Experian 2011 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements 147

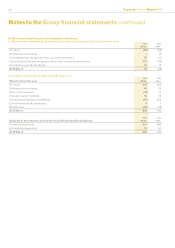

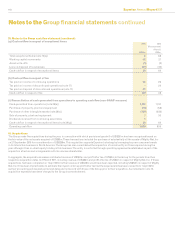

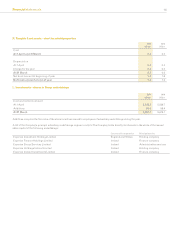

40. Acquisitions (continued)

Details of the net assets acquired at provisional fair values are given below.

Mighty Net,

Inc

US$m

Other

acquisitions

US$m

Total

US$m

Intangible assets 80 37 117

Trade and other receivables 2 7 9

Cash and cash equivalents – 6 6

Trade and other payables (12) (17) (29)

Deferred tax liabilities – (10) (10)

70 23 93

Goodwill 138 63 201

208 86 294

Satised by:

Cash 208 69 277

Deferred consideration – 11 11

Recognition of non-controlling interest – 6 6

208 86 294

The fair values above contain certain provisional amounts which will be nalised no later than one year after the date of acquisition. Provisional

amounts have been included at 31 March 2011 as a consequence of the timing and complexity of the acquisitions. Fair value adjustments in

respect of acquisitions made during the year resulted in an increase in book value of US$103m and arose principally in respect of acquisition

intangibles. At the dates of acquisition, the gross contractual amounts receivable in respect of trade and other receivables amounted to

US$9m which was expected to be collected in full. Goodwill represents the synergies, assembled workforce and future growth potential of the

businesses acquired and of the amount arising in the year some US$138m is expected to be deductible for tax purposes.

There have been no material gains, losses, error corrections or other adjustments recognised in the year ended 31 March 2011 that relate to

acquisitions in the current or previous years. Contingent consideration settled during the year on acquisitions made in previous years was

US$25m.

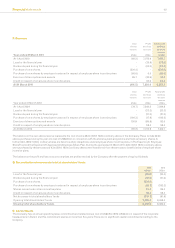

41. Assets and liabilities classied as held for sale

During the year ended 31 March 2010, approval was given to a number of small disposals and accordingly the assets and liabilities of the

businesses involved were classied as held for sale at 31 March 2010. The disposals were completed in the year ended 31 March 2011 and the

resulting loss was US$21m (note 13).

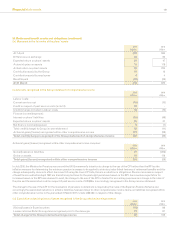

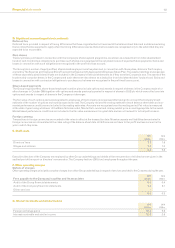

42. Operating lease commitments - minimum lease payments

2011

US$m

2010

US$m

Commitments under non-cancellable operating leases are payable in:

Less than one year 52 48

Between one and ve years 134 127

More than ve years 78 87

264 262

The Group leases ofces and technology under non-cancellable operating lease agreements with varying terms, escalation clauses and

renewal rights and the net charge for the year was US$59m (2010: US$51m).

43. Capital commitments

2011

US$m

2010

US$m

Capital expenditure for which contracts have been placed:

Property, plant and equipment 23 16

Intangible assets 30 28

53 44

.