Volvo 2005 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo Group 2005 135

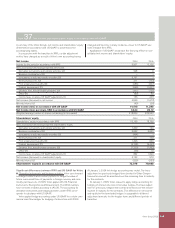

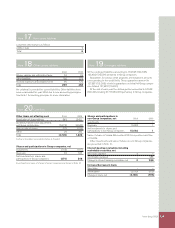

Note 9 Allocations

2004 2005

Allocation to additional depreciation (1) 0

Utilization of tax allocation reserves 1,525 –

Total 1,524 0

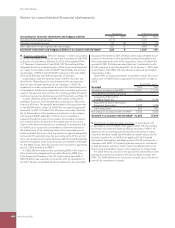

Note 7 Interest income and expenses

Interest income and similar credits amounting to 114 (294), included

interest in the amount of 112 (289) from subsidiaries and interest

expenses and similar charges totaling 31 (238), included interest of

31 (213) to subsidiaries.

In 2004 interest-rate swaps were included in interest income with

53 and in interest expenses with 112. As from 2005 these are dis-

closed net and are included in interest expenses with 3.

Note 5 Income from investments in associated companies

Income from associated companies that are reported in the Group accounts in accordance with the equity method pertains to participation

in Blue Chip Jet HB 0 (–1).

Note 6 Income from other investments

In 2004 revaluation of shareholdings amounted to 820, whereof

reversal of previous year’s write-down of Scania AB, 915 and write-

down of Henlys Group Plc, 95. Divestment of total shares in Bilia AB

resulted in a capital gain of 28.

Note 4 Income from investments in Group companies

Of the income reported, 9,161 (101) pertained to dividends from

Group companies. Of the dividend, 394 pertained to anticipated divi-

dend from Volvo Financial Services AB. All shares in Volvo Lastvag-

nar AB, 8,678, were received as dividend from Volvo Global Trucks

AB, after which shares in Volvo Global Trucks AB were written down

by 8,420. In 2004 write-downs of shareholdings amounted to 1,364.

Transfer price adjustments and Group contributions total a net of

5,360 (5,673). Divestment of total shares in Celero Support AB

resulted in a capital gain of 518.

Note 3 Other operating income and expenses

O th er ope r at in g i nc o me and exp en se s incl ud e profi t sh ar in g pay me nt s to e mp l oye e s in t he amo unt of 1 (0).

Note 8 Other fi nancial income and expenses

O th er fi nan ci a l inc om e and exp e nse s inc lu d e excha n ge ra te differ-

enc e s on loa ns , gua r a nt ee co mmi s si on s from subs id ia r i e s , cos t s for

co nfi rme d cre di t fac ili t ie s as wel l as cos t s of h a v in g Vol vo sha re s

re gi s te re d on var io us st o ck exch a ng e s . In 20 04 rep a y me nt of inter-

es t and re si du a l taxes re ga r di ng a j udgement in the Administr ative

co urt of a pp e a l and exp e ns e s for dist r ib u ti o n of t he sha re s in Ain ax

AB to Vol vo’s sha re h ol d er s are inc lu d e d . E xc ha n ge diffe re nc e s on

loa n s have bee n rec o un te d for yea r 200 4 due to new a c c ou nt in g

pr in c ip le s. Se e Note 1 A c c ou nt in g pri nc ip le s for mor e info r ma ti on.