dividends paid to shareholders, return

capital to shareholders, issue or purchase

shares or sell assets to reduce net debt.

Going concern

The Board formed a judgment at the time of

approving the Group and parent company

financial statements that there was a

reasonable expectation that the Group

and the Company had adequate resources

to continue in operational existence for

the foreseeable future. In arriving at this

conclusion the Board took account of:

•Current and anticipated trading

performance which is the subject of

detailed comment in the business review;

•Current and anticipated levels of net

debt and the availability of the committed

borrowing facilities which are detailed

above; and

•Exposures to and management of

financial risks which are summarised

above and detailed in the notes to the

Group financial statements.

For this reason, the going concern basis

continues to be adopted in the preparation

of the Group and parent company financial

statements.

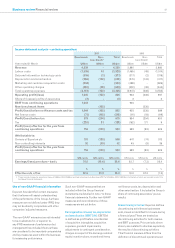

Financial review continued

Helping Vodafone get closer

to its customers

Vodafone is one of the world’s largest mobile communications companies, with

more than 360 million customers. Over the past decade, Experian has developed a

growing relationship with Vodafone, which last year expanded into Greece, India,

Portugal and Turkey, bringing the total number of countries supported to 12.

Experian enables Vodafone to make faster and better informed decisions

throughout the customer lifecycle; whether it’s identifying potential new

customers, setting the most appropriate credit terms, pinpointing additional

sales opportunities or determining the appropriate contact strategy. Through

more insightful and intimate interactions, Experian is helping Vodafone enhance

the customer experience.

Detlef Schultz, CEO of Vodafone Procurement Company, said: “Experian has

become a strategically important global supplier to Vodafone, providing us with

valuable insight that helps us get closer to millions of customers around the world”.