Experian 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements 109

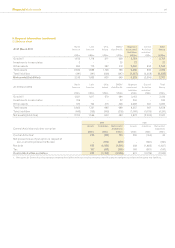

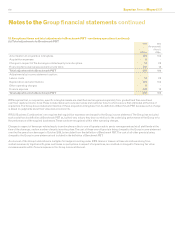

8. Financial risk management (continued)

The put option associated with the remaining 30% stake in Serasa is valued at the higher of 95% of the equity value of Serasa or the value of

Serasa based on the P/E ratio of Experian and the latest earnings of Serasa. A Monte Carlo simulation has been used to calculate the liability.

The key assumptions in arriving at the value of the put are the equity value of Serasa, the future P/E ratio of Experian at the date of exercise, the

respective volatilities of Experian and Serasa and the risk free rate in Brazil. It is assumed that the put may be exercised in June 2012. Changes

in these assumptions may impact on the amounts disclosed in the Group balance sheet and the Group income statement. Gains and losses in

respect of the valuation of the put option since acquisition in June 2007 have been recorded as nancing fair value remeasurements. Movements

in the year ended 31 March 2011 and the year ended 31 March 2010 primarily relate to an increase in the equity value of Serasa.

A further 10% increase in the equity value of Serasa would have resulted in an increase of some US$83m in the value of the put obligation. A

change of 10% in the Brazilian real exchange rate against the US dollar from that prevailing at the balance sheet date would result in a change of

some US$87m in the value of the obligation.

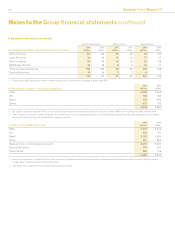

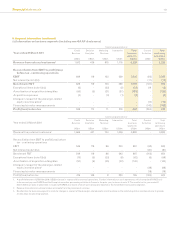

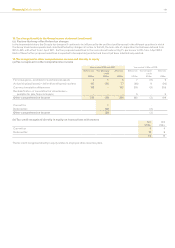

9. Segment information

(a) Narrative disclosures

Under IFRS 8 ‘Operating segments’, an operating segment is a component of an entity:

-that engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses relating to

transactions with other components); and

-whose operating results are regularly reviewed by the chief operating decision maker to assess its performance and make decisions about

resources to be allocated to the segment; and

-for which discrete nancial information is available.

Experian is organised into, and managed on a worldwide basis over, the following ve operating segments, based on geographic areas,

supported by its central Group functions:

-North America;

-Latin America;

-UK and Ireland;

-Europe, Middle East and Africa (‘EMEA’); and

-Asia Pacic.

The chief operating decision maker assesses the performance of the above operating segments on the basis of EBIT, as dened in note 7.

The ‘All other segments’ category required to be disclosed under IFRS 8 has been captioned in these nancial statements as EMEA/Asia

Pacic. This combines information in respect of the EMEA and the Asia Pacic segments as, on the basis of their share of the Group’s results

and net assets, neither of these operating segments is individually reportable under IFRS 8.

Experian separately presents information equivalent to segment disclosures in respect of the costs of its central Group functions under the

caption of ‘Central Activities’, as management believes that the reporting of this information is helpful to users of the nancial statements.

Information disclosed under Central Activities includes costs arising from nance, treasury and other global functions.

Inter-segment transactions are entered into under the normal commercial terms and conditions that would also be available to unrelated third

parties. There is no material impact from inter-segment transactions on the Group’s results.

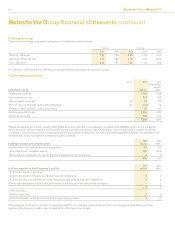

Segment assets consist primarily of property, plant and equipment, intangible assets including goodwill, inventories, derivatives designated as

hedges of future commercial transactions, and receivables. They exclude tax assets, cash and cash equivalents and derivatives designated as

hedges of borrowings.

Segment liabilities comprise operating liabilities including derivatives designated as hedges of future commercial transactions. They exclude

tax liabilities, borrowings and related hedging derivatives.

Capital expenditure comprises additions to property, plant and equipment and intangible assets, excluding additions resulting from acquisitions

through business combinations.

Information presented to meet the requirements of IFRS 8 additionally includes analysis of the Group’s revenues over groups of service lines.

This is supplemented by voluntary disclosure of the protability of those same groups of service lines and, for ease of reference, Experian

continues to use the term ‘business segments’ when discussing the results of groups of service lines. The four business segments for Experian,

details of which are given in the business and market overview, are:

-Credit Services;

-Decision Analytics;

-Marketing Services; and

-Interactive.