Experian 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements 133

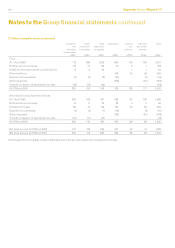

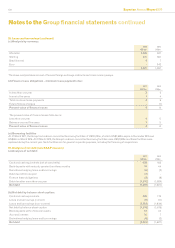

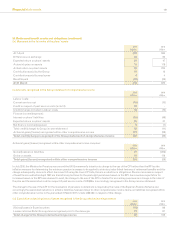

32. Maturity prole of nancial liabilities – contractual undiscounted cash ows

At 31 March 2011 Less than

1 year

US$m

1 to 2

years

US$m

2 to 3

years

US$m

3 to 4

years

US$m

4 to 5

years

US$m

Over 5

years

US$m

Total

US$m

Loans and borrowings 96 95 631 64 64 1,578 2,528

Net settled derivative nancial instruments

(note 31(c)) 6 (4) (9) 6 3 - 2

Gross settled derivative nancial instruments

(note 31(c)) (30) (40) (40) (40) (40) (150) (340)

Put options in respect of Serasa and other non-

controlling interests 4 998 37 - - - 1,039

Trade and other payables 476 7 - - - - 483

552 1,056 619 30 27 1,428 3,712

At 31 March 2010 Less than

1 year

US$m

1 to 2

years

US$m

2 to 3

years

US$m

3 to 4

years

US$m

4 to 5

years

US$m

Over 5

years

US$m

Total

US$m

Loans and borrowings 60 61 681 568 32 818 2,220

Net settled derivative nancial instruments

(note 31(c)) 30 10 (7) (14) 2 - 21

Gross settled derivative nancial instruments

(note 31(c)) (19) (17) (17) (17) (17) (41) (128)

Put options in respect of Serasa and other non-

controlling interests - - 803 14 - - 817

Trade and other payables 521 6 - - - - 527

592 60 1,460 551 17 777 3,457

Cash ows in respect of VAT, other taxes payable, social security costs and accruals are excluded from the analysis for trade and other payables.

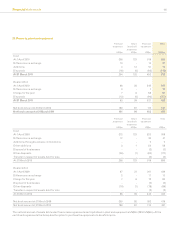

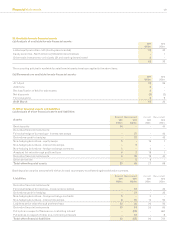

33. Share-based payments

The Group has a number of equity settled, share-based employee incentive plans. Option, award and share prices are disclosed in sterling as

this is the currency in which the price of Experian plc ordinary shares is quoted.

(a) Share options

(i) Summary of arrangements

Experian Share Option Plan Experian Sharesave Plans

Nature Grant of options ‘Save as you earn’ plans

Vesting conditions:

– Service period 3 years11 year for US plan

3 or 5 years for other plans

– Performance/Other n/a2Saving obligation over the vesting period

Maximum term 10 years 1, 3.5 or 5.5 years

Method of settlement Share distribution Share distribution

Expected departures (at grant date) 5% 1 year3 - 5%

3 years3 - 30%

5 years3 - 50%

Option exercise price calculation4Market price over the 3 dealing days

preceding the grant 15% discount to market price on the date of

grant for US plan

20% discount to market price over 3 dealing

days preceding the grant for other plans

1. Options with a four year service period were granted at demerger and vested in October 2010.

2. Options granted to directors of the Company after 1 April 2009 have been subject to performance conditions based on the growth in Benchmark EPS.

3. Such expected departures include an assumption about participants who will not meet the savings requirement of the plans.

4. Three day averages are calculated by taking middle market quotations of an Experian plc share from the London Stock Exchange daily ofcial list.

5. In addition, fully vested options exist under The North America Stock Option Plan, a former GUS share option plan, and these had a maximum term of six years from

the date of grant.