Experian 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 Experian Annual Report 2011

Notes to the Group nancial statements continued

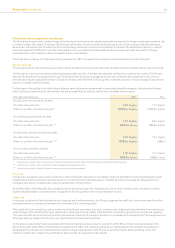

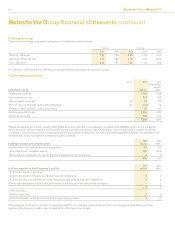

7. Use of non-GAAP measures in the Group nancial statements (continued)

Earnings before interest and tax (‘EBIT’)

EBIT is dened as prot before amortisation of acquisition intangibles, acquisition expenses, goodwill impairments, adjustments to contingent

consideration, charges in respect of the demerger-related equity incentive plans, exceptional items, net nance costs, tax and discontinued

operations. It includes the Group’s share of continuing associates’ pre-tax results.

Benchmark earnings

Benchmark earnings represents Benchmark PBT less attributable tax and non-controlling interests. Benchmark earnings attributable to non-

controlling interests represents that portion of Benchmark earnings that relate to non-controlling interests. Benchmark PBT less attributable

tax is designated as overall benchmark earnings. The attributable tax for the purposes of determining benchmark earnings excludes signicant

tax credits and charges arising in the year which, in view of their size or nature, are not comparable with previous periods together with tax

arising on exceptional items and on total adjustments to Benchmark PBT.

Benchmark earnings per share (‘Benchmark EPS’)

Benchmark EPS represents Benchmark earnings divided by a weighted average number of shares, and is disclosed to indicate the underlying

protability of the Group.

Exceptional items

The separate reporting of non-recurring exceptional items gives an indication of the Group’s underlying performance. Exceptional items are

those arising from the prot or loss on disposal of businesses, closure costs of major business units or costs of signicant restructuring

programmes. All other restructuring costs are charged against EBIT in the segments in which they are incurred.

Operating cash ow

Operating cash ow is calculated as cash generated from operations adjusted for outows in respect of the purchase of property, plant and

equipment and other intangible assets and adding dividends from continuing associates but excluding any cash inows and outows in respect

of exceptional items. It is dened as EBIT less changes in working capital, plus depreciation/amortisation, less capital expenditure, less prot or

loss retained in continuing associates.

Net debt

Net debt is calculated as total debt less cash and cash equivalents and other highly liquid bank deposits with original maturities greater

than three months. Total debt includes loans and borrowings (and the fair value of derivatives hedging loans and borrowings), overdrafts and

obligations under nance leases. Accrued interest is excluded from net debt.

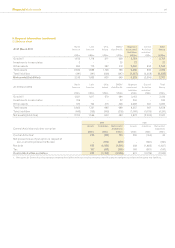

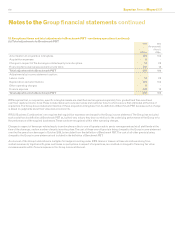

8. Financial risk management

(a) Financial risk factors

The Group’s activities expose it to a variety of nancial risks: market risk (including foreign exchange risk, interest rate risk and price risk),

credit risk and liquidity risk. The Group’s nancial risk management focuses on the unpredictability of nancial markets and seeks to minimise

potentially adverse effects on the Group’s nancial performance. The Group seeks to reduce its exposure to nancial risks and uses derivative

nancial instruments to hedge certain risk exposures. The Group also ensures surplus funds are managed and controlled in a prudent manner

which will protect capital sums invested and ensure adequate short-term liquidity, whilst maximising returns.

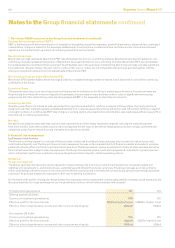

Market risk

Foreign exchange risk

The Group operates internationally and is exposed to foreign exchange risk from future commercial transactions, recognised assets and

liabilities and investments in, and loans between, undertakings with different functional currencies. The Group manages such risk, primarily

within undertakings whose functional currencies are the US dollar, by borrowing in the relevant currencies and using forward foreign exchange

contracts. The principal transaction exposures in 2011 were to sterling and the euro.

On the basis of the prole of foreign exchange transaction exposures, and an assessment of reasonably possible changes in such exposures, the

Group’s sensitivity to foreign exchange risk can be quantied as follows, with all other variables held constant:

Foreign exchange exposure 2011 2010

Sterling against US dollar:

Currency strengthening/weakening 10% 10%

Effect on prot for the nancial year US$1m higher/lower US$60m higher/ lower

Effect on other comprehensive income and other components of equity US$nil US$nil

Euro against US dollar:

Currency strengthening/weakening 10% 10%

Effect on prot for the nancial year US$nil US$7m higher/lower

Effect on other comprehensive income and other components of equity US$nil US$nil