Volvo 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The other business areas also reported favorable

order bookings during the latter half of 2005 and our

assessment is that all business areas will bene fit from

competitive products and continued strong demand

during 2006.

Naturally, there are risks inherent in implementing

such comprehensive changes in a period of high pro-

duction volumes. As expected, production costs rose

during the fourth quarter, due among other factors to

using old and new production systems in parallel com-

bined with high utilization during the transition period,

in primarily 2006.

This applies, among other, to Renault Trucks, which

is consolidating from three to two assembly plants, and

Volvo Powertrain, which is transitioning from eighteen

to two engine families.

On the other hand, we view the situation of

implementing changes in a period of

strong demand and favorable prof-

itability as an advantage.

We have previously carried

out a number of efficiency

enhancements and improve-

ments within the distribu-

tion and service network.

Combined with the new

industrial and product

structures, this provides us

highly favorable possibilities

to further advance pos itions

on the market in the coming

years. The new product lines are

well on their way to becoming

the most competitive ever.

Standing solidly on the

new and more efficient

structure, we are mov-

ing forward with our

long-term object-

ives.

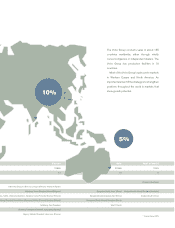

We think that a major share of our future growth will

occur in Asia. A major future issue is how we can best

gain ground in the Chinese and Indian markets.

We have had a cautious strategy, with relatively

modest risk-taking, but our involvement in Asia is

long term.

At the same time we are working to broaden our

customer offering. In this respect, our increased

efforts in the area of customer financing have been

highly successful.

Environmental issues are also high on the agenda.

In addition to the aforementioned new engine gener-

ation, we have also accelerated the intensity in devel-

opment of alternative drivelines, with the diesel engine

as the base. We have developed a unique hybrid con-

cept for heavy vehicles that reduces fuel consumption

significantly. Combined with new and more cost-effi-

cient battery technology, it can be a commercially

viable alternative on the market within a few years. We

are also conducting promising trials using non-fossil

fuel to power diesel engines.

Our position as the world’s largest manufacturer of

heavy diesel engines naturally provides a solid base

for this development work.

The rapid rate of change and the sharply improved

earnings during 2005 could not have been achieved

without the excellent efforts of the personnel at our

various units. I would like to take the opportunity to

thank everyone for a work very well performed. As a

result of the increase in the return on shareholders’

equity from slightly less than 14% to nearly 18%, our

global employee profit-sharing program received a

maximum allotment of SEK 450 M.

We have high expectations for continued growth

and increased profitability over the business cycle and

are looking forward to continue developing the Group.

We anticipate yet another exciting year in 2006.

Leif Johansson

President and CEO

7