Experian 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements 141

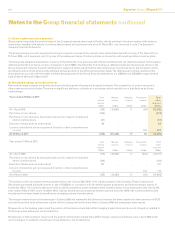

34. Retirement benet assets and obligations (continued)

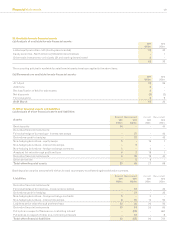

(x) Historical information

2011

US$m

2010

US$m

2009

US$m

2008

US$m

2007

US$m

Fair value of plans' assets 913 822 595 1,045 1,069

Present value of dened benet obligations (858) (910) (653) (913) (984)

Net pension assets/(obligations) 55 (88) (58) 132 85

Experience adjustment on plans' assets - (gains)/losses (10) (178) 236 101 53

Experience adjustment on dened benet obligations - (gains)/losses (57) (1) 1 8 (5)

The Group’s retirement benet assets and obligations are denominated primarily in sterling.

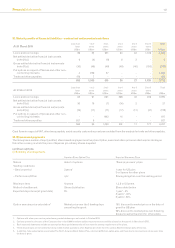

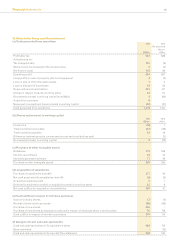

35. Deferred tax

(a) Net deferred tax liabilities 2011

US$m

2010

US$m

At 1 April 37 122

Differences on exchange 8 19

Charge/(credit) in the Group income statement (note 15) 64 (102)

Business combinations (note 40) 10 5

Tax recognised within other comprehensive income (note 16(a)) 30 3

Tax recognised in equity on transactions with owners (note 16(b)) (15) (8)

Transfer in respect of liabilities held for sale - (4)

Other transfers (13) 2

At 31 March 121 37

Net deferred tax liabilities are presented in the Group balance sheet as:

Deferred tax assets (159) (176)

Deferred tax liabilities 280 213

At 31 March 121 37

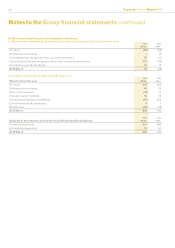

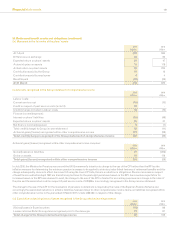

(b) Gross deferred tax assets

Movements in gross deferred tax assets, without taking into consideration the offsetting of assets and liabilities within the same tax

jurisdiction, comprise:

Accelerated

depreciation

US$m

Intangibles

US$m

Share

incentive

plans

US$m

Tax losses

US$m

Other

temporary

differences

US$m

Total

US$m

At 1 April 2010 20 62 39 118 158 397

Differences on exchange 1 - - - 8 9

Credit/(charge) in the Group income statement (13) (36) 2 8 15 (24)

Tax recognised within other comprehensive income - - - - (30) (30)

Tax recognised in equity on transactions with owners - - 15 - - 15

Other transfers - - - (9) 10 1

At 31 March 2011 8 26 56 117 161 368

Accelerated

depreciation

US$m

Intangibles

US$m

Share

incentive

plans

US$m

Tax losses

US$m

Other

temporary

differences

US$m

Total

US$m

At 1 April 2009 22 63 22 17 144 268

Differences on exchange 1 3 - - 10 14

Credit/(charge) in the Group income statement (3) (4) 9 101 9 112

Tax recognised within other comprehensive income - - - - (3) (3)

Tax recognised in equity on transactions with owners - - 8 - - 8

Other transfers - - - - (2) (2)

At 31 March 2010 20 62 39 118 158 397