Volvo 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Condensed income statement

SEK M 2004 2005

Net sales 9,598 7,549

Income after

financial items 1,365 2,033

Income taxes (430) (609)

Income for the period 935 1,424

Distribution of credit portfolio, net1

% 2004 2005

Operational leasing 20 1

Financial leasing 25 40

Installment contracts 38 41

Dealer financing 16 17

Other customer credits 1 1

1 Impact of IFRS leasing classification

52% (52) of the total was accounted for by

tenants outside the Volvo Group. 81% (84) of

the leases extend for five years or more.

Expanding credit portfolio

During 2005, the volume of new financing

amounted to SEK 33 billion, up by more than

SEK 3.5 billion compared with 2004.

On December 31, 2005, total assets

amounted to SEK 86 billion (72), of which

SEK 79 billion (64) related to the net credit

portfolio. Adjusted for the effects of foreign-

exchange movements, the credit portfolio

grew by 10% during the year, compared with

growth of 11% in the preceding year.

From a currency perspective, 37% of the

portfolio was denominated in EUR, 35% in

USD, 9% in GBP and 6% in CAD. The remain-

ing 13% is primarily a mix of other European

and Latin American currencies.

Good returns and profitability

Operating income for VFS in 2005 amounted

SEK 2,033 M, up 49% from the SEK 1,365 M

reported in 2004. Return on equity was 15.3%

(11.1), with a year-end equity ratio of 11.2%

(11.6). Throughout 2005, VFS successfully

achieved a healthy balance among credit risk,

volume, sales penetration and professional

pricing. All customer finance regions improved

performance over the prior year.

Write-offs in 2005 totaled SEK 297 M, cor-

responding to an annualized write-off ratio of

0.40% (0.66). On December 31, total credit

reserves amounted to SEK 1,751 M giving a

credit-reserve ratio at year-end of 2.17%.

Commercial Focus initiative

During 2005, VFS developed and launched a

new strategic initiative called “Commercial

Focus” (CF) to further improve its effective-

ness and contribute greater value to the

Group’s Business Areas, its dealers and cus-

tomers. The goals of CF are to integrate VFS’s

activities more closely with those of the other

Business Areas, enhance the depth and

breadth of VFS’s services and develop how

services are provided to key accounts. The first

six of numerous global projects were started

in 2005 to support these goals. VFS believes

this initiative will increase its market share as

it continues to maintain prudent pricing and

credit levels.

Volvo Financial Services (VFS) pro-

vides services in three main areas:

customer finance and insurance,

treasury operations and real-estate manage-

ment. These services enable Volvo to apply a

Group-wide approach to financial risk. They

also play a key role in Volvo’s strategy for

becoming the world’s leading provider of com-

mercial transport solutions.

Customer in focus

Volvo’s expanding customer finance oper-

ations cover Europe, North America, Australia,

and parts of South America and Asia. VFS

conducts customer finance operations in more

than 50 countries. Finance programs are

offered to the dealers and end-customers of

Volvo’s business areas. The range of financial

services includes installment contracts, finan-

cial and operational leasing, and the financing

of dealers. In many markets insurance service

and maintenance contracts are also offered

separately or in combination with financing

services.

Volvo’s internal bank, Volvo Treasury, coord-

inates the Group’s global funding strategy and

financial infrastructure. It is responsible for

the management of all interest-bearing assets

and liabilities and the execution of foreign-

exchange transactions. A diversified funding

strategy kept the Group’s borrowing cost at

competitive levels and gave strong support

to VFS’s growing customer finance activities

in 2005.

Operations within Danafjord, VFS’s real-

estate unit, include the renting and develop-

ment of commercial real estate in Sweden and,

increasingly, in other countries. During the

year, Danafjord sold some of its non-strategic

property in Kalmar and Torslanda generating

a gain of SEK 188 M. The occupancy rate at

the end of 2005 was 99.9% (99.8), and

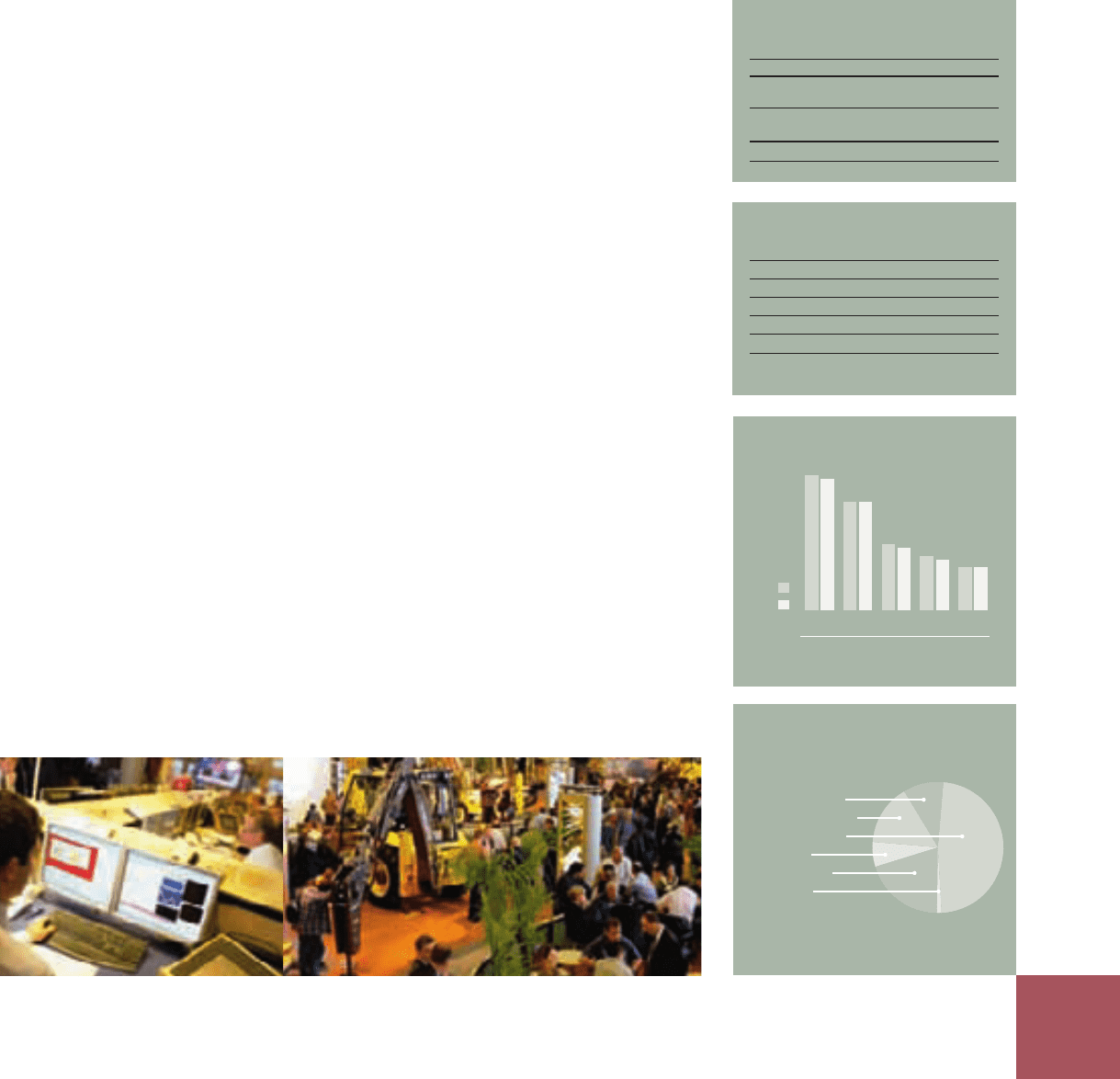

Penetration, %

Volvo

Trucks

Renault

Trucks

Mack

Trucks

2005

2004

Volvo

CE

Buses

28 28 17

16

11 1135 34 14 13

Mack Trucks, 10%

Renault Trucks, 15%

Volvo Trucks, 48%

Buses, 6%

Volvo CE, 20%

Other, 1%

Credit portfolio

by business area, %

Volvo Group 2005 71