Volvo 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

92 Volvo Group 2005

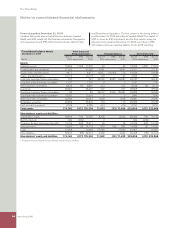

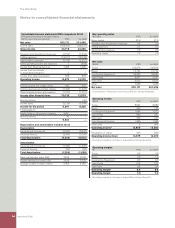

Notes to consolidated fi nancial statements

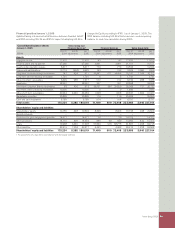

Fair value of derivative instruments

In accordance with IAS 39, which is applied by Volvo as of January 1,

2005, all derivative fi nancial instruments should be reported in the

balance sheet at fair value. The difference between IAS 39 and

accounting principles applied for derivative fi nancial instruments

under Swedish GAAP is dependent on the use of the derivative

instruments:

– Derivative fi nancial instruments used for hedging of forecasted

commercial cash-fl ows and forecasted electricity consumption:

Under Swedish GAAP Volvo has applied hedge accounting for the

main part of these derivatives and these instruments have conse-

quently not been reported in the balance sheet (“Off-balance sheet

instruments”). Gains and losses on these contracts have been

charged to the income statement at the time of maturity of the spe-

cifi c contracts. Under IFRS, the fair value of outstanding derivative

instruments is debited or credited to a separate component of equity

to the extent the requirements for cash-fl ow hedge accounting are

fulfi lled. To the extent that the requirements are not met, the unreal-

ized gain or loss is charged to the income statement.

– Derivative fi nancial instruments used for hedging of interest-rate

risks and currency-rate risks on loans:

Under Swedish GAAP Volvo has applied hedge accounting for these

derivatives and the carrying value of such derivatives has therefore

corresponded to currency-rate and interest-rate gains and losses

accruable up to the reporting date. Under the more complex rules in

IAS 39 Volvo has chosen not to apply hedge accounting for interest

rate contracts. The difference between carrying values reported

under Swedish GAAP and fair values to be reported under IFRS per-

tains to unrealized interest rate gains and losses attributable to the

period between the reporting date and maturity dates of the deriva-

tives. The difference should be charged to income over the hedged

instrument’s remaining time to maturity. The unrealized gains and

losses will be charged to the fi nancial net in the income statement.

Derecognition of fi nancial assets

In accordance with IAS 39, which ís applied by Volvo as of January 1,

2005, fi nancial assets should be derecognized from the balance

sheet when substantially all risks and rewards have been transferred

to an external party. Under Swedish GAAP, fi nancial assets should

be derecognized at settlement or if the ownership of the fi nancial

assets has been transferred to an external party. The transition

effect on January 1, 2005, attributable to this accounting change is

mainly related to certain dealer fi nancing arrangements for which

Volvo has retained components of credit risk. Such credit risk com-

mitments have under Swedish GAAP been reported as contingent

liabilities. This has mainly affected the segment reporting and to a

less extent Volvo’s consolidated balance sheet.

Consolidation of temporary investments

Under Swedish GAAP, temporary investments in subsidiaries should

not be consolidated. Under IFRS, all subsidiaries should be consoli-

dated. Restatements and transition effects relating to this account-

ing change pertains mainly to Volvo’s investment in the LB Smith

distribution business. This operation was acquired in May 2003 and

at December 31, 2004 the major part of this operation had been

divested. The 2004 income statement is restated with the parts of

LB Smith that have been divested during the year. The remaining

part, still owned by Volvo, has been consolidated in full according to

Swedish GAAP in the fourth quarter of 2004.

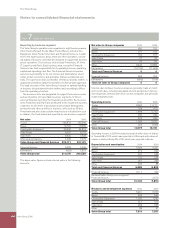

IFRS 2 Share-based Payments

Volvo has decided that the “new share-based incentive program”

adopted at the 2004 Annual General Meeting is covered by IFRS 2

Share-based payments. The impact, however, was limited. The IFRS

2 distinguishes between “cash-settled” and “equity-settled” compo-

nents of share-based payments, in Volvo cases, shares. The Volvo

program include both a cash-settled and an equity-settled part. The

equity-settled part was earlier accounted for at fair value and pro-

vided for as an accrued expense over the vesting period with a “true

up” each reporting date. According to IFRS 2 the fair value is deter-

mined at the grant-date, recognized as an expense during the vest-

ing period and credited to equity. Additional social costs are

reported as a liability and is revalued at each balance sheet day in

accordance with URA 46.

IFRS 5 Non-Current Asset Held for Sale

and Discontinued Operations

IFRS 5 is applied prospectively from January 1, 2005, according to

IFRS 1. Volvo had not identifi ed any non-current assets that could be

classifi ed held for sales and which would have had material impact

on the balance sheet as of December 31, 2004 and no effect has

been identifi ed in the 2004 income statement. Discontinued opera-

tions pertain to signifi cant operations, such as operating segments,

comprising one or more cash-generating units. The rules for discon-

tinued operations have not been applicable for Volvo during 2004

and 2005.

Other transition rules according to IFRS 1

and IFRS standards

In applying IFRS, Volvo had the possibility to chose to measure prop-

erty, plant and equipment at fair value. Volvo has chosen not to use

this possibility but continue the present valuation of property, plant

and equipment at historical cost less accumulated depreciation. The

same treatment is also used for investment properties. IFRS 1 pro-

vides an option how to treat the effects of Changes in Foreign

Exchange Rates, according to IAS 21. A fi rst time adopter of IFRS

could set the cumulative translation difference to zero for foreign

operations. Volvo has chosen this possibility and set the translation

difference to zero at January 1, 2004. Assumptions made under pre-

vious GAAP shall not be changed under the transition to IFRS

unless there is objective evidence that those were in error. Volvo has

made no changes in assumptions in the preparation of comparative

information prepared in accordance with IFRS. According to SIC 12,

Special Purpose Entities should be consolidated as from January 1,

2004. Volvo has not identifi ed any such Special Purpose Entities.

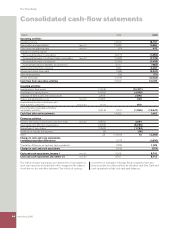

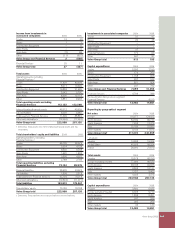

Defi nition of cash and cash equivalents in

presentation of cash-fl ow statements

Under Swedish GAAP, all investments in marketable debt securities

have been included in the defi nition of cash and cash equivalents for

the purpose of the cash-fl ow statement. In accordance with Volvo’s

fi nancial risk policy, all such securities should fulfi ll requirements

regarding low risk and high liquidity. Under IFRS, investments in mar-

ketable securities are excluded from the defi nition of cash and cash

equivalents for the purpose of the cash-fl ow statement if these

instruments have maturity dates beyond three months from the date

of investment. In the 2004 closing no marketable securities were

defi ned as cash equivalents according to IFRS. Classifi cation of cash

and cash equivalents in the cash-fl ow statement does not affect

Volvo’s net fi nancial position.