Experian 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements 113

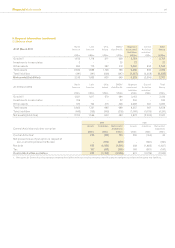

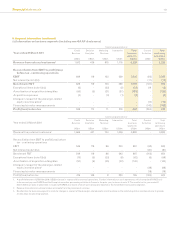

9. Segment information (continued)

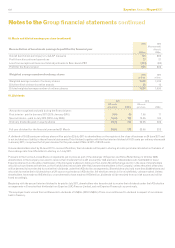

(c) Information on business segments (including non-GAAP disclosures)

Continuing operations1

Year ended 31 March 2011 Credit

Services

US$m

Decision

Analytics

US$m

Marketing

Services

US$m

Interactive

US$m

Total

business

segments

US$m

Central

Activities

US$m

Total

continuing

operations

US$m

Revenue from external customers21,812 436 815 1,176 4,239 - 4,239

Reconciliation from EBIT to prot/(loss)

before tax - continuing operations

EBIT 609 119 123 259 1,110 (66) 1,044

Net interest (note 14(b)) - - - - - (71) (71)

Benchmark PBT 609 119 123 259 1,110 (137) 973

Exceptional items (note 13(a)) (6) - (23) (2) (31) 29 (2)

Amortisation of acquisition intangibles (60) (5) (27) (37) (129) - (129)

Acquisition expenses (5) - (2) (1) (8) - (8)

Charges in respect of the demerger-related

equity incentive plans3- - - - - (13) (13)

Financing fair value remeasurements - - - - - (142) (142)

Prot/(loss) before tax 538 114 71 219 942 (263) 679

Continuing operations1

Year ended 31 March 2010 Credit

Services

US$m

Decision

Analytics

US$m

Marketing

Services

US$m

Interactive

US$m

Total

business

segments

US$m

Central

Activities

US$m

Total

continuing

operations

US$m

Revenue from external customers21,669 441 734 1,036 3,880 - 3,880

Reconciliation from EBIT to prot/(loss) before

tax - continuing operations

EBIT 549 119 86 243 997 (62) 935

Net interest (note 14(b)) - - - - - (81) (81)

Benchmark PBT 549 119 86 243 997 (143) 854

Exceptional items (note 13(a)) (16) (5) (33) (8) (62) (6) (68)

Amortisation of acquisition intangibles (57) (6) (45) (32) (140) - (140)

Charges in respect of the demerger-related

equity incentive plans3- - - - - (28) (28)

Financing fair value remeasurements - - - - - (18) (18)

Prot/(loss) before tax 476 108 8 203 795 (195) 600

1. A prot before tax of US$119m (2010: US$53m) arose in respect of discontinued operations. Further information on such operations, which comprised FARES only

in the current year and FARES and the Group’s transaction processing activities in France in the prior year, is shown in note 17. The results for the year ended 31

March 2010 have been re-presented in respect of FARES, the results of which were previously reported in the Credit Services business segment.

2. Revenue from external customers arose principally from the provision of services.

3. No allocation by business segment is made for charges in respect of the demerger-related equity incentive plans as the underlying data is maintained only to provide

an allocation by operating segment.