Experian 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Chief Executive’s review 25

The acquisition, which is expected

to complete later this calendar year,

will build on the strength we have

established in Brazil. We are excited

by the potential to bring Experian’s

global expertise to these markets and

by the attractive market fundamentals,

particularly in Colombia.

In the United Kingdom, both credit

supply and demand remained muted,

holding back progress in Credit

Services. That said, new entrants

in the nancial services sector are

expanding the lending market, creating

new opportunities for Experian. We are

also beneting from the investments we

have made in new customer segments,

which are progressing well. We have

seen some recovery in Decision

Analytics as appetite increases for

our analytics and our fraud prevention

and risk management software.

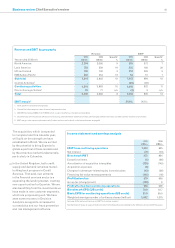

Revenue and EBIT by geography

Revenue EBIT3

Year ended 31 March 2011

US$m

2010

US$m

Growth1

%

2011

US$m

2010

US$m

Growth1

%

North America 2,254 2,060 9 610 572 7

Latin America 722 559 19 235 166 30

UK and Ireland 736 730 3 213 205 5

EMEA/Asia Pacic 502 454 12 54 51 7

Sub total 4,214 3,803 10 1,112 994 10

Central Activities2-- - (66) (62)

Continuing activities 4,214 3,803 10 1,046 932 11

Discontinuing activities425 77 n/a (2) 3 n/a

Total 4,239 3,880 8 1,044 935 10

EBIT margin524.8% 24.5%

1. Total growth at constant exchange rates

2. Central Activities comprise costs of central corporate functions

3. 2010 EBIT excludes US$56m from FARES (which is now classied as a discontinued operation)

4. Discontinuing activities include UK account processing, some UK hosted database activities, UK mortgage software activities and other smaller discontinuing activities

5. EBIT margin is for continuing business only. Further analysis can be found in the nancial review on page 48

Income statement and earnings analysis

2011

US$m

2010

US$m

EBIT from continuing operations 1,044 935

Net interest (71) (81)

Benchmark PBT 973 854

Exceptional items (2) (68)

Amortisation of acquisition intangibles (129) (140)

Acquisition expenses (8) -

Charges for demerger-related equity incentive plans (13) (28)

Financing fair value remeasurements (142) (18)

Prot before tax 679 600

Group tax (charge)/credit (129) 9

Prot after tax from continuing operations 550 609

Benchmark EPS (US cents) 70.0 63.7

Basic EPS for continuing operations (US cents) 57.9 59.0

Weighted average number of ordinary shares (million) 1,002 1,015

See page 48 for analysis of revenue and EBIT by business segment

See the nancial review on pages 47 to 49, and note 7 to the Group nancial statements for denitions of non-GAAP measures

33