Experian 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

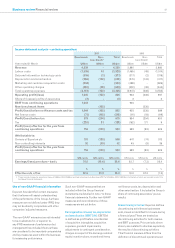

Business review Financial review 45

Accounting policies, estimates and

assumptions

The principal accounting policies used

are shown in note 5 to the Group financial

statements. Details of critical accounting

estimates and assumptions are shown in

note 6(a) to those financial statements.

The most significant of these relate to tax,

pension benefits, goodwill and financial

instruments and the key features can be

summarised as follows:

•Estimates made in respect of tax assets

and liabilities include the consideration

of transactions in the ordinary course

of business for which the ultimate tax

determination is uncertain.

•The recognition of pension benefits

involves the selection of appropriate

actuarial assumptions. Changes therein

may impact on the amounts disclosed in

the Group balance sheet and the Group

income statement.

•The assumptions used in the cash flow

projections underpinning the impairment

testing of goodwill include assumptions

in respect of profitability and future

growth, together with pre-tax discount

rates specific to the Group’s operating

segments.

•The assumptions in respect of the

valuation of the put option associated

with the remaining 30% stake of Serasa

are the equity value of Serasa, the

future P/E ratio of Experian at the date

of exercise, the respective volatilities of

Experian and Serasa and the risk free rate

in Brazil.

Financial risk management

The risks and uncertainties that are

specific to Experian’s business together

with more general risks are set out on

pages 38 to 41. As indicated therein,

the Group’s financial risk management

focuses on the unpredictability of financial

markets and seeks to minimise potentially

adverse effects on the Group’s financial

performance.

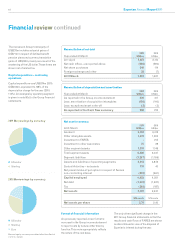

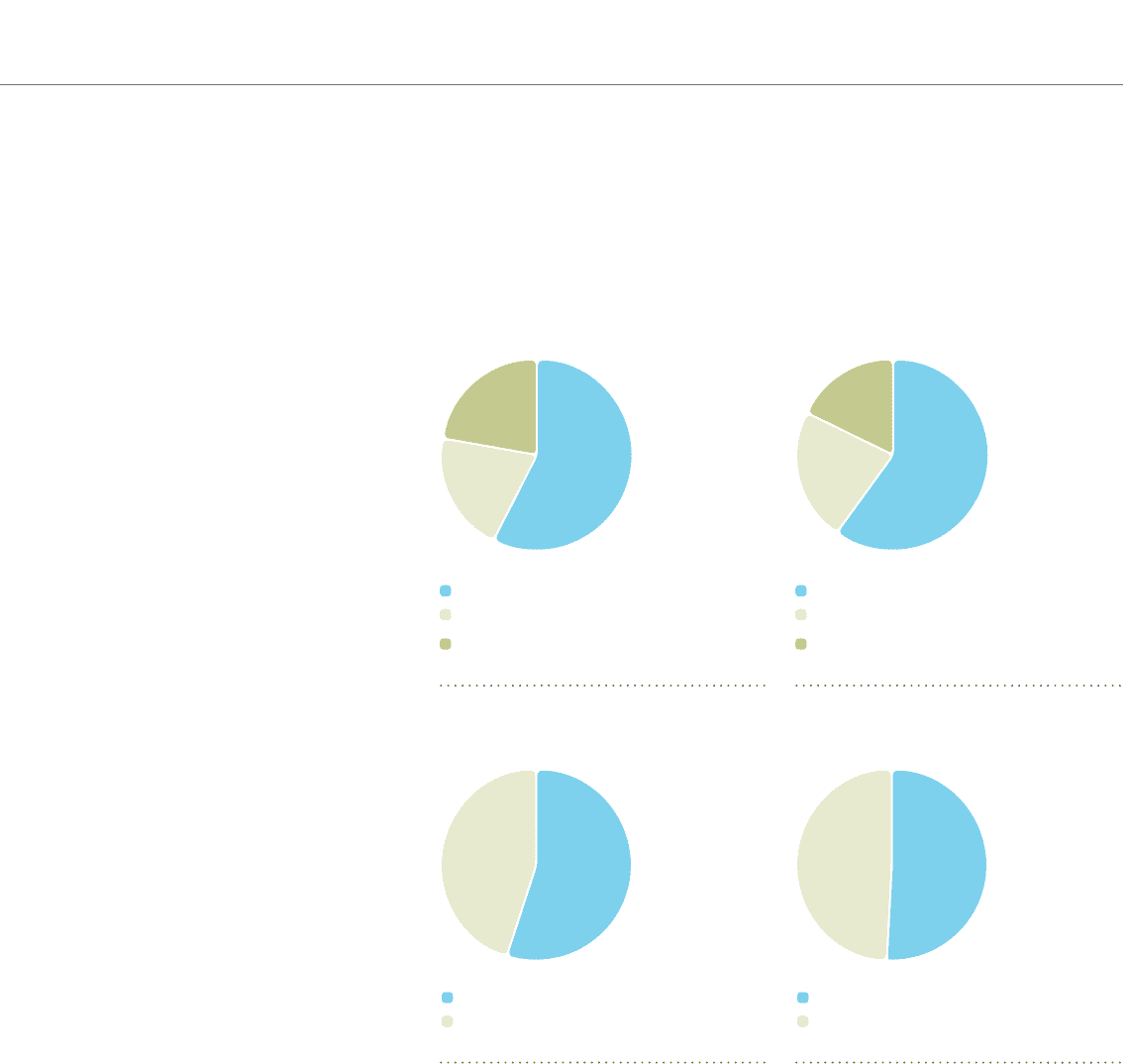

2010 EBIT by currency

US dollar

Sterling

Brazilian real

Experian seeks to reduce its exposures to

foreign exchange, interest rate and other

financial risks. Detailed disclosures in

respect of such risks are included within

the notes to the Group financial statements

and the key features are summarised below.

Foreign exchange risk is managed by:

•Use of forward foreign exchange

contracts for future commercial

transactions;

•Swapping the proceeds of bonds issued

in sterling and euros into US dollars;

•Denominating internal loans in relevant

currencies to match the currencies of

assets and liabilities in entities with

different functional currencies; and

•Entering into forward foreign exchange

contracts in the relevant currencies in

respect of investments in entities with

other functional currencies, whose net

assets are exposed to foreign exchange

translation risk.

Interest rate risk is managed by:

•Use of both fixed and floating rate

borrowings;

•Use of interest rate swaps to adjust

the balance of fixed and floating rate

liabilities; and

•Mix of duration of borrowings and interest

rate swaps to smooth the impact of

interest rate fluctuations.

2011 Net debt by interest rate

Fixed

Floating

2010 Net debt by interest rate

Fixed

Floating

2011 EBIT by currency

US dollar

Sterling

Brazilian real