Experian 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Chief Executive’s review 27

Brazil credit market welcomes

positive data sharing

At the end of last year, the Brazilian government legalised the sharing of positive

data between companies for the purposes of granting credit. Previously,

consumer credit les were only allowed to contain negative information, such

as delinquent accounts, failed cheques or bankruptcy. The change in legislation

brings Brazil into line with other major credit markets, including the US and

UK where positive data accounts for the great majority of information held by

Experian’s credit bureaux.

The ability to record and share full payment histories at account level will enable

Experian to provide much richer credit proles of consumers in Brazil. It opens

the way for more predictive credit scores and a range of advanced customer

management and fraud prevention tools. For clients, the use of positive data

will reduce the risks of lending through more informed decision-making, while

helping to make credit more accessible to Brazilian consumers.

Experian already holds positive data on around 70 million individuals in Brazil

and is now working with banks, retails chains, utility and telecommunication

companies, and other data owners to secure agreements to share their

information and promote the benets of positive data sharing.

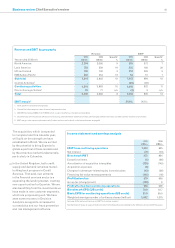

In setting our capital allocation strategy

for FY12, we have taken into account

anticipated free cash ow, the likely

future value of the Serasa put option,

the current acquisition pipeline and

the anticipated completion of the

Computec acquisition in calendar year

2011. After adjusting for the Computec

acquisition, FY11 pro forma net debt is

around 2 times EBITDA. We therefore

do not intend to initiate a further

share buyback programme, although

we do expect there to be some share

purchases in respect of employee share

plans that vest.

Dividend

For the year ended 31 March 2011, we are

announcing a second interim dividend

of 19 US cents per share. This gives a

full year dividend of 28 US cents per

share, 2.5 times covered by Benchmark

EPS, in line with our previously

announced increased dividend payout

policy, and up 22%. The second interim

dividend will be paid on 22 July 2011

to shareholders on the register at the

close of business on 24 June 2011.

Board

In accordance with the provisions of

the UK Corporate Governance Code,

the Board has decided that, in future, all

directors should be subject to annual

re-election by shareholders. David

Tyler has notied the Board of his

intention not to stand for re-election

to the Board at the 2012 annual general

meeting, following completion of two

three-year terms as a non-executive

director of the Company.