Volvo 2005 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

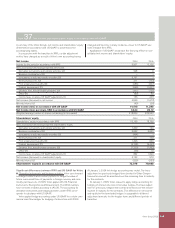

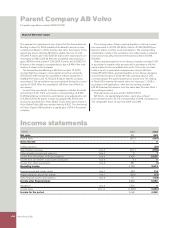

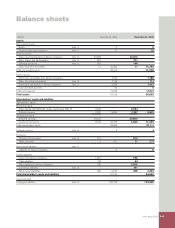

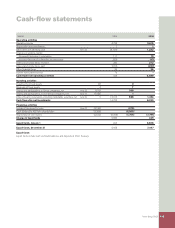

Parent Company AB Volvo

134 Volvo Group 2005

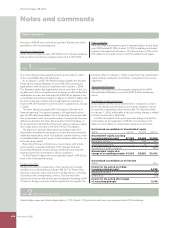

General information

Am ou nt s in SEK M un le s s othe rwi se spe ci fi ed. Th e amou nt s wit hi n

pa re nt he se s refe r to prec e di ng yea r.

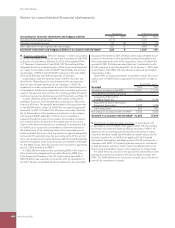

Intra-Group transac tions

O f the Pare nt Com pa n y ’s sal e s , 567 (426) w er e to G r ou p comp a ni e s

an d purch a se s fro m Gro up com pa ni e s amo unt e d to 35 6 (126).

Fe e s to au di t or s

Fe e s and othe r remu ne r at i on s pai d to exte r na l audi t or s for the fi sca l

ye ar 20 0 5 tot a le d 31 (26), of whic h 10 (13) for audi ti ng , dis t r ib u te d

betwe en Pr i ce wa te r h ou se C o op e r s , 10 (13) and other s, 0 (0), and 21

(13) rela te d to n o n- au di t servi c e s fro m Pri c ew at er h ou se C o o pe r s .

Note 1 Accounting principles

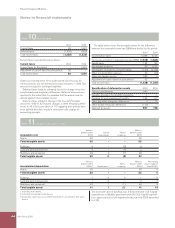

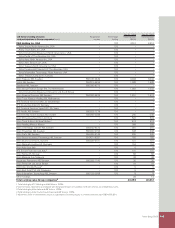

Note 2 Administrative expenses

Administrative expenses include depreciation of 1 (1) of which 1 (1) pertain to machinery and equipment and 0 (0) to buildings.

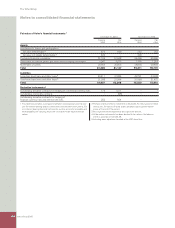

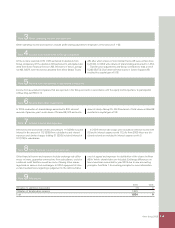

Summarized reconciliation of shareholders’ equity

SEK M 040101 041231 050101

Shareholders’ equity according

to previous Annual report 60,768 53,668 53,668

Revaluation of loans 235 283 283

Share-based payments – 14 14

Investments in listed companies – – (501)

Shareholders’ equity after

change of accounting principle 61,003 53,965 53,464

Summarized reconciliation of net income

SEK M 2004

Income for the period according

to previous Annual report 5,098

Revaluation of loans 66

Deferred tax (18)

Income for the period after change

of accounting principle 5,146

The accounting principles applied by Volvo are described in Note 1

to the cons ol id a te d fi nanc i al sta te me nts .

As of Jan ua ry 1, 200 5 , the Par en t Com pa ny ap pl i e s the Swedi sh

Fi na n ci a l Acc ou nt in g Sta nd a rd s Coun c il ’s RR 32 Ac c ou nt in g for

le ga l ent it i e s , wit h ret ro act i ve re s t at e me nt fro m Jan ua ry 1, 2 0 0 4.

Th e Sta nd a rd me an s that le ga l ent it i e s whos e secu r i ti e s on the clos-

ing dat e are lis te d on a Swe d ish st o ck exch a ng e or othe r auth or i ze d

ma r ket p la c e as main ru le sha ll ap pl y the IF R S/ I A S as app li e d in t h e

co nso li d ate d acc o unt in g . Com pa r is on fi gu re s for 200 4 , in t a b le s and

the note s, hav e bee n res t at e d wher e app li c a bl e . An exce pt io n is

how ev er IA S 39 Fina n ci a l Inst r um en t s whic h is appl ie d as of J a nu ary

1, 200 5 .

Th e Vol vo Gro up has ado pte d IA S 19 Emp lo ye e Ben efi ts in i t s

fi nan ci a l rep orti ng. Th e par en t comp a ny is stil l app l y in g the pri nc i-

ple s of FA R ’s Rec om me nd a ti on No . 4 “Acc o unt in g of pensi o ns lia bi l-

it ie s and pe nsi o n cos t s” as in prev i ou s yea r s . Con se qu e nt l y ther e are

diffe re nc e s betwe en the Volvo Gro up and the Pa re nt Co mp a ny in

the acc o unt in g for defi n ed -b e ne fi t pe nsi o n plan s as well as in v al ua -

tio n of p l an as se t s inve st e d in t he Vol vo Pens io n Foun da ti on .

Th e diff er en c e bet w e en dep re c ia ti o n acco rd in g to p l an and

de pr ec i at io n allo wa b le for tax purp o se s is r ep o rted as acc um ul at ed

add i ti on a l depr e ci at io n , whi ch is inclu d ed in untaxe d res erve s . In the

co nso li d ate d ba la nc e she et a sp li t is made betw e en defe r re d tax lia-

bil i t y an d equi ty ca p ita l .

Rep orti ng of Grou p cont r ibu t io ns is in ac c or d an c e with a s t a te -

men t issu ed by a sp e ci a l comm itte e of th e Swed ish Fi na nc i a l

Ac co un ti ng Sta nd a rd s Cou nc il . Gro up co ntr i bu t io ns are rep o rt e d

am on g Inco m e from inve s t me nt s in Grou p comp a nie s.

For the Par en t Com pa ny the mos t impo rta n t impact of RR 32 ha s

be en in the follo w in g thre e are as :

He dg e acc ou nt in g

He dg e acc ou nt in g in a leg a l enti ty of net i nv e st m en t s in fo re i gn

op er a ti on s is no t per mi tt e d acco rd in g to R R 32. T h e Pare nt Co m-

pa ny has in prev i ou s year s use d a lo a n to h ed g e shar e s in a fore ig n

subs id ia ry in t he cor re s po nd in g cur re nc y. Thi s loa n has bee n

rep o rted at hist or i c a l rate an d not b e e n reva lu at e d . Acco r din g to IA S

21 lo an s in fo re i gn cur re nc i e s shal l be r ep o rted at clos in g rate . Th e

tr an si ti o n ef fe c t on Janu a ry 1, 200 4, is repo rte d in th e shar e ho ld e rs’

equ i t y wh er e as rev a lu at io n as of 2 0 04 is rec og ni ze d in t he inc om e

statement .

Share-based Payments

Th e new shar e- b as e d ince nt i ve pro gr a m adop te d at t he 20 0 4

An nu al Ge ne r a l Meet in g is c ov e re d by I F R S 2 Sh a re -b a se d pay -

ments.

Inv e st m en t s in ot he r com pa ni e s

In acc or da n ce wi th IA S 39, all inve s t me nt s in comp a ni es, exc ep t if

the s e inve st m en t s are cla ss i fi e d as ass oc i ate d com pa n ie s , sho ul d

be rep orte d in t he ba la n ce she et at fair va lu e . The tra ns it i on ef f ect

on Jan ua ry 1, 20 0 5 , at t ri bu t a b le to this acc ou nt ing ch an ge is rela te d

to Vol vo’s inve s tm e nt in D e utz AG

A f u rt he r des cr i pt io n of t he mos t imp ort an t cha ng e s for the P a r-

ent Co mp a ny by t he app l ic a ti on of RR 32 is found be lo w in th e

ta b le s of reco nc i li at io n of sh a re ho l de r s’ equi ty an d net i nc o me .

Notes and comments