Experian 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements 131

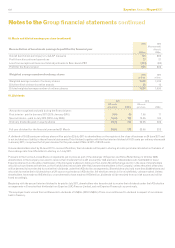

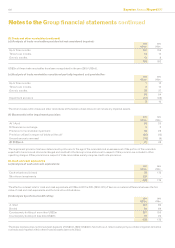

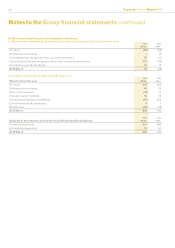

30. Available for sale nancial assets

(a) Analysis of available for sale nancial assets: 2011

US$m

2010

US$m

Listed equity securities - UK (sterling denominated) 36 32

Equity securities - North America (US dollar denominated) - 1

Other trade investments - principally UK and sterling denominated 6 -

42 33

The accounting policies for available for sale nancial assets have been applied to the above items.

(b) Movements on available for sale nancial assets: 2011

US$m

2010

US$m

At 1 April 33 26

Additions 3 -

Reclassication of held for sale assets 3 -

Net disposals (1) (2)

Fair value gains 4 9

At 31 March 42 33

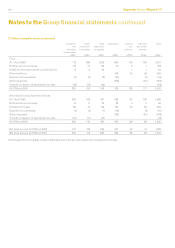

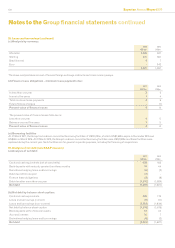

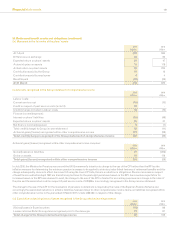

31. Other nancial assets and liabilities

(a) Analysis of other nancial assets and liabilities:

Assets Current

2011

US$m

Non-current

2011

US$m

Current

2010

US$m

Non-current

2010

US$m

Bank deposits 14 - - 44

Derivative nancial instruments:

Fair value hedge of borrowings - interest rate swaps - 37 - 43

Derivatives used for hedging - 37 - 43

Non-hedging derivatives - equity swaps 5 - 16 1

Non-hedging derivatives - interest rate swaps - 2 - -

Non-hedging derivatives - foreign exchange contracts 1 - 2 -

Assets at fair value through prot and loss 6 2 18 1

Derivative nancial instruments 6 39 18 44

Other derivatives - 6 9 -

Total other nancial assets 20 45 27 88

Bank deposits comprise amounts held with an A rated counterparty as collateral against derivative contracts.

Liabilities Current

2011

US$m

Non-current

2011

US$m

Current

2010

US$m

Non-current

2010

US$m

Derivative nancial instruments:

Fair value hedge of borrowings - cross currency swaps - 31 - 35

Derivatives used for hedging - 31 - 35

Non-hedging derivatives - foreign exchange contracts 5 - 5 -

Non-hedging derivatives - interest rate swaps 8 20 15 50

Liabilities at fair value through prot and loss 13 20 20 50

Derivative nancial instruments 13 51 20 85

Put option in respect of Serasa non-controlling interest - 870 - 661

Put options in respect of other non-controlling interests - 34 - 8

Total other nancial liabilities 13 955 20 754