Experian 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128 Experian Annual Report 2011

Notes to the Group nancial statements continued

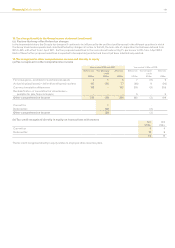

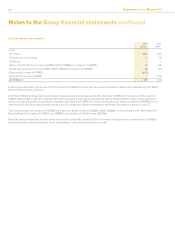

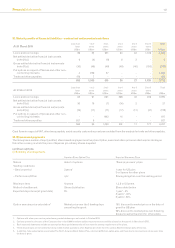

25. Trade and other receivables (continued)

(d) Analysis of trade receivables past due but not considered impaired: 2011

US$m

2010

US$m

Up to three months 167 159

Three to six months 14 15

Over six months 13 8

194 182

US$2m of these trade receivables have been renegotiated in the year (2010: US$nil).

(e) Analysis of trade receivables considered partially impaired and provided for: 2011

US$m

2010

US$m

Up to three months 712

Three to six months 815

Over six months 38 27

53 54

Impairment provision (47) (38)

6 16

The other classes within trade and other receivables at the balance sheet dates do not include any impaired assets.

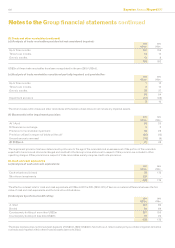

(f) Movements in the impairment provision: 2011

US$m

2010

US$m

At 1 April 38 25

Differences on exchange 52

Provision for receivables impairment 34 29

Provision utilised in respect of debts written off (20) (12)

Unused amounts reversed (10) (6)

At 31 March 47 38

The impairment provision has been determined by reference to the age of the receivable and an assessment of the portion of the receivable

expected to be recovered. Amounts charged and credited to the Group income statement in respect of this provision are included in other

operating charges. Other provisions in respect of trade receivables mainly comprise credit note provisions.

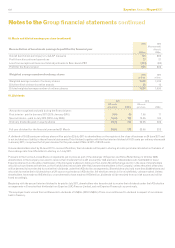

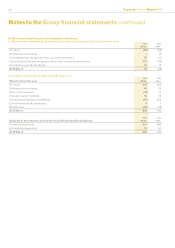

26. Cash and cash equivalents

(a) Analysis of cash and cash equivalents: 2011

US$m

2010

US$m

Cash at bank and in hand 78 175

Short-term investments 330 -

408 175

The effective interest rate for cash and cash equivalents at 31 March 2011 is 2.8% (2010: 4.8%). There is no material difference between the fair

value of cash and cash equivalents and the book value stated above.

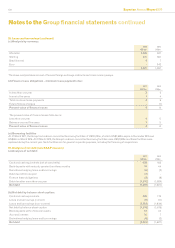

(b) Analysis by external credit rating: 2011

US$m

2010

US$m

A rated 327 86

B rated 60 69

Counterparty holding of more than US$2m 387 155

Counterparty holding of less than US$2m 21 20

408 175

The above analysis does not include bank deposits of US$14m (2010: US$44m) held with an A rated counterparty as collateral against derivative

contracts and reported within other nancial assets (see note 31(a)).