Experian 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review Financial review 47

Use of non-GAAP financial information

Experian has identified certain measures

that it believes will assist understanding

of the performance of the Group. As these

measures are not defined under IFRS, they

may not be directly comparable with other

companies’ adjusted measures.

The non-GAAP measures are not intended

to be a substitute for, or superior to,

any IFRS measures of performance but

management has included them as these

are considered to be important comparables

and key measures used within the business

for assessing performance.

Such non-GAAP measures that are

included within the Group financial

statements are detailed in note 7 to those

financial statements. Further non-GAAP

measures and reconciliations of those

measures are set out below.

Earnings before interest, tax, depreciation

and amortisation (‘EBITDA’): EBITDA

is defined as profit before amortisation

of acquisition intangibles, acquisition

expenses, goodwill impairments,

adjustments to contingent consideration,

charges in respect of the demerger-related

equity incentive plans, exceptional items,

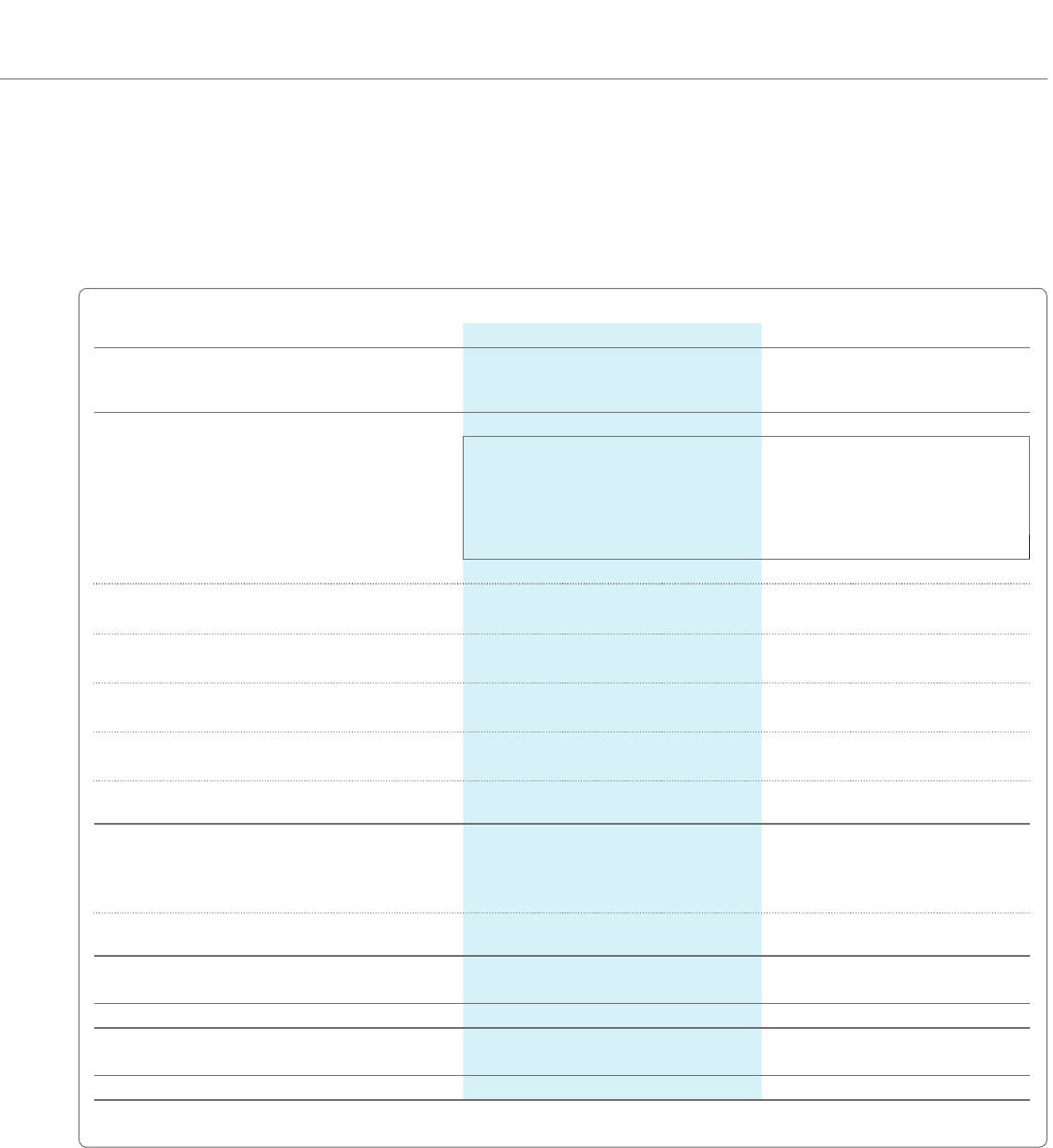

Income statement analysis – continuing operations

2011 2010

Benchmark Non-

benchmark1

Total Benchmark Non-

benchmark1

Total

Year ended 31 March US$m US$m US$m US$m US$m US$m

Revenue 4,239 - 4,239 3,880 - 3,880

Labour costs (1,535) 10 (1,525) (1,465) (49) (1,514)

Data and information technology costs (316) (1) (317) (317) (2) (319)

Depreciation and amortisation (288) (132) (420) (274) (143) (417)

Marketing and customer acquisition costs (594) - (594) (489) - (489)

Other operating charges (460) (29) (489) (402) (42) (444)

Total operating expenses (3,193) (152) (3,345) (2,947) (236) (3,183)

Operating profit/(loss) 1,046 (152) 894 933 (236) 697

Share of (losses)/profits of associates (2) - (2) 2- 2

EBIT from continuing operations 1,044 935

Non-benchmark items (152) (236)

Profit/(loss) before net finance costs and tax 1,044 (152) 892 935 (236) 699

Net finance costs (71) (142) (213) (81) (18) (99)

Profit/(loss) before tax 973 (294) 679 854 (254) 600

Tax (220) 91 (129) (162) 171 9

Profit/(loss) after tax for the year from

continuing operations 753 (203) 550 692 (83) 609

Attributable to:

Owners of Experian plc 701 (193) 508 647 (74) 573

Non-controlling interests 52 (10) 42 45 (9) 36

Profit/(loss) after tax for the year from

continuing operations 753 (203) 550 692 (83) 609

US cents US cents US cents US cents US cents US cents

Earnings/(loss) per share – basic 70.0 (19.4) 50.6 63.7 (7.3) 56.4

%%%% % %

Effective rate of tax 22.6 31.0 19.0 19.0 67.3 (1.5)

1. These include charges for exceptional items of US$2m (2010: US$68m) and total adjustments to Benchmark PBT of US$292m (2010: US$186m), full details of which are included in note 13 to

the Group financial statements.

net finance costs, tax, depreciation and

other amortisation. It includes the Group’s

share of continuing associates’ pre-tax

results.

Discontinuing activities: Experian defines

discontinuing activities as businesses

sold, closed or identified for closure during

a financial year. These are treated as

discontinuing activities for both revenue

and EBIT purposes. Prior periods, where

shown, are restated to disclose separately

the results of discontinuing activities.

This financial measure differs from the

definition of discontinued operations set