Experian 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 Experian Annual Report 2011

Notes to the Group nancial statements continued

8. Financial risk management (continued)

Liquidity risk

The Group maintains long-term committed facilities to ensure it has sufcient funds available for operations and planned expansions. The

Group monitors rolling forecasts of projected cash ows to ensure that it will have adequate undrawn committed facilities available.

Details of the facilities available to the Group and their utilisation at the balance sheet date are given in note 28. The maturity analysis of

nancial liabilities is given in note 32.

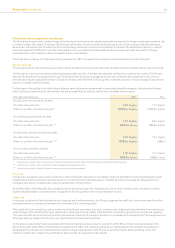

(b) Capital risk management

The Group’s objectives in managing capital are to safeguard its ability to continue as a going concern in order to provide returns for

shareholders and benets for other stakeholders and to maintain an optimal capital structure and cost of capital.

In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to shareholders, return capital to

shareholders, issue or purchase shares or sell assets to reduce net debt. As part of its internal reporting processes the Group monitors capital

employed by operating segment. For this purpose, capital employed is dened as net assets excluding net debt and tax balances. At 31 March

2011 the Group’s capital employed was US$4,453m (2010: US$4,251m). The Group manages its working capital and capital expenditure in order to

meet its target to convert at least 90% of EBIT into operating cash ow and the conversion percentage for the year ended 31 March 2011 was 98%

(2010: 100%).

(c) Fair value estimation

The fair value of derivative nancial instruments and other nancial assets and liabilities is determined by using market data and established

estimation techniques such as discounted cash ow and option valuation models. The fair value of foreign exchange contracts is based

on a comparison of the contractual and year end exchange rates. The fair values of other derivative nancial instruments are estimated by

discounting the future cash ows to net present values using appropriate market rates prevailing at the year end.

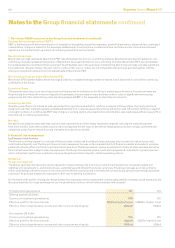

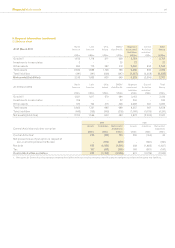

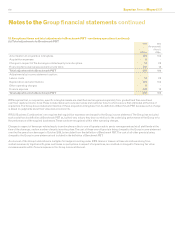

The following table presents an analysis of the Group’s nancial assets and nancial liabilities that are measured at fair value by level, as

required and dened by IFRS 7 ‘Improving disclosures about nancial instruments’:

2011 2010

Level 1

US$m

Level 2

US$m

Level 3

US$m

Total

US$m

Level 1

US$m

Level 2

US$m

Level 3

US$m

Total

US$m

Financial assets:

Loans and receivables - 14 - 14 - 44 - 44

Derivatives used for hedging - 37 - 37 - 43 - 43

Financial assets at fair value

through prot and loss - 8 6 14 - 19 9 28

Available for sale 42 - - 42 33 - - 33

42 59 6 107 33 106 9 148

Financial liabilities:

Derivatives used for hedging - 31 - 31 - 35 - 35

Financial liabilities at fair value

through prot and loss - 33 904 937 - 70 669 739

- 64 904 968 - 105 669 774

Net nancial assets/(liabilities) 42 (5) (898) (861) 33 1 (660) (626)

Assets and liabilities whose valuations are based on unadjusted quoted prices in active markets for identical assets and liabilities are

classied as Level 1 in the above analysis. Assets and liabilities which are not traded in an active market and whose valuations are derived from

available market data that is observable for the asset or liability are classied as Level 2. Assets and liabilities whose valuations are derived

from inputs not based on observable market data are classied as Level 3.

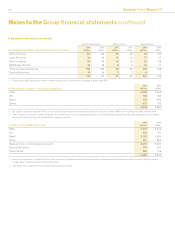

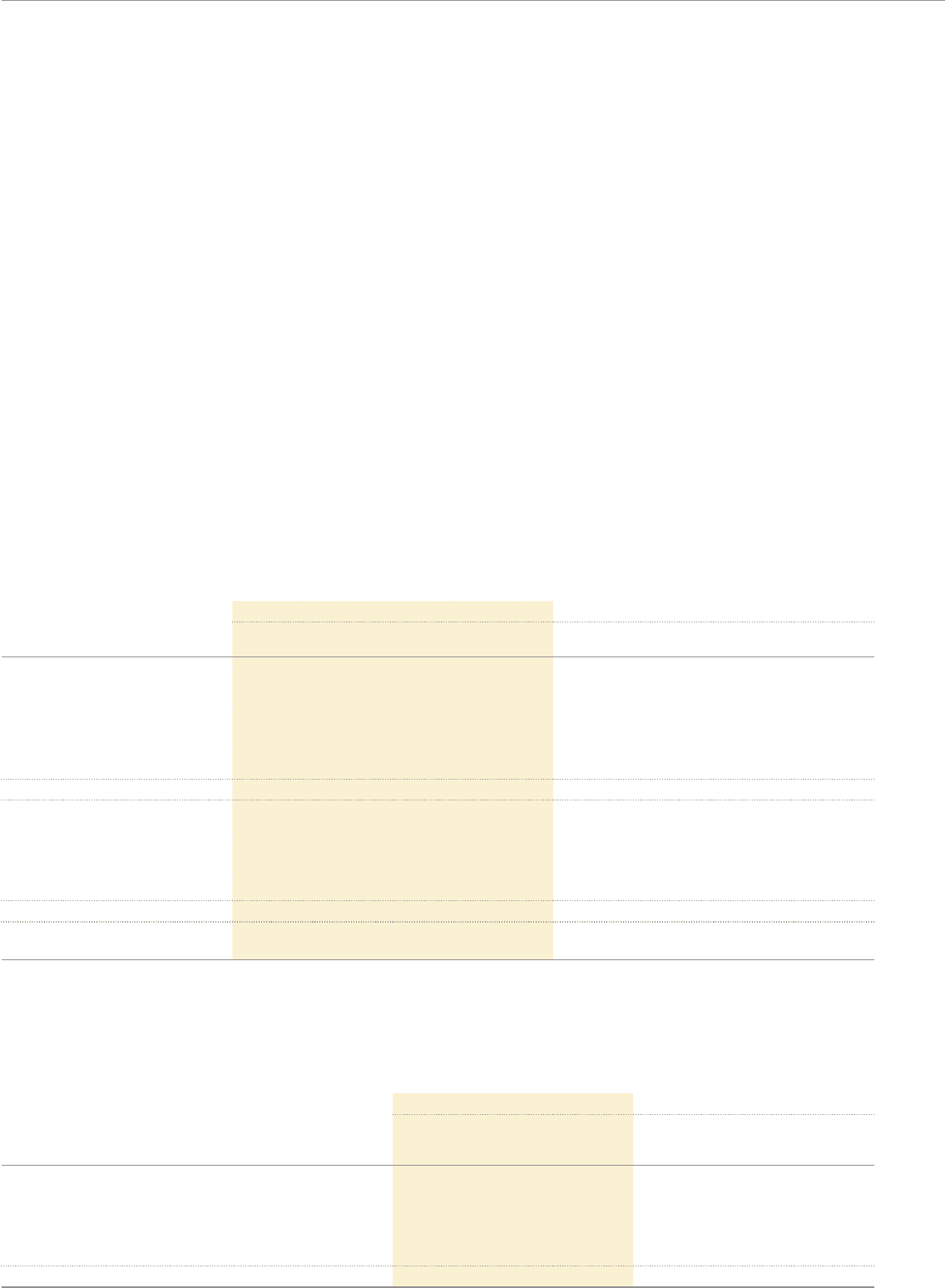

The following table presents an analysis of the changes in nancial assets and liabilities classied as Level 3 which comprise put and call

options associated with corporate transactions:

Year ended 31 March 2011 Year ended 31 March 2010

Serasa put

option

US$m

Other

derivatives

US$m

Total

US$m

Serasa put

option

US$m

Other

derivatives

US$m

Total

US$m

At 1 April (661) 1 (660) (424) - (424)

Additions - (21) (21) - (8) (8)

Valuation gains and losses recognised in income statement (142) (6) (148) (113) 9 (104)

Currency translation gains and losses recognised in other

comprehensive income (67) (2) (69) (124) - (124)

At 31 March (870) (28) (898) (661) 1 (660)