Experian 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

126 Experian Annual Report 2011

Notes to the Group nancial statements continued

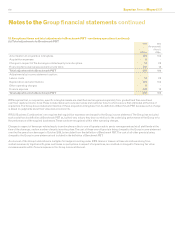

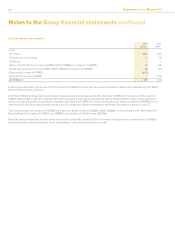

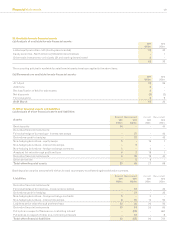

23. Investments in associates

2011

US$m

2010

US$m

Cost

At 1 April 243 332

Differences on exchange 1 (1)

Additions - 7

Share of prot after tax (including US$5m (2010: US$56m) in respect of FARES) 3 58

Dividends received (including US$2m (2010: US$41m) in respect of FARES) (3) (41)

Disposal of interest in FARES (217) -

Disposal of assets by FARES - (112)

At 31 March 27 243

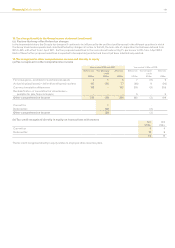

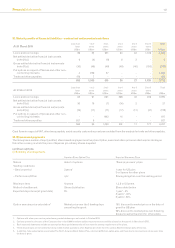

Following the disposal by the Group of its 20% holding of FARES during the year, the Group’s interests in associated undertakings at 31 March

2011 are not individually material.

At 31 March 2010, the Group’s principal interest in associated undertakings was the 20% holding of FARES with the balance of the capital of

FARES held by FAC. In the year ended 31 March 2011, pursuant to the notice received from FAC on 22 April 2010 in respect of the exercise of

its buy-out option, Experian completed the disposal of its interest in FARES. The results of and gains and losses in respect of FARES are now

reported within results for discontinued operations with comparative gures re-presented and further information is shown in note 17.

The Group’s share of the revenue of FARES in the period to 22 April 2010 was US$22m (2010: US$263m for the full year). At 31 March 2010 the

Group’s share of the assets of FARES was US$383m and its share of liabilities was US$176m.

Since the balance sheet date, the Group has purchased a further 40% interest in DP Information in Singapore for a consideration of US$23m

and it now holds a controlling interest in this undertaking. Further details are given in note 46.