Experian 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Financial review 43

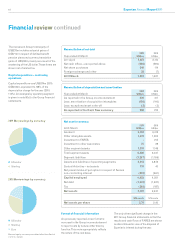

As indicated in the cash flow summary

table, free cash flow in the year ended 31

March 2011 was US$792m (2010: US$799m).

The net cash inflow in the year of US$508m

(2010: US$590m) is after acquisition spend

of US$301m (2010: US$41m) and equity

dividends of US$251m (2010: US$206m).

There have been a number of significant

developments in the Group’s funding

arrangements during the year:

•As detailed in note 39(e) to the Group

financial statements, there was a

cash outflow in the year of US$349m

(2010: US$114m) in respect of net

share purchases including the buyback

programme.

•In December 2010, the Group received

gross proceeds of US$314m on the

completion of the disposal of its interest

in FARES.

•New five-year committed revolving

credit facilities totalling US$1,700m

were arranged and used to re-finance the

then existing facilities which were due to

mature in 2012.

•£400m 4.75% Euronotes 2018 were issued

in January 2011 under the Euro medium

term note programme and the proceeds

were swapped into US dollars.

The earliest date of maturity of committed

bank facilities is December 2015 with

the £334m 5.625% Euronotes 2013 due for

redemption in December 2013. Accordingly,

there is no undue concentration of

repayment obligations in respect of debt

instruments. The maturity profile of loans

and borrowings is shown in note 28 to the

Group financial statements.

At 31 March 2011, net debt was US$1,501m

(2010: US$1,627m) and undrawn committed

borrowing facilities totalled US$1,700m

(2010: US$1,932m). At 31 March 2011, the

adjusted net debt/EBITDA ratio, including

the value of the Serasa put option at that

date of US$870m, was 1.8 times.

There have been no defaults under any

covenants given on loans or borrowings in

the year under review or the prior year.

Share price, net assets and total equity

The share price of Experian ranged from

a low of £5.72 to a high of £8.19 during the

year. On 31 March 2011, the mid market price

was £7.72, giving a market capitalisation of

US$12.7bn at that date (2010: US$10.1bn).

An analysis of net assets and capital

employed is given in the net assets

summary table. As part of the internal

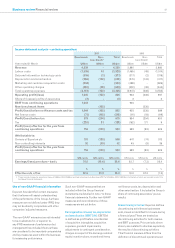

Cash flow summary

Year ended 31 March 2011

US$m 2010

US$m

EBIT from continuing operations 1,044 935

Depreciation and amortisation 288 274

Loss on sale of fixed assets 51

Capital expenditure (374) (314)

Sale of property, plant and equipment 730

Decrease/(increase) in working capital 4(22)

Loss/(profit) retained in associate 3(2)

Charge in respect of equity incentive plans within

Benchmark PBT 51 33

Operating cash flow11,028 935

Net interest paid (92) (68)

Tax paid (88) (26)

Dividends paid to non-controlling interests (56) (42)

Free cash flow 792 799

Net cash outflow from exceptional items (20) (62)

Acquisitions (301) (41)

Purchase of investments (3) (7)

Disposal of other financial assets and investments in

associates – discontinued operations 279 118

Costs on disposal of transaction processing activities

in France -(17)

Disposal of other businesses 12 6

Equity dividends paid (251) (206)

Net cash inflow 508 590

Foreign exchange movements 12 35

Net share purchases (349) (114)

Other financing related cash flows 72 (494)

Movement in cash and cash equivalents –

continuing operations 243 17

Movement in cash and cash equivalents – discontinued

operations 219

Movement in cash and cash equivalents 245 36

1. A reconciliation of cash generated from operations as reported in the Group cash flow statement on page 96 to

operating cash flow as reported above is given in note 39 to the Group financial statements.

reporting process, capital employed is

monitored by operating segment and

further information by operating segment

given in note 9(b) to the Group financial

statements. Capital employed includes

net pension assets of US$55m (2010:

obligations of US$88m) and net derivative

financial liabilities of US$13m (2010:

US$34m).