Experian 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

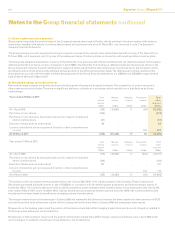

142 Experian Annual Report 2011

Notes to the Group nancial statements continued

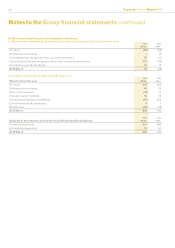

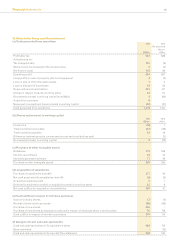

35. Deferred tax (continued)

Deferred tax assets are recognised in respect of tax losses carried forward and other temporary differences to the extent that the realisation of

the related tax benet through future taxable prots is probable.

The Group has not recognised deferred tax assets of US$289m (2010: US$302m) in respect of losses that can be carried forward against future

taxable income and deferred tax assets of US$17m (2010: US$16m) in respect of capital losses that can be carried forward against future taxable

gains. These losses are available indenitely.

At the balance sheet date there were deferred tax assets expected to reverse within the next year of US$71m (2010: US$107m).

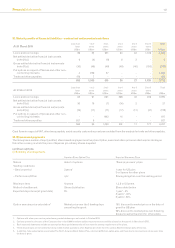

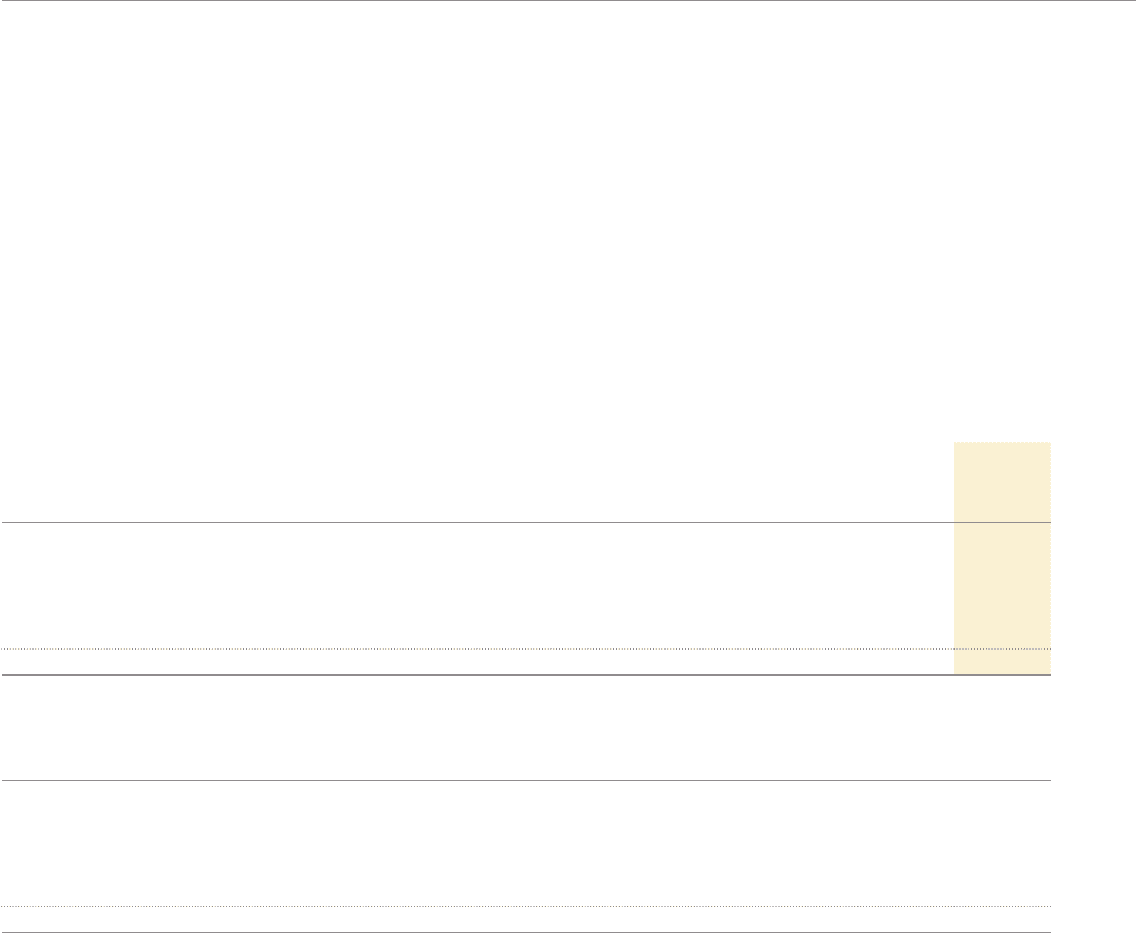

(c) Gross deferred tax liabilities

Movements in gross deferred tax liabilities, without taking into consideration the offsetting of liabilities and assets within the same tax

jurisdiction, comprise:

Accelerated

depreciation

US$m

Intangibles

US$m

Other

temporary

differences

US$m

Total

US$m

At 1 April 2010 36 362 36 434

Differences on exchange - 14 3 17

Charge/(credit) in the Group income statement (3) 37 6 40

Business combinations - 10 - 10

Other transfers - 14 (26) (12)

At 31 March 2011 33 437 19 489

Accelerated

depreciation

US$m

Intangibles

US$m

Other

temporary

differences

US$m

Total

US$m

At 1 April 2009 5 243 142 390

Differences on exchange 1 32 - 33

Charge/(credit) in the Group income statement 30 86 (106) 10

Business combinations - 5 - 5

Transfer in respect of liabilities held for sale - (4) - (4)

At 31 March 2010 36 362 36 434

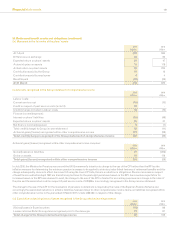

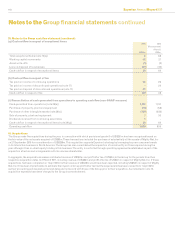

Deferred tax liabilities of US$2,052m (2010: US$1,447m) have not been recognised for the withholding and other taxes that would arise on the

distribution to Experian plc of the unremitted earnings of certain subsidiary undertakings. As these earnings are continually reinvested, no such

tax is expected to arise in the foreseeable future.

At the balance sheet date there were deferred tax liabilities expected to reverse within the next year of US$45m (2010: US$57m).

(d) UK deferred tax balances

In the UK, the main rate of corporation tax has been reduced from 28% to 26% with effect from 1 April 2011. Deferred tax balances held in the UK

have therefore been provided at 26%. Further proposed reductions to this rate will reduce it by 1% per annum to 23% from 1 April 2014. Each of

these further proposed reductions is expected to be separately enacted and has not yet been substantively enacted.