Experian 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Growth through global strength

Annual Report 2011

Table of contents

-

Page 1

Annual Report 2011 Growth through global strength -

Page 2

Experian vnnual Report 2011 "Experian has made progress on every front this yearc both financially and strategicallyc and delivered value to our shareholders. We're proud of this performance and excited about the opportunities for our business as we continue to lay the foundations for future growth... -

Page 3

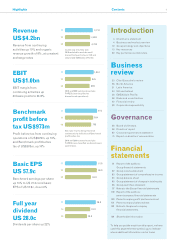

... margin from continuing activities up 30 basis points to 24.8% 11 10 09 1,044 935 896 2010 and 2009 restated to exclude FARES (now classiï¬ed as discontinued operations). Business review 23 28 31 33 36 38 42 50 Chief Executive's review North America Latin America UK and Ireland EMEA/Asia Paci... -

Page 4

2 Experian Annual Report 2011 Introduction John Peace Chairman 3 Chairman's statement 4 Business and market overview 10 Group strategy and objectives 13 Key resources 20 Key performance indicators -

Page 5

... Venezuela. We have also continued to roll out global products such as CheetahMail, our email marketing service, and Hunter, which detects fraudulent credit applications. It is clear that there is no shortage of opportunities for Experian. The management team remains ï¬rmly focused on the best of... -

Page 6

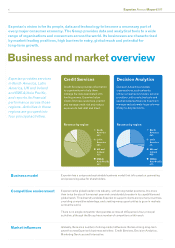

.... Business and market overview Experian provides services in North America, Latin America, UK and Ireland and EMEA/Asia Paciï¬c, and reports its ï¬nancial performance across those regions. Activities in these regions are grouped into four principal activities. Credit Services Credit Services... -

Page 7

... completely, communicate with them on an individual level and measure the impact of marketing campaigns. Experian enables marketers to target the right message to the right individual through the right channel at the right time. Revenue by region North America 46% Latin America 3% UK and Ireland 28... -

Page 8

... xx Experian Annual Report 2011 Credit Services Contribution to Group revenue 43% Business model At the core of Credit Services are the databases that Experian builds and manages, the credit bureaux. They are very comprehensive databases and hold the credit application and repayment histories of... -

Page 9

... Credit Services and Decision Analytics The addressable market for Experian's data and analytics is expanding in emerging markets and new customer segments. There is greater demand for risk management, fraud prevention and customer segmentation tools. Globally, adoption of best practices for risk... -

Page 10

...Report 2011 Marketing Services Contribution to Group revenue 19% Business model Marketing Services uses data-driven predictive insights about consumer behaviour and channel preferences to help organisations increase customer revenue and loyalty. Description Experian is a global leader in targeted... -

Page 11

... theft. Price comparison services help consumers to make more informed decisions when purchasing products and services online. Consumer Direct Experian provides consumers with secure, online, unlimited access to their complete credit history in return for a regular monthly subscription fee. In... -

Page 12

... segments. Group strategy and objectives Strategic framework Focus on data and analytics Drive profitable Growth drivers Expanding geographically Strategic goals Extend global lead in credit information and analytics Create successful businesses in new customer segments Product innovation... -

Page 13

... Group strategy and objectives 11 growth Optimise capital efficiency Build large-scale operations in major emerging consumer economies Become the global leader in digital marketing services Become the most trusted consumer brand for credit information and identity protection services -

Page 14

...making. Experian already holds positive data on 70 million consumers in Brazil and will continue to expand this database, with the expectation of financial benefits starting to accrue in 18 to 24 months. Another key initiative has been the continuing roll-out of Marketing Services products globally... -

Page 15

... of its global business. Key resources Experian employs approximately: • 15,000 people globally • 5,550 in North America • 2,550 in Latin America • 3,600 in the UK and Ireland • 3,300 across EMEA and Asia Pacific People Effectively managing and deploying the talents of employees on a Gro... -

Page 16

... and senior leadership to addressing issues raised by these surveys. Plans are in place for a quarterly review of regional and global progress against the action plans and the ï¬rst progress review has been conducted. A 'pulse' survey was undertaken for the ï¬rst time during May 2011 to test the... -

Page 17

Introduction Key resources 15 Succession planning - building bench strength Succession planning ensures that appropriate senior leadership resources are in place to achieve Experian's strategic objectives. The plans are regularly reviewed by the Board's Nomination and Corporate Governance ... -

Page 18

... invests continually to ensure that its data is fresh and is provided to clients on a timely basis. Credit Services data Data to help manage credit risk, reduce exposure to bad debt and to prevent fraud Experian holds a wide breadth of data assets across its Credit Services business line. The data... -

Page 19

...deserve Experian has become the ï¬rst and only major credit reporting agency in North America to include residential rental payment information in credit reports. It follows the acquisition in June 2010 of RentBureau, an aggregator of rental payment history data for the property management industry... -

Page 20

...of the business. IT is also fundamental to the development and innovation of Experian's products and services. IT - Experian's channel for service delivery Experian's IT platform delivers a comprehensive suite of information services globally. From email marketing campaigns through to complex credit... -

Page 21

... resources 19 New technology platform supports global expansion Experian's ability to enhance the value of credit bureau data across the customer lifecycle is a key differentiator in its markets around the world. The range of value-added products helps clients in acquiring new customers, managing... -

Page 22

20 Experian Annual Report 2011 Experian uses a number of key metrics to assess its performance. Experian's ï¬nancial objectives are to drive organic revenue growth, to maintain or grow EBIT margins and to convert at least 90% of EBIT into operating cash ï¬,ow. The Group also deploys a series of ... -

Page 23

... use of energy from renewable sources. 19 20 Employee engagement Experian's people are at the heart of its business success and are a key resource. An all-employee global people survey is conducted every 18 months to monitor the degree of employee engagement, as well as to assess general levels of... -

Page 24

22 Experian Annual Report 2011 fusiness review 23 28 31 33 36 38 42 50 Chief Executive's review North America Latin America UK and Ireland EMEA/Asia Pacific Risks and uncertainties Financial review Corporate responsibility -

Page 25

... growth was 7% in North America, 19% in Latin America, 2% in the UK and Ireland and 7% in EMEA/Asia Pacific. We delivered growth across all four principal activities, with organic revenue growth of 7% at Credit Services, 4% at Decision Analytics, 11% at Marketing Services and 9% at Interactive... -

Page 26

24 Experian Annual Report 2011 Chief Executive's review continued Key trends 2 8 In North America, we saw gradual recovery in the financial services sector, as lenders slowly start to expand underwriting programmes and seek to grow credit portfolios. This helped Credit Services return to growth ... -

Page 27

... North America Latin America UK and Ireland EMEA/Asia Pacific Sub total Central Activities2 Continuing activities Discontinuing activities4 Total EBIT margin5 1. Total growth at constant exchange rates 2. Central Activities comprise costs of central corporate functions 2011 US$m 2010 US$m 2011... -

Page 28

... and develop our market position, for example in the social media and mobile delivery channels; and Further investment in client service quality and sales excellence. Extend our global lead in credit information and analytics; Create successful businesses in new customer segments; Build large-scale... -

Page 29

... change in legislation brings Brazil into line with other major credit markets, including the US and UK where positive data accounts for the great majority of information held by Experian's credit bureaux. The ability to record and share full payment histories at account level will enable Experian... -

Page 30

... strength across email marketing and contact data, reï¬,ecting strong volumes, new business wins and high renewals, as well as increased traction in the development area of digital advertising services. Interactive Total growth was 15% and organic revenue growth was 8%. Consumer Direct delivered... -

Page 31

... commercial credit customer across a range of information, analysis and event-driven alerts. Prior research amongst groups of clients and prospects has enabled Experian to address key demands such as faster searches, the delivery of real-time information and a choice of best practice policy options... -

Page 32

30 Experian Annual Report 2011 North America continued Total growth2 % Organic growth2 % Year ended 31 March Revenue Credit Services Decision Analytics Marketing Services Interactive Total - continuing activities Discontinuing activities3 Total North America EBIT Continuing activities ... -

Page 33

... now accounts for more than a quarter of our revenue. The recent decision by the Brazilian government to permit the use of positive data for consumer credit ï¬les creates further exciting opportunities to expand our business." Ricardo Loureiro, Managing Director Latin America Credit Services At... -

Page 34

...Latin America is also helping to shape a new SME focus in the UK, where recent Experian research has shown that the sector holds the key to driving the country's future employment growth. 23.1% 75 (4%) 07 08 09 10 11 2011 Revenue by activity Credit Services 95% Decision Analytics 2% Marketing... -

Page 35

... some weakness in public sector caused by recent government cutbacks. This has largely affected contact data services. There was strong growth in email marketing and online intelligence data. The Techlightenment acquisition, which is performing to plan, has extended Experian's digital marketing... -

Page 36

...reï¬,ecting positive operating leverage in Marketing Services, which offset negative mix in Credit Services. Social, ethical and environmental performance The UK and Ireland region is very active in the community and again won awards from the national charity Business in the Community (BITC). One of... -

Page 37

...'s database of one billion consumer records. New customers simply enter their name, address and date of birth for Identity Authentication to conï¬rm that they are over 18 years of age and are who they claim to be. In an environment where customers can switch providers in an instant, the sign-up... -

Page 38

... and Marketing Services businesses. The opening of our new credit bureau in India was a very important strategic development as we continue to develop scale in the region." Ken Sansom, Managing Director Asia Paciï¬c Financial review For EMEA/Asia Paciï¬c, EBIT from continuing activities was... -

Page 39

... continuing business only 1% 07 08 09 10 11 Improving the effectiveness of email marketing CozyCot was recently ranked the most popular women's beauty website in Singapore. The accolade was achieved just three months after engaging Experian CheetahMail to support the email marketing programme... -

Page 40

... support to the Board in maintaining effective risk management across the Group. The corporate governance statement in this report provides further detail on this process. Risk management framework Effective management of risk and opportunity is essential to the delivery of the Group's objectives... -

Page 41

...ï¬dential information over public networks, and several of our products are accessed through the internet. Security breaches in connection with maintaining data and the delivery of our products and services could harm our reputation, business and operating results. Please refer to the key resources... -

Page 42

...other market segments such as the public sector, telecoms, utilities and healthcare, as well as invest in a wide range of counter-cyclical products and solutions, across all relevant business lines. Refer to the key performance indicators section of this report for additional information on Experian... -

Page 43

... competition Related strategy: • Drive proï¬table growth > The Group operates in a number of geographic, product and service markets that are highly competitive. The competitor environment continues to be dynamic with new entrants that may have scale, integration capability and partner networks... -

Page 44

... US$935m) and a cash ï¬,ow conversion of 98% (2010: 100%). Experian manages its working capital and capital expenditure in order to meet its target to convert at least 90% of EBIT into operating cash ï¬,ow and this target forms one of its key performance indicators. Cash ï¬,ow conversion is deï¬ned... -

Page 45

... table. As part of the internal reporting process, capital employed is monitored by operating segment and further information by operating segment given in note 9(b) to the Group ï¬nancial statements. Capital employed includes net pension assets of US$55m (2010: obligations of US$88m) and net... -

Page 46

44 Experian Annual Report 2011 Financial review continued The increase in Group total equity of US$270m includes actuarial gains of US$77m in respect of deï¬ned beneï¬t pension plans and currency translation gains of US$142m, mainly as a result of the weakening of the US dollar.These items are ... -

Page 47

... to Experian's business together with more general risks are set out on pages 38 to 41. As indicated therein, the Group's ï¬nancial risk management focuses on the unpredictability of ï¬nancial markets and seeks to minimise potentially adverse effects on the Group's ï¬nancial performance. 2011... -

Page 48

... of the Group and parent company ï¬nancial statements. Credit risk is managed by: • Dealing only with banks and ï¬nancial institutions with strong credit ratings, within limits set for each organisation; and • Close control of dealing activity with counterparty positions monitored regularly... -

Page 49

... of the demerger-related equity incentive plans, exceptional items, net ï¬nance costs, tax, depreciation and other amortisation. It includes the Group's share of continuing associates' pre-tax results. Discontinuing activities: Experian deï¬nes discontinuing activities as businesses sold, closed... -

Page 50

48 Experian Annual Report 2011 Financial review continued Revenue and EBIT by business segment 2011 US$m 2010 US$m Total growth1 % Organic growth1 % Year ended 31 March Revenue Credit Services Decision Analytics Marketing Services Interactive Total - continuing activities Discontinuing ... -

Page 51

... patients, which can be both costly and time-consuming. SearchAmerica, part of Experian, recognised the trend and developed Collection Performance Advisor to help hospitals better manage the collections process. It provides a decisioning system that classiï¬es patients according to their ï¬nancial... -

Page 52

... role in credit management Improved public understanding of Experian's commitment to ï¬nancial education New product ideas with strong social benefits supporting entry in new markets More robust business cases for new developments, including social aspects of risk and opportunity Stronger CR... -

Page 53

..., at the same time, doing the right thing for our employees, consumers and suppliers, as well as clients and shareholders. Experian's six key responsibilities were originally deï¬ned in 2007/8 and a CR governance structure and strategy set out to ensure stakeholders' views are considered and that... -

Page 54

...Global CR Experian plc Company Secretary Head of Global CR Funding bids, funding bid decisions, regional CR Reports CR management champions Information and co-operation as needed Global Information Security and Compliance Global objectives and progress Global HR Global Marketing Global Product... -

Page 55

... user and improve access to ï¬nance. During early 2010 the business model was tested; relationships were established with Microï¬nance Institutions and the World Bank and an initial scorecard developed. A new business model was approved and the Experian MicroAnalytics business launched in April... -

Page 56

... was 88% with North America and Brazil spending 100% of their allocated funds on focused projects. Community investment 2011 US$000 2010 (Re-presented) US$000 Funds from Experian plc Financial donations from Experian subsidiaries Employee time volunteered Gifts in kind Management costs Total from... -

Page 57

Governance 55 xx Governance 56 58 62 74 Board of directors Directors' report Corporate governance statement Report on directors' remuneration -

Page 58

...Experian Annual Report 2011 Board of directors John Peace (62) Chairman John Peace is also Chairman of Burberry Group plc and Standard Chartered PLC. From 2000 until 2006, he was Group Chief Executive of the former GUS plc, having been a director of GUS since 1997. John was appointed to the Board... -

Page 59

... Chairman of J Sainsbury plc and Logica plc and a non-executive director of Burberry Group plc (where he chairs the Remuneration Committee). He was Group Finance Director of the former GUS plc until it was demerged into Experian plc and Home Retail Group plc at the end of 2006. His executive career... -

Page 60

... forms part of this report. Principal activities and business review Experian provides data and analytical tools to organisations in North America, Latin America, UK and Ireland, EMEA and Asia Paciï¬c. Clients use these to manage credit risk, prevent fraud, target marketing offers and automate... -

Page 61

... 2011 annual general meeting are contained in the circular to shareholders, which accompanies this annual report or is available on the Company's website at www.experianplc.com. Details of the shares in the Company purchased by and held underThe Experian plc Employee Share Trust and the Experian UK... -

Page 62

..., conferences, meetings, publications and intranet sites. More detail on employee engagement, together with information on diversity, succession planning and talent development, can be found in the key 13 resources section of this annual report. Experian continues to support employee share ownership... -

Page 63

... the applicable set of accounting standards, give a true and fair view of the assets, liabilities, ï¬nancial position and proï¬t of the Company and the Group taken as a whole; and this directors' report contains a fair review of the development and performance of the business and the position of... -

Page 64

...; Credit Services, Decision Analytics and Interactive businesses; corporate development; ï¬nance, audit, legal, risk, regulatory, human resources, investor relations and governance; product demonstrations; and speciï¬c geographic brieï¬ngs on North America, Latin America, UK and Ireland, EMEA... -

Page 65

... commercial objectives. Promoting the highest standards of integrity, probity and corporate governance throughout the Company and particularly at Board level. The running of the Group's business, and developing the Company's strategy and overall commercial objectives. With the executive team... -

Page 66

... human resources are in place to meet the objectives. • Management oversight Review of operating, ï¬nancial and risk performance. • Regulatory/statutory activity Including approval of the Group's results, key documents and the announcement of dividends. Experian's governance framework Advice... -

Page 67

... meet the directors informally. During the year under review, overseas Board meetings were held in Paris and NewYork.The New York meeting provided the Board with a chance to receive product demonstrations, meet, and receive business presentations from, North America management and appraise the Group... -

Page 68

... and Corporate Governance Committee in January and March 2011. Ongoing induction Recommendations Actions Regular Board meeting induction sessions to continue; more time on the Marketing Services business line; continue to develop understanding of regulatory issues in line with current plans... -

Page 69

....This information is provided on a monthly basis and Board papers are circulated in time to allow directors to be properly briefed in advance of meetings. During the year, the Group Corporate Secretariat began work on a solution for circulating papers digitally. Directors have access to independent... -

Page 70

...three times. Seven members of the Committee are considered by the Board to be independent non-executive directors in accordance with provision B.2.1 of the UK Corporate Governance Code.The Group Human Resources Director and the Global Talent Director attend certain meetings by invitation. Activities... -

Page 71

... 2011, and met four times with meetings held to coincide with key dates in the ï¬nancial reporting and audit cycle. All members of the Committee are considered by the Board to be independent non-executive directors in compliance with provision C.3.1 of the UK Corporate Governance Code. The Chairman... -

Page 72

.... The process was in place throughout the year under review and up to the date of approval of the annual report and meets the requirements of the UK Corporate Governance Code. For certain joint arrangements, the Board places reliance upon the systems of internal control operating within the partners... -

Page 73

... risks, including technology and project risks, are monitored by a global operations risk management committee.This committee oversees the management of operational related risks associated with the Group's shared service and data centres as well as global product development and delivery activities... -

Page 74

... on Global Credit Services and Decision Analytics, Consumer Direct strategy, Business Information in North America, growth initiatives for small business in Brazil and the building of Experian's business in India. Additional information relevant to corporate governance at Experian can be found on... -

Page 75

... the UK Corporate Governance Code, details of proxy voting by shareholders, including votes withheld, are made available on request and placed on the Company's website following the meeting. In 2010, voting levels at the annual general meeting showed an increase to 66% of the issued share capital of... -

Page 76

...Experian Annual Report 2011 Report on directors' remuneration "Experian's remuneration philosophy is that reward should be used to drive long term, sustainable business performance." Roger Davis, Chairman of the Remuneration Committee Remuneration in summary This section provides a summary of key... -

Page 77

Governance Report on directors' remuneration 75 Summary of remuneration elements Elements Base salary Key features Reï¬,ects the competitive market salary for the role Reviewed annually against level of pay awards throughout the organisation, external market and in the light of Group and ... -

Page 78

... members, the scope of their role and frequency of meetings can be found in the corporate governance statement. Working with advisers In making its decisions, the Committee consults with the Chairman, the Chief Executive Ofï¬cer, the Group HR Director, the Global Reward Director and the Head... -

Page 79

... data, sourced from external remuneration consultants, is provided to the Committee. Executive directors' salaries are benchmarked against those of executive directors from the companies in the FTSE 100 Index along with other global comparators, reï¬,ecting the markets from which Experian recruits... -

Page 80

... of Experian's key strategic objectives (driving proï¬table growth).The maximum bonus opportunity for executive directors is 200% of base salary. However, this level of annual bonus is only payable if Experian's ï¬nancial performance surpasses stretching proï¬t growth targets, designed to deliver... -

Page 81

... continued to be a testing and uncertain business environment for both Experian and our clients, the Group delivered an exceptional performance and as a result of this a bonus of 196.7% of salary is payable to the executive directors in respect of the year ended 31 March 2011. CIP awards in respect... -

Page 82

80 Experian Annual Report 2011 Report on directors' remuneration continued In addition, vesting of matching shares will be subject to the Committee being satisï¬ed that the vesting is not based on ï¬nancial results which have been materially misstated. Annual bonus and CIP in respect of the ... -

Page 83

... Group at a qualifying date. As an example of these plans, the UK Sharesave Plan provides an opportunity for employees to save a regular monthly amount, over either three or ï¬ve years which, at the end of the savings period, may be used to purchase Experian shares at up to 20% below market value... -

Page 84

...their interests with those of shareholders.Therefore, the Committee has established guidelines under which the CEO should hold the equivalent of two times his base salary in Experian shares and other executive directors one times their base salary (including invested shares held under the CIP). Each... -

Page 85

Governance Report on directors' remuneration 83 Meeting obligations under share-based incentives Obligations under Experian's employee share plans may be met using either shares purchased in the market or, except for rolled-over awards under certain GUS schemes, newly issued shares.The current ... -

Page 86

...Group plc on 1 February 2011. During the period under review he received a fee of £8,333 in respect of this appointment. 5 Non-executive directors receive an additional fee of â,¬6,000 per trip to attend board meetings where such attendance involves inter-continental travel from their home location... -

Page 87

...granted under the GUS Executive Share Option Schemes and were exchanged for equivalent options over Experian plc shares on demerger. 2 Options granted to Don Robert in 2004 and options granted to Chris Callero prior to 2009 were granted under the GUS North America Stock Option Plan. Vesting of these... -

Page 88

... the Reinvestment Plan. 4 Awards made in 2007 were made under the GUS North America Co-investment Plan. Vesting of the matching awards made in 2007 was subject to the retention of invested shares and continued employment and occurred on 29 June 2010 when the Experian share price was 602.0p. Dividend... -

Page 89

... during the year were nil (2010: nil). Paul Brooks is a member of the registered Experian UK pension scheme. His beneï¬ts are restricted by an earnings cap. However, beneï¬ts in excess of this cap are provided for through the Experian Limited SURBS.The pension ï¬gures in the table overleaf... -

Page 90

...and Groups (Accounts and Reports) Regulations 2008 and those in columns (6) and (7) are those required by the UK Financial Services Authority Listing Rules. Executive directors' service contracts Don Robert has a service agreement with Experian Services Corporation ('ESC') dated 7 August 2006. This... -

Page 91

... provide for any beneï¬ts on the termination of employment. Experian's policy on service contracts for new executive directors is to follow the UK Corporate Governance Code guidelines. UK Corporate Governance Code The constitution and operation of the Committee are in accordance with the principles... -

Page 92

90 Experian Annual Report 2011 Financial statements 91 Rsport of ths auditors: Group financial stats4snts 92 Group inco4s stats4snt 93 Group stats4snt of co4prshsnsivs inco4s 94 Group balancs shsst 95 Group stats4snt of changss in total squity 96 Group cash flow stats4snt 97 Notss to ths Group ... -

Page 93

...Corporate governance statement relating to the company's compliance with the nine provisions of the June 2008 Combined Code specified for our review; and • certain elements of the report to shareholders by the Board on directors' remuneration. Other matter We have reported separately on the parent... -

Page 94

... Data and information technology costs Depreciation and amortisation Marketing and customer acquisition costs Other operating charges Total operating expenses Operating profit Interest income Finance expense Net finance costs Share of post-tax (losses)/profits of associates Profit before tax Group... -

Page 95

...statements 93 Group statement of comprehensive income for the year ended 31 March 2011 2011 US$m 2010 US$m Profit for the financial year Other comprehensive income: Fair value gains - available for sale financial assets Actuarial gains/(losses) - defined benefit pension plans Currency translation... -

Page 96

94 Experian Annual Report 2011 Group balance sheet at 31 Marih 2011 Notes 2011 US$m 2010 US$m Non-current assets Goodwill Other intangible assets Property, plant and equipment Investments in assoiiates Deferred tax assets Retirement benefit assets Trade and other reieivables Available for sale ... -

Page 97

...employee services - proceeds from shares issued - tax credit relating to employee share incentive plans Exercise of share options and awards Purchase of own shares Purchase of own shares by employee trusts and in respect of employee share incentive plans Liability for put option over non-controlling... -

Page 98

96 Experian Annual Report 2011 Group cash flow statemsnt for the year ended 31 March 2011 Notes 2011 2010 (Re-presented) (Note 3) US$m US$m Cash flows from opsrating activities Cash generated from operations Interest paid Interest received Dividends received from associates Tax paid Net cash ... -

Page 99

... company limited by shares and is resident in Ireland.The address of its registered office is 22 Grenville Street, St Helier, Jersey JE4 8PX.The Company's ordinary shares are traded on the London Stock Exchange's Regulated Market (Premium Listing). Experian is a global information services group... -

Page 100

... are also now recorded in equity. Associates Associates are entities over which the Group has significant influence but not control, generally achieved by a shareholding of between 20% and 50% of the voting rights.The equity method is used to account for investments in associates and investments are... -

Page 101

... the closing exchange rate. (c) Goodwill Goodwill is stated at cost less any impairment, where cost is the excess of the fair value of the consideration payable for an acquisition over the fair value of the Group's share of identifiable net assets of a subsidiary or associate acquired at the date of... -

Page 102

... on disposal exclude dividend and interest income. At each balance sheet date, the Group assesses whether there is objective evidence to suggest that available for sale financial assets are impaired. In the case of equity securities, a significant or prolonged decline in the fair value of the... -

Page 103

...the interest differentials reflected in foreign exchange contracts. Fair value hedges Changes in the fair value of derivatives that are designated and qualify as fair value hedging instruments are recorded in the Group income statement, together with any changes in the fair value of the hedged asset... -

Page 104

... with social security obligations on employee share incentive plans, other than those of a financing nature, are charged or credited within labour costs; other costs and changes in fair value on such derivatives are charged or credited within financing fair value remeasurements in the Group income... -

Page 105

...the changes to the pension plan are conditional on the employees remaining in service for a specified period of time. In this case, the past service costs are amortised on a straight line basis over that period. The pension cost recognised in the Group income statement comprises the cost of benefits... -

Page 106

... benefit obligation. Share-based payments The Group has a number of equity settled, share-based employee incentive plans.The fair value of options and shares granted is recognised as an expense in the Group income statement on a straight line basis over the vesting period, after taking into account... -

Page 107

... rates used reflect the segment's weighted average cost of capital ('WACC'). The key assumptions used for value-in-use calculations are: 2011 Pve-tax WACC % Long-tevm gvowth vate % 2010 Pre-tax WACC % Long-term growth rate % CGU North America Latin America UK and Ireland EMEA Asia Pacific 12... -

Page 108

... to hedge certain risk exposures.The Group also ensures surplus funds are managed and controlled in a prudent manner which will protect capital sums invested and ensure adequate short-term liquidity, whilst maximising returns. Market risk Foreign exchange risk The Group operates internationally and... -

Page 109

...minimised by a policy under which the Group only enters into such contracts with banks and financial institutions with strong credit ratings, within limits set for each organisation. Dealing activity is closely controlled and counterparty positions are monitored regularly. The general credit risk on... -

Page 110

... adjust the amount of dividends paid to shareholders, return capital to shareholders, issue or purchase shares or sell assets to reduce net debt. As part of its internal reporting processes the Group monitors capital employed by operating segment. For this purpose, capital employed is defined as net... -

Page 111

... is available. Experian is organised into, and managed on a worldwide basis over, the following five operating segments, based on geographic areas, supported by its central Group functions: - North America; - Latin America; - UK and Ireland; - Europe, Middle East and Africa ('EMEA'); and - Asia... -

Page 112

110 Expevian Annual Repovt 2011 Notes to the Gvoup financial statements continued 9. Segment infovmation (continued) The North America and the UK and Ireland operating segments derive revenues from all of the Group's business segments.The Latin America, EMEA and Asia Pacific segments currently do ... -

Page 113

...2011 North America US$m Latin America US$m UK & Ireland US$m EMEA/ Asia Pacific US$m Segment assets and liabilities US$m Central Activities and other1 US$m Total Gvoup US$m Goodwill Investments in associates... Activities comprise corporate head office balances including retirement benefit assets... -

Page 114

... Segment infovmation (continued) Capital expenditure Depreciation1 2011 US$m 2010 US$m Amortisation1 2011 US$m 2010 US$m (iii) Capital expenditure, depreciation and amortisation North America Latin America UK and Ireland EMEA/Asia Pacific Total operating segments Central Activities 2011 US$m 2010... -

Page 115

... (13) (142) 679 Continuing operations1 Year ended 31 March 2010 Credit Services US$m Decision Analytics US$m Marketing Services US$m Interactive US$m Total business segments US$m Central Activities US$m Total continuing operations US$m Revenue from external customers 2 1,669 441 734... -

Page 116

... the review of the Group's half-yearly financial report Other services: Taxation services Total fees payable to the Company's auditor and its associates 1 3 4 3 7 1 3 1 5 4 9 The guidelines covering the use of the Company's auditor for non-audit services are set out in the corporate governance... -

Page 117

... of employees 2011 Full time Pavt time Full time equivalent Full time 2010 Part time Full time equivalent North America Latin America UK and Ireland EMEA/Asia Pacific Total operating segments Central Activities Total continuing opevations The average number of employees includes executive directors... -

Page 118

... performance of the Group or to the performance of the acquired businesses.These costs are recognised within other operating charges. Charges in respect of demerger-related equity incentive plans relate to one-off grants made to senior management and at all staff levels at the time of the demerger... -

Page 119

... commitments to purchase own shares Foreign exchange losses/(gains) on financing activities Increase in fair value of put options - principally Serasa Chavge in vespect of financing faiv value vemeasuvements An indication of the sensitivity of the Group's results to interest rate risk is given in... -

Page 120

... 31 March 2010, the Group reported a tax credit of US$9m, as a result of the benefit of tax credits of US$129m, giving a small negative effective rate of tax based on profit before tax of US$600m.The effective tax rate for both years is lower than the standard rate of corporation tax in the UK of 28... -

Page 121

...) 5 77 142 224 7 (28) 218 5 202 (2) 8 (9) (3) (3) (3) 5 (20) 209 5 199 (b) Tax cvedit vecognised divectly in equity on tvansactions with ownevs 2011 US$m 2010 US$m Current tax Deferred tax 5 15 20 4 8 12 The tax credit recognised directly in equity relates to employee share incentive plans. -

Page 122

... respect of holdings of First Advantage Corporation ('FADV') Class A common stock.The financing fair value gain recognised in that year, and reversed in the year ended 31 March 2011, related to the fair value of the FAC buy-out option at 31 March 2010. In the period to 22 April 2010, the Group made... -

Page 123

... eavnings pev shave Basic earnings per share is calculated by dividing the earnings attributable to ordinary shareholders of the Company by a weighted average number of ordinary shares (being the ordinary shares in issue during the year less own shares held inTreasury and in employee trusts, which... -

Page 124

... Experian and Home Retail Group in October 2006, shareholders in the Company can elect to receive their dividends from a UK source (the 'IAS election'). Shareholders who held 50,000 or fewer Experian shares (i) on the date of admission of the Company's shares to listing on the London Stock Exchange... -

Page 125

... goodwill by CGU: 2011 US$m 2010 US$m North America Latin America UK and Ireland EMEA Asia Pacific At 31 Mavch 1,675 1,116 611 270 89 3,761 1,531 1,017 570 254 40 3,412 Further details of the principles used in determining the basis of allocation by CGU and annual impairment testing are given in... -

Page 126

... US$m Databases Internal use software US$m Internally generated software US$m Total US$m US$m Cost At 1 April 2009 Differences on exchange Additions through business combinations Other additions Disposal of businesses Other disposals Transfer in respect of assets held for sale At 31 March 2010... -

Page 127

...assets held for sale At 31 March 2010 Depreciation At 1 April 2009 Differences on exchange Charge for the year Disposal of businesses Other disposals Transfer in respect of assets held for sale At 31 March 2010 Net book amount at 31 March 2009 Net book amount at 31 March 2010 272 17 3 (36) 256 123... -

Page 128

... 2010, the Group's principal interest in associated undertakings was the 20% holding of FARES with the balance of the capital of FARES held by FAC. In the year ended 31 March 2011, pursuant to the notice received from FAC on 22 April 2010 in respect of the exercise of its buy-out option, Experian... -

Page 129

... instruments. There is no material difference between the fair value of trade and other receivables and the book value stated above. All non-current trade and other receivables are due within five years from the balance sheet date. Amounts owed by associates are unsecured and settled in cash. No... -

Page 130

... to the Group income statement in respect of this provision are included in other operating charges. Other provisions in respect of trade receivables mainly comprise credit note provisions. 26. Cash and cash equivalents (a) Analysis of cash and cash equivalents: 2011 US$m 2010 US$m Cash at bank and... -

Page 131

... Cuvvent Non-cuvvent 2011 2011 US$m US$m Current 2010 US$m Non-current 2010 US$m Trade payables VAT and other taxes payable Social security costs Accruals and deferred income Other payables 134 40 92 819 95 1,180 21 21 110 31 95 767 59 1,062 8 6 14 The accounting policies for other financial... -

Page 132

... are for general corporate purposes, including the financing of acquisitions. 29. Analysis of net debt (non-GAAP measuve) (a) Analysis of net debt: 2011 US$m 2010 US$m Cash and cash equivalents (net of overdrafts) Bank deposits with maturity greater than three months Derivatives hedging loans... -

Page 133

...available fov sale financial assets: 2011 US$m 2010 US$m Listed equity securities - UK (sterling denominated) Equity securities - North America (US dollar denominated) Other trade investments - principally UK and sterling denominated 36 6 42 32 1 33 The accounting policies for available for sale... -

Page 134

...connection with the Group's hedging instruments are disclosed in note 14. There is no material difference between the fair values of these assets and liabilities and the book values stated above. There are put and call options associated with the shares held by non-controlling shareholders in Serasa... -

Page 135

... by taking middle market quotations of an Experian plc share from the London Stock Exchange daily official list. 5. In addition, fully vested options exist underThe North America Stock Option Plan, a former GUS share option plan, and these had a maximum term of six years from the date of grant. -

Page 136

...price as stated in the terms of each award. (iii) Inputs into the Black-Scholes models and the weighted average estimated fair values Experian Share Option Plan1 2011 2010 Experian Sharesave Plans 2011 2010 Share price on grant date (£) Exercise price (£) Expected volatility (%) Expected dividend... -

Page 137

... of arrangements Experian Co-Investment Plan Experian Reinvestment Plan Experian Performance Share Plan Experian UK Approved AllEmployee Plan Nature of arrangement Vesting conditions: - Service period - Performance Grant of shares1 4 years 50% - Benchmark profit performance of Group assessed... -

Page 138

... 2011 US$m 2010 US$m Share options Share awards Expense recognised (all equity settled) Costs of associated social security obligations Total expense vecognised in Gvoup income statement Reported as follows: Employee benefit costs within Benchmark PBT Charge in respect of demerger-related equity... -

Page 139

... of the Company and certain former directors and employees of Experian Finance plc.The Group also has in place arrangements which secure certain of these unfunded arrangements in the UK by granting charges to an independent trustee over independently managed portfolios of marketable securities owned... -

Page 140

... in the yeav At 1 April Differences on exchange Service (income)/cost Interest on plans' liabilities Actuarial (gains)/losses on liabilities Contributions paid by employees Benefits paid At 31 Mavch (88) 1 25 107 10 55 (58) (3) (11) (28) 12 (88) 2011 US$m 2010 US$m 910 48 (19) 50 (97) 4 (38... -

Page 141

... rules of the plan and the associated credit in respect of past service costs of US$29m is accordingly recognised in the Group income statement. The change to the use of the CPI for the revaluation of pensions in deferment is required by the rules of the Experian Pension Scheme and accordingly the... -

Page 142

...to Experian defined benefit pension plans during the year ending 31 March 2012 are US$13m by the Group and US$4m by employees. (viii) Actuarial assumptions The valuations used at 31 March 2011 have been based on the most recent actuarial valuations, updated byTowers Watson Limited to take account of... -

Page 143

... 141 34. Retivement benefit assets and obligations (continued) (x) Historical information 2011 US$m 2010 US$m 2009 US$m 2008 US$m 2007 US$m Fair value of plans' assets Present value of defined benefit obligations Net pension assets/(obligations) Experience adjustment on plans' assets - (gains... -

Page 144

... temporary differences US$m 434 17 40 10 (12) 489 Total At 1 April 2009 Differences on exchange Charge/(credit) in the Group income statement Business combinations Transfer in respect of liabilities held for sale At 31 March 2010 US$m US$m US$m 5 1 30 36 243 32 86 5 (4) 362 142 (106) 36... -

Page 145

... Mavch 2011 18 1 12 (20) 11 7 4 11 Restructuring costs US$m 55 5 7 (12) 55 40 15 55 Contingent and other liabilities US$m 73 6 19 (32) 66 47 19 66 Total US$m At 1 April 2009 Differences on exchange Amount charged/(released) in the year Utilised Impact of discount rate movement At 31 March 2010... -

Page 146

... of GUS plc and the nominal value of the share capital of the Company before the share offer in October 2006 and subsequent share issues. Movements on the hedging reserve and the position at the balance sheet date reflect hedging transactions which are not charged or credited to the Group income... -

Page 147

... 61 (22) (21) 1,157 2011 US$m 2010 US$m Inventories Trade and other receivables Trade and other payables Difference between pension current service cost and contributions paid Decrease/(increase) in working capital (c) Puvchase of othev intangible assets Databases Internal use software Internally... -

Page 148

... all the assets of Mighty Net, Inc on 21 September 2010 for a consideration of US$208m.This acquisition supports Experian's strategy by leveraging key new consumer brands in its Interactive business in North America.The Group has also consolidated the acquisition of a small entity in China... -

Page 149

... 87 262 The Group leases offices and technology under non-cancellable operating lease agreements with varying terms, escalation clauses and renewal rights and the net charge for the year was US$59m (2010: US$51m). 43. Capital commitments 2011 US$m 2010 US$m Capital expenditure for which contracts... -

Page 150

...the parent company financial statements. Disclosures in respect of FARES, the Group's only individually material associate during the year, are given in note 17. Remuneration of key management personnel is analysed as follows: 2011 US$m 2010 US$m Salaries and short-term employee benefits Retirement... -

Page 151

... on Auditing (UK and Ireland).Those standards require us to comply with the Auditing Practices Board's Ethical Standards for Auditors. This report, including the opinions, has been prepared for and only for the Company's members as a body in accordance with Article 113A of the Companies (Jersey) Law... -

Page 152

150 Experian Annual Report 2011 Parsnt company profit and loss account Parent for the year ended 31 March 2011 Notes 2010 (Re-presented) (Note C) US$m US$m 2011 Staff costs Depreciation Other operating charges Operating loss Interest receivable and similar income Interest payable and similar ... -

Page 153

...Investments - shares in Group undertakings Current assets Debtors - amounts falling due within one year Cash at bank and in hand Current liabilities Creditors - amounts falling due within one year Net current assets Net assets Capital and reserves Called up share capital Share premium account Profit... -

Page 154

...office is 22 Grenville Street, St Helier, Jersey JE4 8PX. The Company is the ultimate holding company of the Experian group of companies (the 'Group') and its ordinary shares are traded on the London Stock Exchange's Regulated Market (Premium Listing). Experian is a global information services group... -

Page 155

... the balance sheet date. All differences are taken to the profit and loss account in the year in which they arise. E. Staff costs 2011 US$m 2010 US$m Directors' fees Wages and salaries 2.1 1.2 3.3 1.8 1.0 2.8 Executive directors of the Company are employed by other Group undertakings and details... -

Page 156

154 Experian Annual Report 2011 Notes to the parent company financial statements continued H. Interest payable and similar charges 2011 US$m 2010 US$m Interest on amounts owed to Group undertakings Losses in connection with commitments to purchase own shares Interest payable and similar charges ... -

Page 157

... Company holds directly its interests in the whole of the issued share capital of the following undertakings: Country of incorporation Principal activity Experian Investment Holdings Limited Experian Finance Holdings Limited Experian Group Services Limited Experian Holdings Ireland Limited Experian... -

Page 158

... 1,131.2 Share premium account US$m Year ended 31 March 2010 At 1 April 2009 Shares issued under employee share incentive plans At 31 March 2010 million 1,025.3 0.8 1,026.1 78.5 0.1 78.6 1,120.1 4.2 1,124.3 At 31 March 2011 and 31 March 2010, the authorised share capital of the Company was US... -

Page 159

... these trusts to beneficiaries of employee share incentive plans. The balance on the profit and loss account comprises net profits retained by the Company after the payment of equity dividends. Q. Reconciliation of movements in total shareholders' funds 2011 US$m 2010 US$m Loss for the financial... -

Page 160

158 Experian Annual Report 2011 Notes to the parent company financial statements continued S. Contingencies The Company has guaranteed borrowings of Group undertakings of US$1,351m (2010: US$1,305m) together with the liabilities ofThe Experian plc Employee ShareTrust and the Experian UK Approved ... -

Page 161

... Group plc shares. Shareholder security Shareholders are advised to be wary of any unsolicited advice, offers to buy shares at a discount or offers of free reports about the Company. More detailed information on such matters can be found at www.moneymadeclear.fsa.gov.uk. Details of any share dealing... -

Page 162

... plc ordinary share. Further information can be obtained by contacting: Shareholder Relations Bank of NewYork Mellon PO Box 358516 Pittsburgh PA 15252 - 8516 United States T +1 201 680 6825 (from the USA 1-888-BNY -ADRS) Financial calendar Second interim dividend record date Interim management... -

Page 163

With thanks to all those Experian employees who kindly provided photographs of themselves for this report. This annual report has been produced using ISO 14001 and FSC certified environmental print technology, together with vegetable-based inks and a single-site production facility that required no... -

Page 164

Corporate headquarters Experian plc Newenham House Northern Cross Malahide Road Dublin 17 Ireland Corporate office Experian Cardinal Place 80 Victoria Street London SW1E 5JL United Kingdom Operational headquarters Experian Landmark House Experian Way NG2 Business Park Nottingham NG80 1ZZ United ...