Experian 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

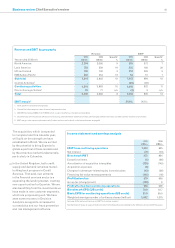

Business review UK and Ireland 33

UK

Ireland

In the UK and Ireland, revenue from continuing activities was US$736m, up 3% at constant

exchange rates. Organic revenue growth was 2%. The acquisition contribution related

primarily to Techlightenment (majority stake acquired January 2011).

Credit Services

Total and organic revenue, at constant

exchange rates, declined by 2%.

Market conditions remained subdued

as restrictions in lending supply were

compounded by weakness in consumer

demand for credit. There was some

stabilisation in credit reference volumes

towards the end of the year, largely for

customer management purpose, while

origination activity remained depressed.

This was partly offset by good growth

in payment validation services.

Decision Analytics

At Decision Analytics, total and organic

revenue growth was 2% at constant

exchange rates (H1 (5%), H2 +9%).

Conditions and pipelines improved as the

year progressed. Recovery was supported

by increased appetite by lenders to

upgrade legacy risk management

platforms, market expansion driven by

new entrants in the lending sector and

growth in new customer segments.

Revenue growth reflected these trends,

with strength in analytics, growth in

value-added products, some recovery

in software and delivery of new public

sector projects.

Marketing Services

Total revenue at constant exchange

rates increased 4%, while organic

revenue growth was 3%. There were

good performances across the retail

and leisure segments, which helped to

offset some weakness in public sector

caused by recent government cutbacks.

This has largely affected contact data

services. There was strong growth in

email marketing and online intelligence

data. The Techlightenment acquisition,

which is performing to plan, has extended

Experian’s digital marketing capabilities

into social media.

“Our business in the UK

made good progress last year,

despite the subdued lending

environment. Lenders are

starting now to plan for growth

and we’ve seen increasing

demand for our analytical

and fraud prevention tools.

We’re also continuing to invest

and expand our presence

in new customer segments,

including the public sector,

telecommunications and utilities.

Our digital marketing products

are in strong demand and have

been further strengthened by the

acquisition of Techlightenment,

and we continue to see good

growth in our direct to consumer

services.”

Francisco Valim,

Chief Executive Officer

UK and Ireland

and