Experian 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

Governance Report on directors’ remuneration

CIP awards in respect of the year ended

31 March 2010 (50% of an award)

2:1

1:1

Experian’s average annual PBT growth over three years

Level of match awarded

5% 11%

CIP awards in respect of the year ended

31 March 2010 (50% of an award)

2:1

1:1

Experian’s cash flow over three years

Level of match awarded

US$2,900m US$3,300m

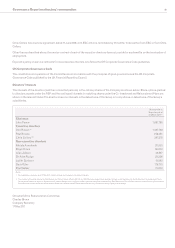

The Committee has selected these two performance measures as they reflect two of Experian’s key strategic objectives (driving profitable

growth and optimising capital efficiency).

Annual bonus in respect of the year ended 31 March 2011

The Committee set stretching targets for the annual bonus in respect of the year ended 31 March 2011 which required broadly upper quartile

levels of performance (with reference to relevant external benchmarks) in order for maximum bonus to be earned. In what continued to be

a testing and uncertain business environment for both Experian and our clients, the Group delivered an exceptional performance and as a

result of this a bonus of 196.7% of salary is payable to the executive directors in respect of the year ended 31 March 2011.

CIP awards in respect of the year ended 31 March 2011

The three executive directors have elected to defer 100% of their bonus earned in respect of the year ended 31 March 2011 into the CIP. It is

intended the same performance measures will be used for the matching awards to be made this year as for the awards made in June 2010

(i.e. growth in PBT and cash flow). The Committee has reviewed the performance targets associated with these measures in the light of

the improved economic conditions in which Experian is operating and has determined that these should be made more stretching than in

recent years. Both performance conditions will be measured over a three-year period. For the 50% of the matching share awards subject to

the growth in PBT performance condition, a 1:1 match will vest for growth in PBT of 7% p.a. on average, increasing to vesting of a 2:1 match

if PBT growth of 14% p.a. is achieved. For the 50% of the matching share awards subject to the cash flow performance condition, a 1:1 match

will vest for cash flow of US$3,000m, increasing to vesting of a 2:1 match if cash flow of US$3,400m is achieved. These performance targets

are illustrated in the graphs below.

CIP awards in respect of the year ended

31 March 2011 (50% of an award)

2:1

1:1

Experian’s average annual PBT growth over three years

Level of match awarded

7% 14%

CIP awards in respect of the year ended

31 March 2011 (50% of an award)

2:1

1:1

Experian’s cash flow over three years

Level of match awarded

US$3,000m US$3,400m