Experian 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 Experian Annual Report 2011

Notes to the Group nancial statements continued

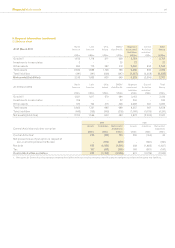

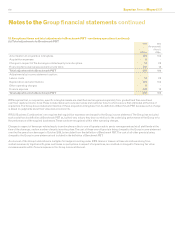

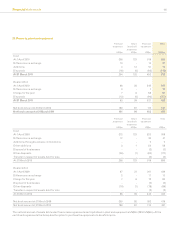

17. Discontinued operations

Discontinued operations comprise FARES (see note 3) and for the prior year additionally included further costs following the disposal in

October 2008 of the Group’s transaction processing activities in France.

(a) Results for discontinued operations 2011

US$m

2010

US$m

FARES:

Share of prots 5 56

Gain arising in connection with disposal of interest in FARES 123 -

Loss arising in connection with arrangements with FARES - (4)

Finance expense - nancing fair value (reversal)/gain (9) 9

Prot before tax of discontinued operations 119 61

Tax charge (46) (26)

Prot after tax of discontinued operations 73 35

Transaction processing activities in France:

Loss on disposal of discontinued operations - (8)

Prot for the nancial year from discontinued operations 73 27

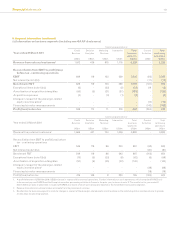

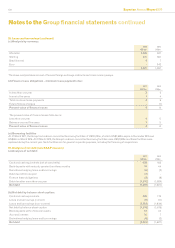

In the period to 22 April 2010, being the date of the exercise by FAC of its buy-out option over Experian’s 20% interest in FARES, Experian used

the equity method to account for its shareholding in FARES. Accordingly Experian’s share of FARES’ post-tax prots was recognised and is

now reported within results for discontinued operations with comparative gures re-presented.

The gain arising in connection with the disposal of the interest in FARES represents the difference between the pre-tax amount of US$314m

realised on the disposal of the interest in December 2010 and its book value of US$217m at the date of the exercise by FAC of its buy-out option,

together with dividends of US$26m received after the exercise of the buy-out option.

The loss of US$4m recognised in the year ended 31 March 2010 in connection with arrangements with FARES related primarily to the

reclassication through the Group income statement of earlier losses in respect of holdings of First Advantage Corporation ('FADV') Class A

common stock. The nancing fair value gain recognised in that year, and reversed in the year ended 31 March 2011, related to the fair value of the

FAC buy-out option at 31 March 2010.

In the period to 22 April 2010, the Group made net sales and recharges to FARES of US$2m (2010: US$28m for the full year). Such net sales and

recharges were made under normal commercial terms and conditions that would be available to third parties.

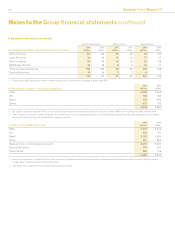

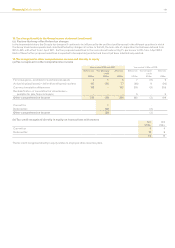

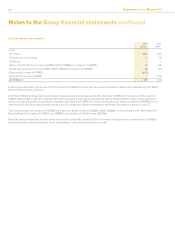

(b) Cash ows attributable to discontinued operations

From operating activities 2011

US$m

2010

US$m

Dividends received 241

Tax paid -(22)

Net increase in cash and cash equivalents – discontinued operations 2 19

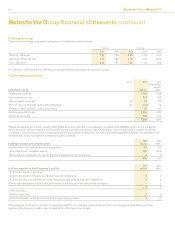

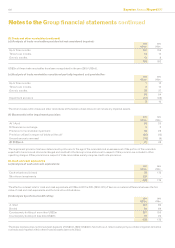

The above amounts relate to FARES for the period to 22 April 2010 (2010: full year). The net proceeds of US$279m arising on the disposal of the

interest in FARES in the year ended 31 March 2011 are disclosed within net cash ows used in investing activities from continuing operations in

the Group cash ow statement. This amount includes further dividends received of US$26m and is stated after the settlement of tax arising on

the disposal of US$61m.

Cash inows of US$118m in respect of transactions completed in the year ended 31 March 2010 are disclosed within net cash ows used in

investing activities from continuing operations in the Group cash ow statement for that year. These comprise:

-Cash of US$70m from the sale of all the shares in FAC received in exchange for direct and indirect holdings in FADV Class A common stock;

and

-Cash of US$48m received on the disposal by FARES of its interests in two business assets.

Following an inow of US$191m in the year ended 31 March 2009, there was a net cash outow of US$17m in respect of additional costs relating

to the disposal of the transaction processing activities in France in the year ended 31 March 2010. This outow is disclosed within net cash ows

used in investing activities from continuing operations in the Group cash ow statement. There was no tax relief on these further costs or on

that portion of the costs reported as a loss on disposal of discontinued operations.