Volvo 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162

|

|

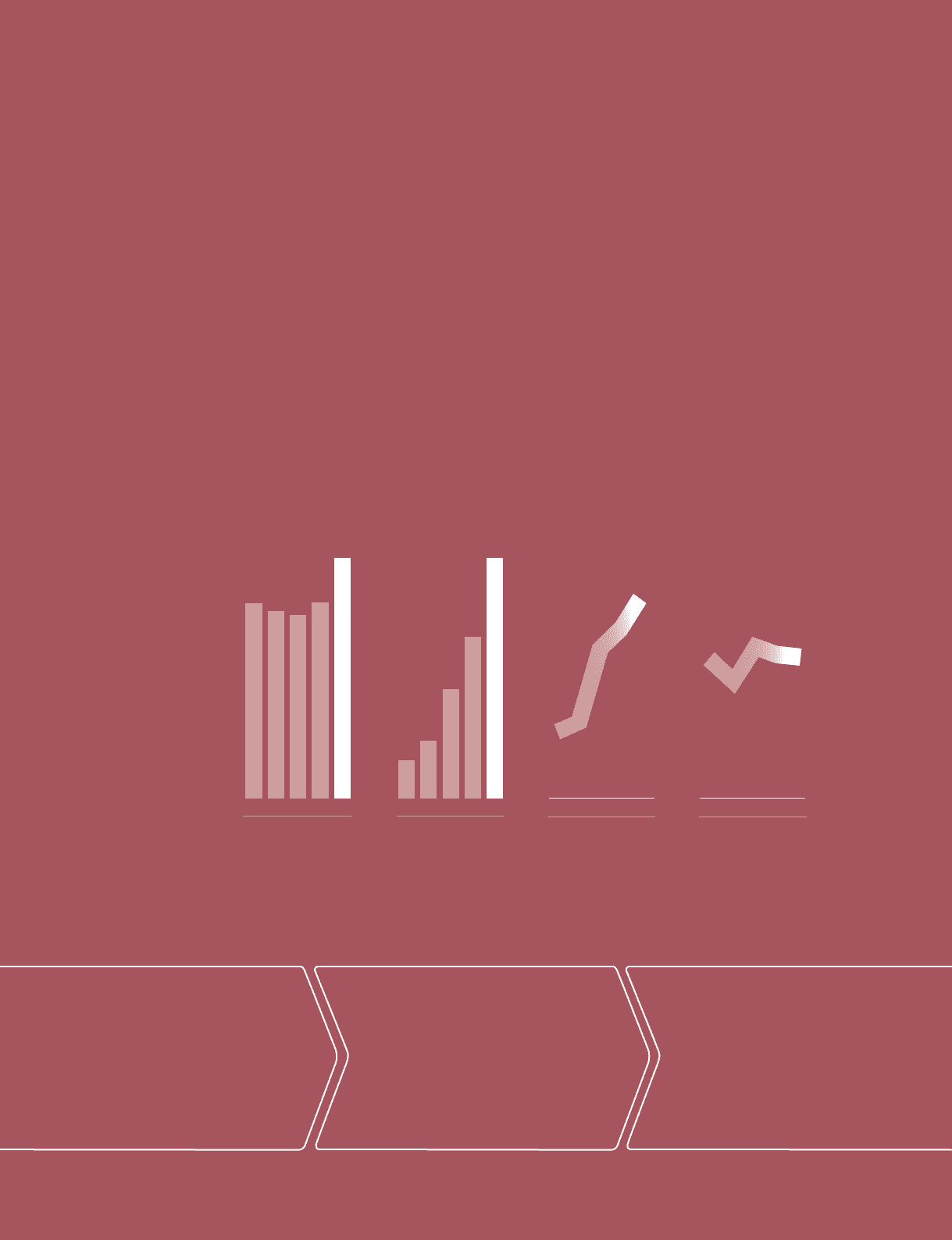

70 Volvo Group 2005

Financial Services

– key component

in the total offering

01 02 03 04 05

64.0 78 . 860.1

61.3 64.3

01 02 03 04 05

325 2,033926

490 1,365

01 02 03 04 05

4.2 15.39.8

4.8 11.1

01 02 03 04 05

20.6 21.723.6

18.8 22.4

Credit portfolio, net 1

SEK bn

Operating income

1

SEK M

Return on shareholders’

equity1, %

Market penetration

1, 2

%

Outcome 2005

• Growth achieved in both new-financing volume

and assets.

• Favorable balance achieved between credit risk,

volume, sales penetration and pricing.

• Finance strategy based on diversification kept

finance costs at a very low level and lent strong

support to customer finance operations.

Ambitions 2005

• Growth in financing volume and assets.

• Maintain discipline in pricing and credit

decisions.

• Conservative management of customer finance

portfolio.

• Assure low-cost funding.

Ambitions 2006

• Expand customer finance operations in

growth markets.

• Closely monitor and adapt operations to

economic conditions.

• Maintain low costs for funding the Group’s

operations.

1 Years 2004 and 2005 are reported in accordance with IFRS and 2001, 2002 and 2003 in accord-

ance with Swedish GAAP. See Note 1 and 3.

2 Share of business funded by VFS in markets where VFS offers financial services.