Experian 2011 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

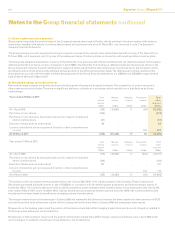

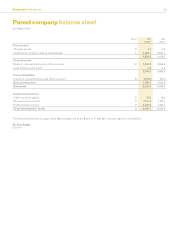

152 ExperianAnnualReport2011

Notes to the parent company nancial statements

for the year ended 31 March 2011

A. Corporate information

Experian plc (the ‘Company’) is incorporated and registered in Jersey under Jersey company law as a public company limited by shares and

is resident in Ireland. The principal legislation under which the Company operates is the Companies (Jersey) Law 1991, as amended, and

regulations made thereunder. The address of its registered ofce is 22 Grenville Street, St Helier, Jersey JE4 8PX.

The Company is the ultimate holding company of the Experian group of companies (the ‘Group’) and its ordinary shares are traded on the

London Stock Exchange’s Regulated Market (Premium Listing). Experian is a global information services group.

B. Basis of preparation

The separate nancial statements of the Company are presented in compliance with the requirements for companies whose shares are traded

on the London Stock Exchange’s Regulated Market. They have been prepared on a going concern basis and under the historical cost convention,

modied by the revaluation of certain nancial instruments, and in accordance with the Companies (Jersey) Law 1991 and UK Generally

Accepted Accounting Practice (‘UK GAAP’). Although the Company is incorporated and registered in Jersey, these nancial statements are

designed to include disclosures sufcient to comply with those parts of the UK Companies Act 2006 applicable to companies reporting under

UK GAAP.

These nancial statements are presented in US dollars, the Company's functional currency, and comprise the prot and loss account, balance

sheet and related notes. Under the terms of Financial Reporting Standard (‘FRS’) 1 ‘Cash ow statements’, the Company is exempt from

publishing a cash ow statement and, under the terms of FRS 8 ‘Related party disclosures’, is also exempt from disclosing transactions with

wholly-owned members of the Group.

The Experian plc Group nancial statements for the year ended 31 March 2011 contain nancial instrument disclosures required by IFRS

7 ‘Financial instruments: disclosure and presentation’ and these would also comply with the disclosures required by FRS 29 ‘Financial

instruments: disclosure and presentation’. Accordingly, the Company has taken advantage of the exemption in FRS 29 and has not presented

separate nancial instrument disclosures.

C. Comparative information

As indicated in note 3 to the Experian plc Group nancial statements, a new format has been adopted in the Group income statement for the

year ended 31 March 2011 and costs therein are now reported by nature rather than by function, with comparative gures re-presented. In the

light of this, the directors have reviewed the presentation of the Company prot and loss account and it is now prepared with reference to Format

2 of Schedule 1, Part 1, of The Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 (‘the Regulations’).

Comparative gures, which were previously prepared with reference to Format 1 of the Regulations, have been re-presented.

D. Signicant accounting policies

The principal accounting policies applied in the preparation of these nancial statements are set out below. These policies have been

consistently applied to both years presented.

Tangible xed assets

Leasehold improvements are held at cost less accumulated depreciation. Cost includes the original purchase price and amounts attributable

to bringing the asset to its working condition for its intended use. Depreciation is charged so as to write off such assets on a straight line basis

over the shorter of their estimated life and the remaining period of the lease.

Operating leases

Leases in which a signicant portion of the risks and rewards of ownership are retained by the lessor are classied as operating leases and

not capitalised. Payments made under operating leases are charged in the prot and loss account on a straight line basis over the period of the

lease.

Investments - shares in Group undertakings

Investments in Group undertakings are stated at cost less any provisions necessary for permanent diminution in value. The fair value of share

incentives issued by the Company to employees of subsidiary undertakings is accounted for as a capital contribution and recognised as an

increase in the Company's investment in Group undertakings with a corresponding increase in total shareholders' funds.

Impairment of xed assets

Where there is an indication of impairment, xed assets are subject to review for impairment in accordance with FRS 11 ‘Impairment of xed

assets and goodwill’. Any impairment is recognised in the year in which it occurs.

Debtors and creditors

Debtors are initially recognised at fair value and subsequently measured at this value. Where the time value of money is material, such items are

carried at amortised cost using the effective interest rate method. Creditors are initially recognised at fair value. Where the time value of money

is material such items are carried at amortised cost using the effective interest rate method.

Cash at bank and in hand

Cash at bank includes deposits held at call with banks and other short-term highly liquid investments.

Accounting for derivative nancial instruments

The Company uses forward foreign exchange contracts to manage its exposures to uctuations in foreign exchange rates. The interest

differential reected in forward foreign exchange contracts is taken to interest receivable and similar income or interest payable and similar

charges. Forward foreign exchange contracts are recognised at fair value, based on forward foreign exchange market rates at the balance sheet

date. Gains or losses on forward foreign exchange contracts are taken to the prot and loss account in the year in which they arise.