Experian 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

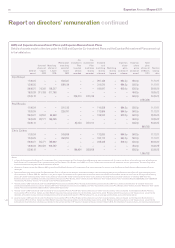

78 Experian Annual Report 2011

Report on directors’ remuneration continued

Salary to

31 March 2011

Salary from

1 April 2011

Percentage

increase

Don Robert US$1,450,000 US$1,500,000 3.4%

Paul Brooks £475,000 £490,000 3.2%

Chris Callero US$930,000 US$960,000 3.2%

In addition to base salary, executive directors receive certain benefits-in-kind including a car or car allowance, private health cover and life

assurance. These are set at market competitive levels for each role.

Pensions

In the UK, a defined contribution plan is available for all employees, with an employer contribution rate (in normal circumstances) of up to

20% for the most senior executives. Retirement age is 65 but benefits can be taken from age 55 onwards.

The UK defined benefit arrangements are closed to new entrants, subject only to exceptions approved by the Committee on a case by case

basis. Members who were in the arrangements at the date of closure continue to accrue benefits. The retirement age is 60 for directors and

the arrangements provide a pension of up to two-thirds of final salary, ill health and dependants’ pensions and life assurance. A Secured

Unfunded Retirement Benefits Scheme (‘SURBS’) provides unfunded pension benefits for executives affected by the 1989 HMRC earnings

cap. The SURBS was closed to new entrants in April 2006.

In the US, Experian provides a Personal Investment Plan (401k) which all US employees, including directors, are eligible to join. This is a

defined contribution arrangement to which participants are able to contribute up to 50% of salary, up to a maximum salary and participant

contribution limit established by the IRS, each calendar year.

Variable remuneration

Annual bonus and Co-investment Plan

Annual bonuses are awarded for achieving profit growth targets. The Committee believes this is appropriate as it reflects one of Experian’s

key strategic objectives (driving profitable growth). The maximum bonus opportunity for executive directors is 200% of base salary. However,

this level of annual bonus is only payable if Experian’s financial performance surpasses stretching profit growth targets, designed to deliver

exceptional results to shareholders. During the year, Kepler advised on the calibration of these targets using benchmarks that reflect

stretching internal and external expectations. The benchmarks used include: broker earnings estimates, earnings estimates for competitors,

straight-line profit growth consistent with median/upper quartile shareholder returns, latest projections for the current year, budget and

strategic plan.

Since 2009, executive directors have been offered the opportunity to defer receipt of between 50% and 100% of their annual bonus and

invest it in Experian shares (‘invested shares’) under the Experian Co-investment Plan (the ‘CIP’). The invested shares are matched with

an additional award of shares (‘matching shares’) with the maximum match being calculated on the basis of two matching shares for each

invested share (‘2:1 basis’). The release of invested shares and matching shares is deferred for three years and the release of the matching

shares is subject to performance conditions which are measured over a three-year period. Performance conditions are determined by the

Committee in advance of grant. Dividend equivalents accrue on these awards. If a participant resigns during the three-year period they

forfeit the right to the matching shares and the associated dividends, although they would be entitled to retain any invested shares. Matching

awards under the CIP may vest early in the event of a change of control.

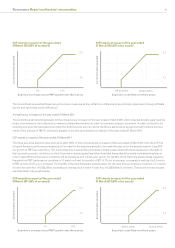

CIP awards in respect of the year ended 31 March 2010

The executive directors elected to defer 100% of their annual bonus earned in respect of the year ended 31 March 2010 into the CIP and

matching shares were awarded on a 2:1 basis. Details of the awards made in June 2010 are given in the table entitled ‘GUS and Experian

Co-investment Plans and Experian Reinvestment Plans’. The release of 50% of the matching shares is subject to the achievement of a

growth in PBT performance condition, measured over three years (a 1:1 match vests for growth in PBT of 5% p.a. on average, increasing to a

2:1 match vesting for growth in PBT of 11% p.a. on average). The other 50% of the matching share awards will vest subject to the achievement

of a three-year cash flow target (a 1:1 match vests for cash flow of US$2,900m increasing to a 2:1 match vesting for cash flow of US$3,300m).

These performance targets are illustrated in the graphs opposite.

10

86