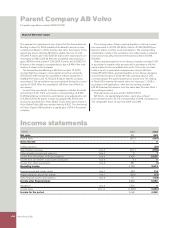

Volvo 2005 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

126 Volvo Group 2005

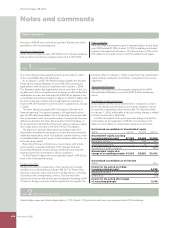

Notes to consolidated fi nancial statements

Net income Shareholders’ equity

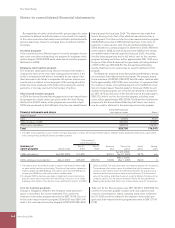

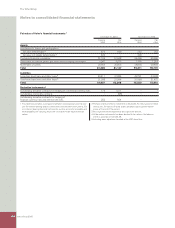

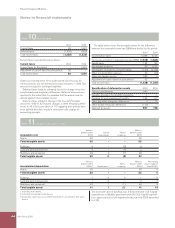

Accounting for derivative instruments and hedging activities 2004 2005 2004 2005

Derivatives Commercial exposure (117) – 1,170 –

Derivatives Financial exposure 23 (4) 672 (3)

Basis adjustment on derecognised fair value hedges 322 13 (542) 143

Derivative instruments and hedging activities in accordance with US GAAP 228 9 1,300 140

B. Business combinations. Effective January 1, 2004, acquisitions

of certain subsidiaries in Volvo are reported in accordance with IFRS

3, Business Combinations. Effective in 2002, Volvo adopted SFAS

141 “Business Combinations” and SFAS 142 “Goodwill and Other

Intangible Assets” in its determination of Net income and Sharehold-

ers’ equity in accordance with US GAAP. Substantially, the account-

ing principles in IFRS 3 and US GAAP correspond. The main differ-

ence being that they have different periods of transition.

In accordance with the transition rules of SFAS 142, Volvo has

identifi ed its “Reporting units” and determined the carrying value

and fair value of each reporting unit as of January 1, 2002. No

impairment loss was recognized as a result of the transitional good-

will evaluation. Furthermore, impairment tests have been performed,

yearly in the year end close process, for existing goodwill. No impair-

ment loss has been recognized as a result of these tests, see Note 14.

In 2001, AB Volvo acquired 100% of the shares in Renault V.I.

and Mack Trucks Inc. from Renault SA in exchange for 15% of the

shares in AB Volvo. The goodwill attributable to this acquisition was

set at SEK 8.4 billion. Under US GAAP the corresponding goodwill

amounted to SEK 11.5 billion. The difference was mainly attributa-

ble to determination of the purchase consideration. In accordance

with Swedish GAAP applicable in 2001, when a subsidiary is

acquired through the issue of own shares, the purchase considera-

tion is determined to be based on the market price of the issued

shares at the time the transaction is completed. In accordance with

US GAAP, such a purchase consideration is determined based on

the market price of the underlying shares for a reasonable period

before and after the terms of the transaction are agreed and publicly

announced. The goodwill value has been reduced by 974 in accord-

ance with an agreement reached between AB Volvo and Renault SA

about the fi nal value of the acquired assets and liabilities in Renault

V.I. and Mack Trucks. Volvo has chosen not to account for aquisitions

prior to 2004 according to IFRS 3.

In 1995, AB Volvo acquired the outstanding 50% of the shares in

Volvo Construction Equipment Corporation (formerly VME) from

Clark Equipment Company in the US. Surplus value (goodwill) of

SEK 2.8 billion was reported in conjunction with the acquisition. In

the Volvo Group’s consolidated fi nancial statements, the sharehold-

ing was written down by SEK 1.8 billion, which was estimated to cor-

respond to that portion of the goodwill that was attributable to the

Volvo trademark at the time of the acquisition. Under US GAAP, the

goodwill of SEK 2.8 billion was amortized over its estimated useful

life (20 years) up to and including 2001. As of January 1, 2002, and

in accordance with SFAS 142 (see above), no planned amortization

of goodwill is made.

Under IFRS no yearly amortization of goodwill is made. This corre-

sponds with US GAAP and no adjustment of net income is made in

2005.

Shareholders’ equity

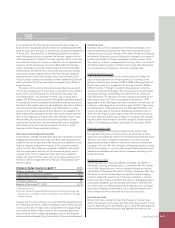

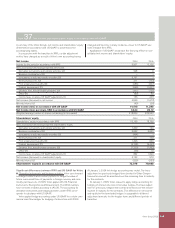

Goodwill 2004 2005

Goodwill in accordance with IFRS 10,321 11,072

Items affecting reporting of goodwill:

Acquisition of Renault V.I.

and Mack Trucks Inc. 3,744 3,744

Acquisition of Volvo Construction

Equipment Corporation 1,328 1,328

Other acquisitions 860 860

Net change in accordance with US GAAP 5,932 5,932

Goodwill in accordance with US GAAP 16,252 17,004

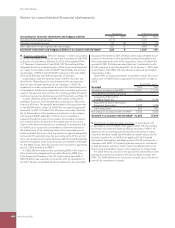

C. Investments in debt and equity securities. In accordance with

In accordance with US GAAP, Volvo applies SFAS 115: “Accounting

for Certain Investments in Debt and Equity Securities.” SFAS 115

addresses the accounting and reporting for investments in equity

securities that have readily determinable fair market values, and for

all debt securities. As of 2005, Volvo applies IAS 39, Financial

Instruments: Recognition and Measurement. IAS 39 corresponds in

substance with SFAS 115 regarding the accounting for investments

in debt and equity securities, which means that adjustments to net

income and shareholders’ equity in this regard are no longer made.

For 2004 Volvo has chosen not to account for investments in debt

and equity securities according to IAS 39, see Note 3 Impact from

IFRS. The 2004 difference in net income is mainly due to the divest-

ment of the investment in Scania.