Experian 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

Governance Report on directors’ remuneration

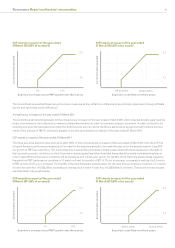

PSP awards to be made in the year ending 31 March 2012

For awards to be made in the year ending 31 March 2012, it is intended that the same performance measures will be used as for the awards

made in June 2010 (i.e. growth in PBT and TSR). The Committee has reviewed the performance targets associated with these measures in

the light of the improved economic conditions in which Experian is operating and has determined that the growth in PBT measure should be

made more stretching than in recent years. Both performance conditions will be measured over a three-year period. For the 75% of any award

subject to the growth in PBT performance condition, 25% will vest for growth in PBT of 7% p.a. on average, increasing to vesting of 100% if

PBT growth of 14% p.a. on average is achieved. It is intended that the remaining 25% of any award will be subject to the same relative TSR

performance condition as applied to the awards made in June 2010. These performance targets are illustrated in the graphs below.

PSP awards to be made in the year

ending 31 March 2012 (75% of an award)

100%

75%

50%

25%

0%

Experian’s average annual PBT growth over three years

% of shares vesting

7% 14%

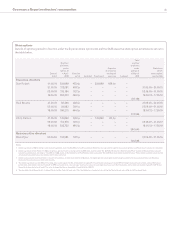

PSP awards to be made in the year

ending 31 March 2012 (25% of an award)

100%

75%

50%

25%

0%

% extent to which Experian’s TSR outperforms

the TSR of the FTSE 100 Index over three years

% of shares vesting

0% 25%

In addition, vesting of any awards made in the year ending 31 March 2012 will be subject to satisfactory ROCE performance and to the

Committee being satisfied that the vesting is not based on financial results which have been materially misstated.

Experian Share Option Plan (‘ESOP’)

Grants were last made to executive directors under the ESOP in June 2009. Following a review of the remuneration package for executive

directors in 2010, the Committee concluded that no grants would be made under this plan in 2010 and has agreed this will also be the case for

2011 (other than in exceptional circumstances). The maximum award under the ESOP is normally 200% of base salary, although up to 400% of

salary may be awarded under exceptional circumstances. Use of the ESOP in the future will remain under review by the Committee. Details

of outstanding awards under the ESOP and the associated performance conditions are set out in the table entitled 'Share options'.

Experian sharesave plans

All executive directors and employees of the Company, and any participating subsidiaries in which sharesave or a local equivalent is

operated, are eligible to participate if they are employed by the Group at a qualifying date. As an example of these plans, the UK Sharesave

Plan provides an opportunity for employees to save a regular monthly amount, over either three or five years which, at the end of the savings

period, may be used to purchase Experian shares at up to 20% below market value at the date of grant.

Shares released to participants in the year ended 31 March 2011

Experian Reinvestment Plans

Awards to executive directors under the 2004 and 2005 cycles of the GUS Co-investment Plans were reinvested in awards under the Experian

Reinvestment Plans at demerger to ensure that directors remained fully aligned to the performance of the demerged business. Matching

awards of shares were made under these plans, the release of which is subject to the achievement of performance conditions, the retention

of reinvested shares and continued employment. The vesting of 50% of the matching awards was subject to achievement against a sliding

scale growth in PBT performance condition. 30% of this part of the award would vest for average growth in PBT of 7% p.a. over a three-year

period, increasing to 100% of this part of the award vesting for average PBT growth of 14% p.a. This part of the matching award vests in two

equal tranches, on the fourth and fifth anniversaries of grant. The remaining 50% of the matching award vests in three tranches, 50% on the

third anniversary of grant, 25% on the fourth anniversary of grant and 25% on the fifth anniversary of grant, subject to continued employment.

85