Experian 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 Experian Annual Report 2011

Notes to the Group nancial statements continued

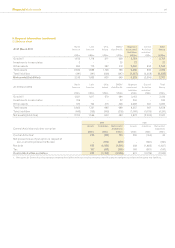

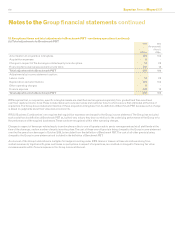

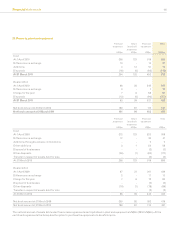

15. Tax charge/(credit) in the Group income statement

(a) Analysis of Group tax charge/(credit) 2011

US$m

2010

(Re-presented)

(Note 3)

US$m

Current tax:

Tax on income for the year 100 82

Adjustments in respect of prior years (35) 11

Total current tax charge 65 93

Deferred tax:

Origination and reversal of temporary differences 51 (98)

Adjustments in respect of prior years 13 (4)

Total deferred tax charge/(credit) 64 (102)

Group tax charge/(credit) 129 (9)

The Group tax charge/(credit) comprises:

UK tax (23) (103)

Non-UK tax 152 94

Group tax charge/(credit) 129 (9)

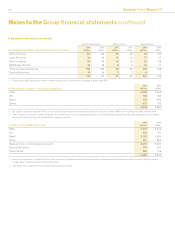

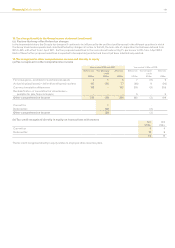

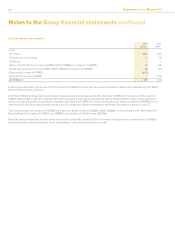

(b) Tax reconciliations

(i) Reconciliation of the Group tax charge/(credit) 2011

US$m

2010

(Re-presented)

(Note 3)

US$m

Prot before tax 679 600

Prot before tax multiplied by the standard rate of UK corporation tax of 28% (2010: 28%) 190 168

Effects of:

Adjustments in respect of prior years (22) 7

Income not taxable (23) (30)

Expenses not deductible 74 38

Adjustment in respect of previously unrecognised tax losses (58) (105)

Reduction in future rate of UK corporation tax 10 -

Effect of different tax rates in non-UK businesses (42) (87)

Group tax charge/(credit) 129 (9)

The effective rate of tax for the year ended 31 March 2011 is 19.0%, based on the prot before tax of US$679m and the tax charge of US$129m.

In the year ended 31 March 2010, the Group reported a tax credit of US$9m, as a result of the benet of tax credits of US$129m, giving a small

negative effective rate of tax based on prot before tax of US$600m. The effective tax rate for both years is lower than the standard rate of

corporation tax in the UK of 28% and the differences are explained above.

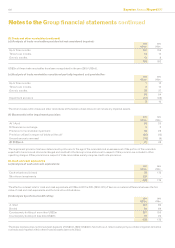

(ii) Reconciliation of the Group tax charge/(credit) to the Benchmark tax charge

2011

US$m

2010

(Re-presented)

(Note 3)

US$m

Group tax charge/(credit) 129 (9)

Add: one-off tax credit 37 105

Add: tax relief on exceptional items 4 33

Add: tax relief on total adjustments to Benchmark PBT 50 33

Tax on Benchmark PBT 220 162

The effective rate of tax based on Benchmark PBT of US$973m (2010: US$854m) and the associated tax charge of US$220m (2010: US$162m),

excluding the effect of a one-off tax credit of US$37m (2010: US$105m), is 22.6% (2010: 19.0%). The one-off current tax credit of US$37m arose in

the year ended 31 March 2011 on the utilisation of earlier tax losses and is excluded from the calculation of this rate in the year ended 31 March

2011 in view of its size and non-recurring nature. The one-off credit in the year ended 31 March 2010 was a deferred tax credit and was excluded

from the calculation of the effective rate for that year in view of its size and non-recurring nature. A further corporation tax credit of US$24m

arose in the year ended 31 March 2010 following resolution of historic positions and the tax credit of US$9m in the Group income statement and

the tax charge on Benchmark PBT of US$162m are both stated after this credit.