Volvo 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 93

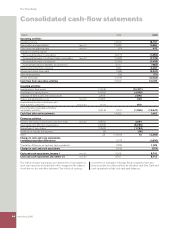

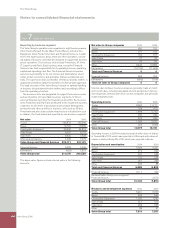

In the transition to IFRS the following reclassifi cation is done in

the cash fl ow statement. Customer fi nance receivables, net, are

reported within Cash fl ow from operating activities, instead of as

previously being reported as Cash fl ow from investing activities.

Cash fl ow related to customer fi nancing operations arises mainly

within Volvo Financial Services (VFS). Changes in customer fi nanc-

ing are currently reported in Volvo’s cash-fl ow statement with VFS

consolidated in accordance with the equity method as changes in

working capital, since Volvo’s operations excluding VFS do not have

any signifi cant customer fi nancing operations. Changes in customer

fi nancing operations are reported on a separate line in Volvo’s cash-

fl ow statement including VFS. Volvo’s reported Operating Cash fl ow

is not affected by the reclassifi cation.

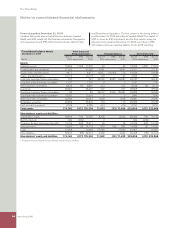

Classifi cation of leasing contracts in segment reporting of

Volvo Financial Services

In accordance with IFRS, operating lease contracts with end-cus-

tomers are in segment reporting for Volvo Financial Services

reported as fi nancial leasing contracts if the residual value in these

contracts is guaranteed to Volvo Financial Services by another Volvo

business area. In the Volvo Group’s consolidated balance sheet,

these leasing agreements are still reported as assets under operat-

ing lease. In comparison with the 2004 closing approximately SEK

12 billion is reclassifi ed to fi nancial leases from operating leases in

the Volvo Financial Services segment reporting.

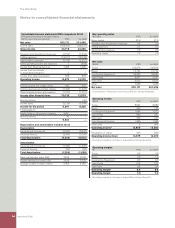

Cash-fl ow statement According to previous presentation Presentation according to IFRS

SEK billion 2004 2005 2004 2005

Operating activities

Operating income 14,7 18,2 14,7 18,2

Depreciation and amortization 10,0 9,9 10,0 9,9

Other non-cash items (0,1) 0,4 (0,1) 0,4

Change in working capital (1,4) (4,7) (1,4) (4,7)

Customer Finance receivables, net (7,4) (7,8)

Financial items and income taxes (0,5) (2,0) (0,5) (2,0)

Cash fl ow from operating activities 22,7 21,8 15,3 14,0

Investing activities

Investments in fi xed assets (7,4) (10,3) (7,4) (10,3)

Investment in leasing vehicles (4,4) (4,5) (4,4) (4,5)

Disposal of fi xed assets and leasing vehicles 2,4 2,6 2,4 2,6

Customer Finance receivables, net (7,4) (7,8)

Operating cash fl ow 5,9 1,8 5,9 1,8