Experian 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements 129

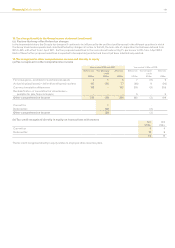

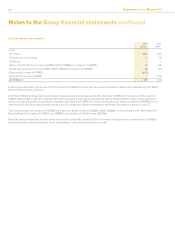

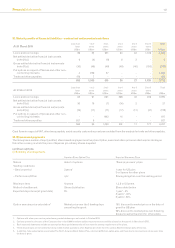

27. Trade and other payables

Current

2011

US$m

Non-current

2011

US$m

Current

2010

US$m

Non-current

2010

US$m

Trade payables 134 - 110 -

VAT and other taxes payable 40 - 31 -

Social security costs 92 - 95 -

Accruals and deferred income 819 21 767 8

Other payables 95 - 59 6

1,180 21 1,062 14

The accounting policies for other nancial liabilities have been applied to nancial instruments of US$818m (2010: US$773m) within the above

items. VAT and other taxes payable of US$40m (2010: US$31m), social security costs of US$92m (2010: US$95m) and accruals and deferred

income of US$251m (2010: US$177m) are not regarded as nancial instruments.

There is no material difference between the fair value of trade and other payables and the book value stated above. All the non-current trade and

other payables are due within ve years from the balance sheet date.

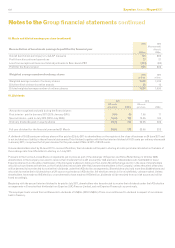

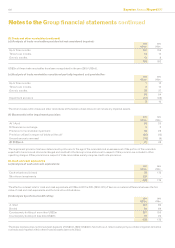

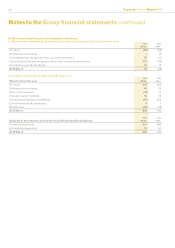

28. Loans and borrowings

(a) Analysis of loans and borrowings:

Current

2011

US$m

Non-current

2011

US$m

Current

2010

US$m

Non-current

2010

US$m

£334m 5.625% Euronotes 2013 - 576 - 552

£400m 4.75% Euronotes 2018 - 642 - -

€500m 4.75% Euronotes 2020 - 701 - 681

Bank loans 3 1 - 598

Bank overdrafts - - 12 -

Finance lease obligations 3 1 5 3

6 1,921 17 1,834

There is no material difference between the carrying values of the Group’s loans and borrowings and their fair values.

During the year ended 31 March 2011, the Group issued bonds with a nominal value of £400m. During the year ended 31 March 2010, the Group

issued bonds with a nominal value of €500m and redeemed bonds with a nominal value of £203m.

The effective interest rates for bonds approximate to the coupon rates indicated above.

Other than nance lease obligations, the borrowings of the Group are unsecured.

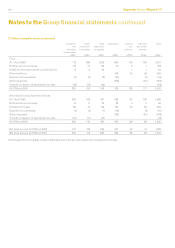

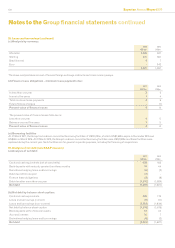

(b) Analysis by contractual repricing dates:

2011

US$m

2010

US$m

Less than one year 8615

One to two years -3

Two to three years 576 -

Three to four years - 552

Over ve years 1,343 681

1,927 1,851