Experian 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Experian Annual Report 2011

Report on directors’ remuneration continued

In addition, vesting of matching shares will be subject to the Committee being satisfied that the vesting is not based on financial results

which have been materially misstated.

Annual bonus and CIP in respect of the year ending 31 March 2012

It is intended that annual bonus arrangements and the operation of the CIP for executive directors will remain unchanged for the year ending

31 March 2012. For matching shares awarded under the CIP, the final performance measures and targets will be determined shortly before

the awards are made in June 2012 and will be disclosed at the appropriate time. However, the Committee undertakes to ensure that any

targets, whilst they must be seen as achievable to retain and motivate executives during the deferral period, are sufficiently stretching in

order to deliver significant shareholder value.

Experian Performance Share Plan (the ‘PSP’)

Under the PSP, shares are awarded to participants subject to the achievement of performance conditions, which are measured over a

three-year period. The maximum award under the PSP is normally 200% of base salary, although up to 400% of salary may be awarded under

exceptional circumstances. Any vesting occurs three years from the date of grant. Performance conditions for awards under the PSP are

determined by the Committee in advance of grant. Dividend equivalents accrue on these awards. Awards under the PSP may vest early in

the event of a change of control.

PSP awards made in the year ended 31 March 2011

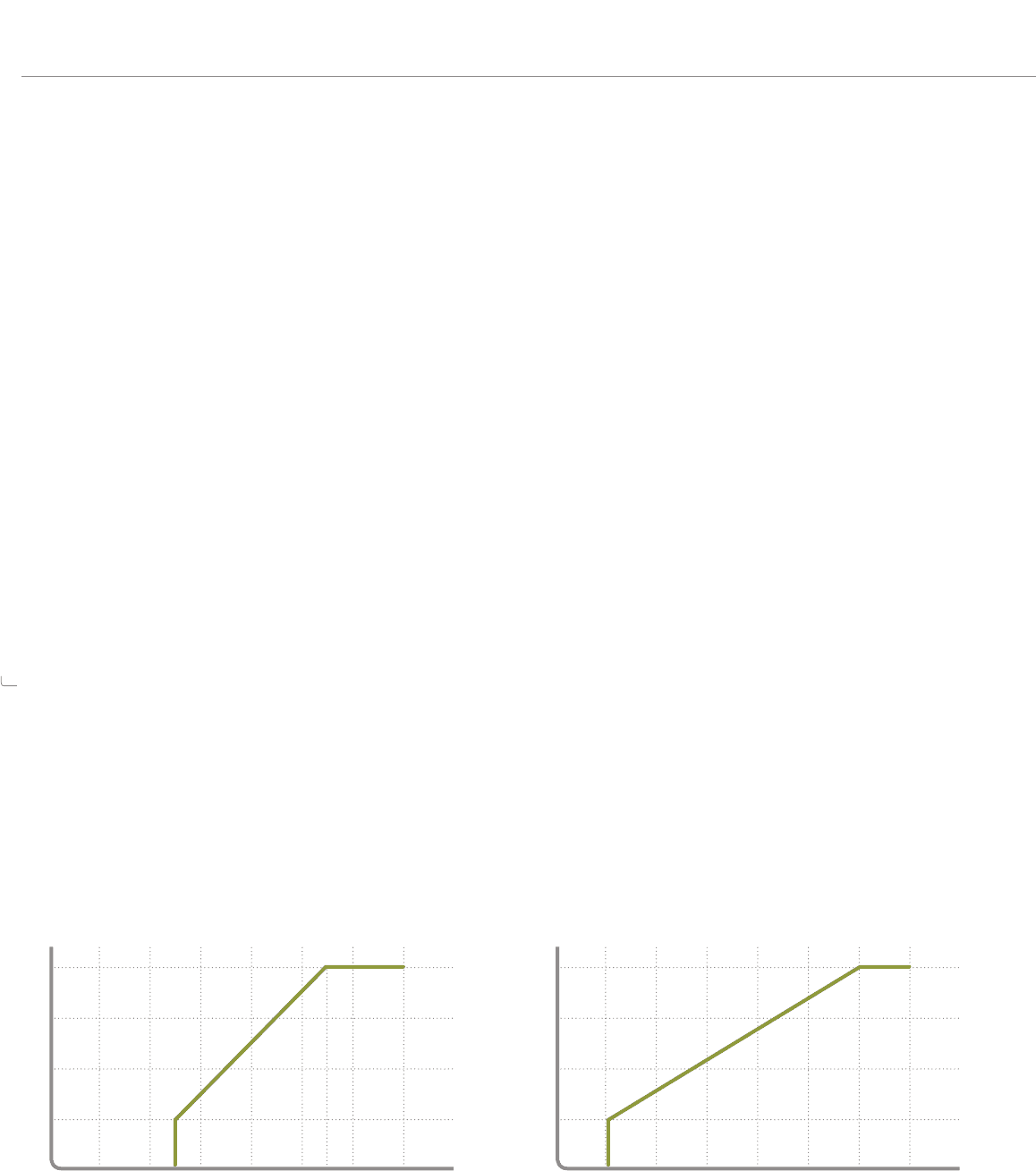

Details of PSP awards made to executive directors in June 2010 are given in the table entitled ‘Performance Share Plan’. 75% of these

awards are subject to a growth in PBT performance condition, measured over a three-year period (25% vesting for growth in PBT of 5%

p.a. on average, increasing to 100% vesting for growth in PBT of 11% p.a. on average). The Committee considers this to be an appropriate

performance measure as it reflects one of Experian’s key strategic objectives (driving profitable growth). The remaining 25% of the awards

made in June 2010 are subject to a TSR performance condition, with vesting according to the percentage extent to which Experian’s TSR

out-performs the TSR of the FTSE 100 Index, measured over a three-year period (25% vesting for TSR performance equal to that of the

FTSE 100 Index increasing to 100% vesting for TSR performance which out-performs the FTSE 100 Index by 25% or more). The Committee

determined that TSR was an appropriate performance measure as it represents value delivered for shareholders relative to Experian’s

peers. These performance conditions are illustrated in the graphs below.

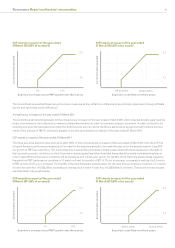

PSP awards made in the year ended

31 March 2011 (25% of an award)

100%

75%

50%

25%

0%

% extent to which Experian’s TSR outperforms

the TSR of the FTSE 100 Index over three years

% of shares vesting

0% 25%

PSP awards made in the year ended

31 March 2011 (75% of an award)

100%

75%

50%

25%

0%

Experian’s average annual PBT growth over three years

% of shares vesting

5% 11%

In addition, vesting of these awards will be subject to satisfactory ROCE performance, to ensure that earnings growth is delivered in a

sustainable and efficient way.

87