Experian 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148 Experian Annual Report 2011

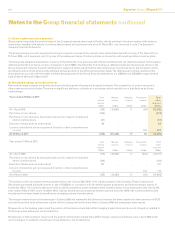

Notes to the Group nancial statements continued

44. Contingencies

There are a number of pending and threatened litigation claims involving the Group in North America and Latin America which are being

vigorously defended. The directors do not believe that the outcome of any such pending or threatened litigation will have a materially adverse

effect on the Group’s nancial position. However, as is inherent in legal proceedings, there is a risk of outcomes unfavourable to the Group. In

the case of unfavourable outcomes the Group would benet from applicable insurance recoveries.

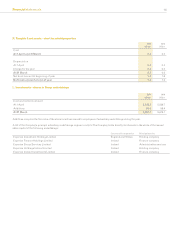

45. Related parties

Signicant subsidiary undertakings at 31 March 2011 are shown in note U to the parent company nancial statements. Disclosures in respect of

FARES, the Group’s only individually material associate during the year, are given in note 17.

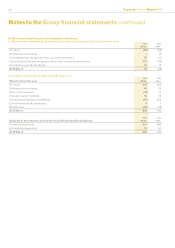

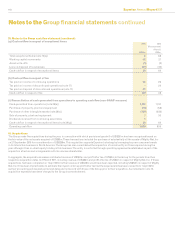

Remuneration of key management personnel is analysed as follows:

2011

US$m

2010

US$m

Salaries and short-term employee benets 12 12

Retirement benets 1 1

Share-based payments 14 13

27 26

Key management personnel comprises the board of directors and their remuneration is charged to labour costs. The amount included

in respect of share-based payments includes attributable costs in respect of demerger-related equity incentive plans. Further details of

directors’ remuneration are given in the audited part of the report on directors’ remuneration. Other than remuneration, there were no material

transactions or balances between the Group and its key management personnel or members of their close families in either the current or

previous year.

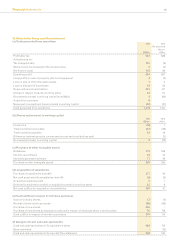

46. Events occurring after the end of the reporting period

Details of the second interim dividend announced since the end of the reporting period are given in note 19.

On 3 May 2011, Experian announced that it had signed a denitive agreement to acquire a majority stake in Computec S.A., a leading Latin

American credit services information provider, based in Colombia. The offer price is equivalent to a valuation of the whole of the equity of

some US$400m. The transaction is subject to regulatory approval and the launching of a delisting tender offer, and is expected to complete in

the second half of this calendar year.

On 5 May 2011, Experian announced an agreement to establish a credit bureau with six of Australia’s leading nancial institutions to provide

consumer and business credit information in Australia. The formation of the joint venture is subject to regulatory approval, on receipt of which

the joint venture company will be established with initial gross assets of A$30m. Experian will own 76% of the entity.

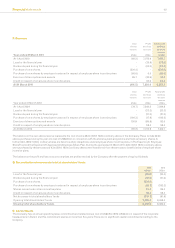

Since the balance sheet date, the Group has also completed two individually immaterial acquisitions. In April 2011, the Group purchased

a further 40% interest in DP Information in Singapore and it now holds a controlling interest in this undertaking. In May 2011 the Group acquired

the whole of the issued share capital of SafetyWeb, Inc, a provider of identity management services in North America. The stake was acquired

from SafetyWeb’s founding shareholders and private equity partners. At 31 March 2011 SafetyWeb, Inc had gross assets of US$3m. A summary

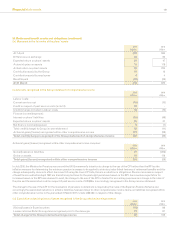

of the provisional net assets acquired and goodwill in respect of these acquisitions is given below.

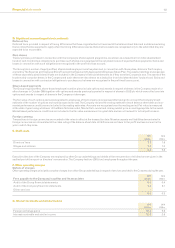

US$m

Total assets 44

Total liabilities (8)

36

Goodwill 28

64

Satised by:

Cash 36

Fair value of existing stake in associate 23

Recognition of non-controlling interest 5

64

Goodwill represents the synergies, assembled workforce and future growth potential of the businesses acquired and, of the above amount, some

US$7m is expected to be deductible for tax purposes.