Experian 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2011

42

Financial review

Experian has delivered a further strong performance against a background of modest

improvement in some core markets and has reported strong revenue growth and good

profit and cash performance.

Revenue and profit performance –

continuing operations

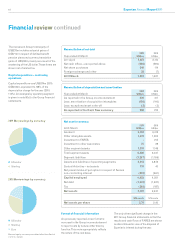

Revenue increased from US$3,880m in the

prior year to US$4,239m in the year ended

31 March 2011. At constant exchange rates,

organic revenue growth was 8%.

Profit before tax increased by 13%, from

US$600m to US$679m. Benchmark PBT

rose by US$119m to US$973m (2010:

US$854m).

Organic revenue growth of 8% translated

into growth in total EBIT at constant

exchange rates of 10% to US$1,044m,

with a margin improvement of 30 basis

points to 24.8%.

Exceptional items – continuing

operations

Expenditure of US$10m arose in the year

in connection with the conclusion of the

strategic programme of cost efficiency

measures. Of this, US$6m related to

redundancy, US$1m related to offshoring

activities, other restructuring and

infrastructure consolidation costs and

US$3m related to asset write-offs.

The gain of US$29m recognised in the

year in respect of the Group’s principal

defined benefit pension plan arose as

a consequence of a change by the UK

Government to the index required to be

used in determining pension increases for

benefits accrued in respect of past service.

The loss on disposal of businesses in the

year principally related to the completion of

a number of small disposals of businesses

whose assets and liabilities were classified

as held for sale at 31 March 2010.

Net interest expense

In the year ended 31 March 2011, the net

interest expense was US$71m (2010:

US$81m), after crediting US$6m (2010:

charging US$1m) in respect of the

differential between the expected return on

pension assets and interest recognised on

pension liabilities. The Group has continued

to benefit from the environment of low

global interest rates together with its strong

cash flow performance.

Tax

The effective rate of tax for the year based

on Benchmark PBT was 22.6% (2010:

19.0%). This rate is defined as the total tax

charge/(credit) as reported in the Group

income statement, adjusted for the tax

impact of non-Benchmark items, divided

by Benchmark PBT. A one-off current tax

credit of US$37m arose in the year ended

31 March 2011 on the utilisation of earlier tax

losses and is excluded from the calculation

of the rate in the year ended 31 March 2011

in view of its size and non-recurring nature.

A one-off deferred tax credit of US$105m

was excluded from the calculation of the

rate in the year ended 31 March 2010 in view

of its size and non-recurring nature.

The cash tax rate for continuing operations

(based on tax paid in the year and

Benchmark PBT for continuing operations)

was 9.0% (2010: 3.0%).

Earnings and dividends per share

Basic earnings per share were 57.9 US

cents (2010: 59.0 US cents), including

earnings of 7.3 US cents (2010: 2.6 US cents)

in respect of discontinued operations.

Benchmark earnings per share increased to

70.0 US cents from 63.7 US cents last year.

The second interim dividend for the year, to

be paid on 22 July 2011, is 19 US cents per

ordinary share (2010: 16 US cents) giving a

total dividend per share for the year of 28

US cents (2010: 23 US cents), an increase

of 22%. The total dividend is covered 2.5

times by Benchmark earnings per share

consistent with the previously announced

reduction in dividend cover from at least

three times to around two and a half times.

Cash flow, funding and net debt

Experian generated good cash flow in the

year with operating cash flow of US$1,028m

(2010: US$935m) and a cash flow

conversion of 98% (2010: 100%). Experian

manages its working capital and capital

expenditure in order to meet its target to

convert at least 90% of EBIT into operating

cash flow and this target forms one of its

key performance indicators. Cash flow

conversion is defined as operating cash

flow expressed as a percentage of EBIT

from continuing operations.

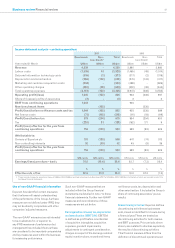

Exceptional items - continuing operations

Year ended 31 March 2011

US$m 2010

US$m

Restructuring costs 10 41

Gain in respect of defined benefit pension plan (29) -

Loss on disposal of businesses 21 24

Cessation of bureau activities -3

Total exceptional items 2 68