Experian 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements 103

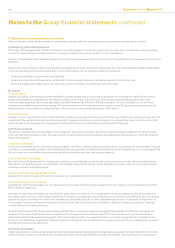

5. Signicant accounting policies (continued)

(p) Provisions

Provisions are recognised when:

- The Group has a present legal or constructive obligation as a result of past events; and

- It is more likely than not that an outow of resources will be required to settle the obligation; and

- The amount has been reliably estimated.

If the effect of the time value of money is material, provisions are determined by discounting the expected future cash ows at a pre-tax rate that

reects current market assessments of the time value of money and, where appropriate, the risks specic to the liability. Where discounting is

used, the increase in the provision due to the passage of time is recognised as an interest expense.

(q) Non-controlling interests

The non-controlling interests in the Group balance sheet represent the share of net assets of subsidiary undertakings held outside the Group.

The movement in the year comprises the prot attributable to such interests together with any dividends paid, movements in respect of

corporate transactions and related exchange differences.

Where put/call option agreements are in place in respect of shares held by the non-controlling shareholders, the put element of the liability is

measured in accordance with the requirements of IAS 32 and is stated at the net present value of the expected future payments. Such liabilities

are shown as current or non-current nancial liabilities in the Group balance sheet. The change in the net present value of such options in the

year is recognised in the Group income statement within net nance costs.

(r) Revenue recognition

Revenue represents the fair value of consideration receivable on the sale of goods and services to external customers, net of value added tax

and other sales taxes, rebates and discounts, including the provision and processing of data, subscriptions to services, software and database

customisation and development and the sale of software licences, maintenance and related consulting services.

Revenue in respect of the provision and processing of data is recognised in the year in which the service is provided. Subscription revenues, and

revenues in respect of services to be provided by an indeterminate number of acts over a specied period of time, are recognised on a straight

line basis over those periods. Customisation, development and consulting revenues are recognised by reference to the stage of completion of

the work generally on the basis of costs incurred to date as a percentage of estimated total costs. Revenue from software licences is recognised

upon delivery. Revenue from maintenance agreements is recognised on a straight line basis over the term of the maintenance period.

Where a single arrangement comprises a number of individual elements which are capable of operating independently of one another, the total

revenues are allocated amongst the individual elements based on an estimate of the fair value of each element. Where the elements are not

capable of operating independently, or reasonable measures of fair value for each element are not available, total revenues are recognised on a

straight line basis over the contract period to reect the timing of services performed.

Sales are generally invoiced in the geographic area in which the customer is located and accordingly the geographic location of the invoicing

undertaking is used as the basis for attributing revenue to individual countries.

(s) Employee benets

Pension and other post employment benets

Dened benet pension arrangements – funded plans

The retirement benet assets and obligations recognised in the Group balance sheet in respect of funded plans comprise the fair value of plan

assets of funded plans less the present value of the related dened benet obligation at the balance sheet date, together with adjustments

for past service costs. The dened benet obligation is calculated annually by independent qualied actuaries using the projected unit credit

method.

The present value of the dened benet obligation is determined by discounting the estimated future cash outows using market yields

available at the assessment date on high-quality corporate bonds that are denominated in the currency in which the benets will be paid, and

that have terms to maturity consistent with the estimated average term of the related pension liability.

Actuarial gains and losses arising from experience adjustments, and changes in actuarial assumptions, are recognised immediately in the

Group statement of comprehensive income.

Past service costs are recognised immediately in the Group income statement, unless the changes to the pension plan are conditional on the

employees remaining in service for a specied period of time. In this case, the past service costs are amortised on a straight line basis over that

period.

The pension cost recognised in the Group income statement comprises the cost of benets accrued plus interest on the dened benet

obligation less the expected return on the plan assets over the year. Service and nancing costs are recognised separately in the Group income

statement.

Dened benet pension arrangements – unfunded plans

Unfunded pension obligations are determined and accounted for in accordance with the principles used in respect of the funded arrangements.