Experian 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146 Experian Annual Report 2011

Notes to the Group nancial statements continued

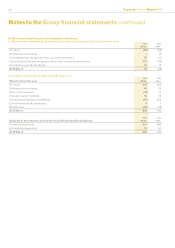

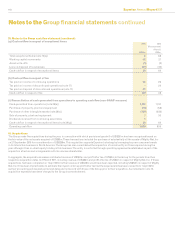

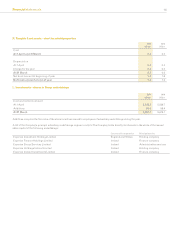

39. Notes to the Group cash ow statement (continued)

(g) Cash outow in respect of exceptional items 2011

US$m

2010

(Re-presented)

(Note 3)

US$m

Total exceptional items (note 13(a)) 2 68

Working capital movements 42 21

Asset write-offs (3) (3)

Loss on disposal of businesses (21) (24)

Cash outow in respect of exceptional items 20 62

(h) Cash outow in respect of tax

Tax paid on income of continuing operations 88 26

Tax paid on income of discontinued operations (note 17) - 22

Tax paid on disposal of discontinued operations (note 17) 61 –

Cash outow in respect of tax 149 48

(i) Reconciliation of cash generated from operations to operating cash ow (non-GAAP measure)

Cash generated from operations (note 39(a)) 1,374 1,157

Purchase of property, plant and equipment (74) (58)

Purchase of other intangible assets (note 39(c)) (300) (256)

Sale of property, plant and equipment 7 30

Dividends received from continuing associates 1 -

Cash outow in respect of exceptional items (note 39(g)) 20 62

Operating cash ow 1,028 935

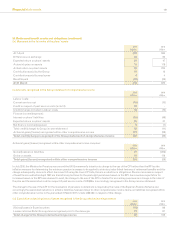

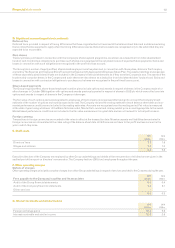

40. Acquisitions

The Group made ve acquisitions during the year, in connection with which provisional goodwill of US$201m has been recognised based on

the fair value of the net assets acquired of US$93m. These transactions included the purchase of substantially all the assets of Mighty Net, Inc

on 21 September 2010 for a consideration of US$208m. This acquisition supports Experian’s strategy by leveraging key new consumer brands

in its Interactive business in North America. The Group has also consolidated the acquisition of a small entity in China acquired during the

year although it has no direct equity holding in this business. The entity is controlled through operating agreements established as part of the

acquisition structure and arrangements with its nominee shareholder.

In aggregate, the acquired businesses contributed revenue of US$67m and prot after tax of US$3m to the Group for the periods from their

respective acquisition dates to 31 March 2011, including revenue of US$60m and prot after tax of US$4m in respect of Mighty Net, Inc. If these

acquisitions had been completed on 1 April 2010, further revenue of US$78m would have been reported, including US$53m in respect of Mighty

Net, Inc. It has been impracticable to estimate the impact on Group prot after tax had the acquired entities been owned from 1 April 2010,

as their accounting policies and period end dates did not accord with those of the Group prior to their acquisition. As indicated in note 13,

acquisition expenses have been charged to the Group income statement.