Experian 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 Experian Annual Report 2011

Notes to the Group nancial statements continued

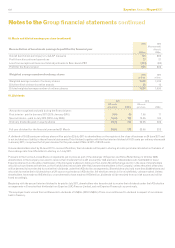

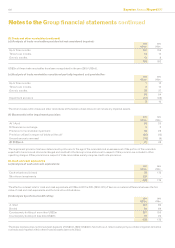

31. Other nancial assets and liabilities (continued)

The accounting policies for nancial instruments have been applied as appropriate to the above items. Amounts recognised in the Group

income statement in connection with the Group’s hedging instruments are disclosed in note 14.

There is no material difference between the fair values of these assets and liabilities and the book values stated above.

There are put and call options associated with the shares held by non-controlling shareholders in Serasa and these are exercisable for a period

of ve years from June 2012.

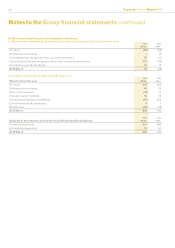

(b) Fair value and notional principal amounts of the Group’s derivative nancial instruments:

2011 2010

Assets Liabilities Assets Liabilities

Fair value

US$m

Notional

US$m

Fair value

US$m

Notional

US$m

Fair value

US$m

Notional

US$m

Fair value

US$m

Notional

US$m

Interest rate swaps 39 646 28 864 43 507 65 1,275

Cross currency swaps - - 31 1,347 - - 35 707

Equity swaps 5 14 - 10 17 47 - -

Foreign exchange contracts 1 272 5 407 2 188 5 176

45 932 64 2,628 62 742 105 2,158

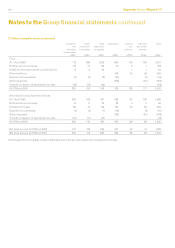

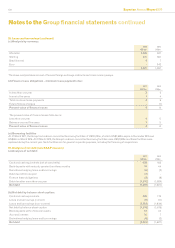

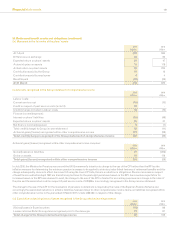

(c) Maturity of derivative nancial liabilities - contractual undiscounted cash ows:

At 31 March 2011 Less than

1 year

US$m

1 to 2

years

US$m

2 to 3

years

US$m

3 to 4

years

US$m

4 to 5

years

US$m

Over 5

years

US$m

Total

US$m

Settled on a net basis - interest rate swaps 6 (4) (9) 6 3 - 2

Settled on a gross basis:

Outows for cross currency swaps 25 24 24 24 24 1,428 1,549

Inows for cross currency swaps (58) (64) (64) (64) (64) (1,578) (1,892)

Outows for foreign exchange contracts 682 - - - - - 682

Inows for foreign exchange contracts (679) - - - - - (679)

Settled on a gross basis (30) (40) (40) (40) (40) (150) (340)

Cash outows/(inows) (24) (44) (49) (34) (37) (150) (338)

At 31 March 2010 Less than

1 year

US$m

1 to 2

years

US$m

2 to 3

years

US$m

3 to 4

years

US$m

4 to 5

years

US$m

Over 5

years

US$m

Total

US$m

Settled on a net basis - interest rate swaps 30 10 (7) (14) 2 - 21

Settled on a gross basis:

Outows for cross currency swaps 13 14 14 14 14 776 845

Inows for cross currency swaps (31) (31) (31) (31) (31) (817) (972)

Outows for foreign exchange contracts 363 - - - - - 363

Inows for foreign exchange contracts (364) - - - - - (364)

Settled on a gross basis (19) (17) (17) (17) (17) (41) (128)

Cash outows/(inows) 11 (7) (24) (31) (15) (41) (107)

The table above analyses the Group’s derivative nancial liabilities into maturity groupings based on the period from the balance sheet date to

the contractual maturity date. As the amounts disclosed are the contractual undiscounted cash ows, they differ from the carrying values and

fair values.