Volvo 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

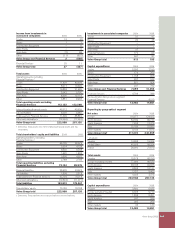

Volvo Group 2005 91

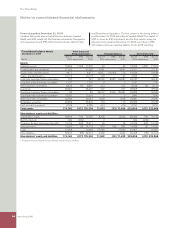

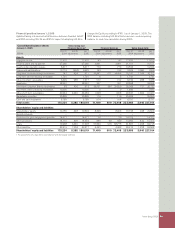

Note 3 Impact of IFRS

Reporting in accordance with IFRS as from 2005

The Volvo Group’s fi nancial reporting is up to 2004 prepared in

accordance with generally accepted accounting principles in Swe-

den (“Swedish GAAP”). Effective from 2005, all listed companies

within the European Union (“the EU”) are required to prepare their

consolidated fi nancial reporting in accordance with International

Financial Reporting Standards (“IFRS”), as adopted by the EU. The

purpose of the presentations on the following pages is to describe

and explain the expected impact on Volvo’s fi nancial reporting as a

consequence of transition to IFRS. Volvo Group’s previous account-

ing principles are described in Note 1 of the 2004 Annual Report.

The presentation below focuses on the areas in which the transition

to IFRS resulted in a change in accounting principles for Volvo.

Restatements and transition effects

In accordance with the IFRS transition rules (IFRS 1), Volvo applies

IFRS as of January 1, 2005, with retroactive application from the

IFRS transition date at January 1, 2004. The general rule is that

restatement of fi nancial reporting for periods after the transition

date should be made as if IFRS has been applied historically. There

are certain exceptions from the general rule of which the most sig-

nifi cant for Volvo are:

– IAS 39 Financial instruments: Recognition and measurement

which can be applied from January 1, 2005.

– Non-amortization of intangible assets with indefi nite useful lives

(e.g. goodwill) in accordance with IFRS should be applied retro-

actively only from the transition date January 1, 2004.

– IFRS 3 Business Combinations which can be applied from January

1, 2004, without restatements of previous acquisitions.

– IFRS 2 Share-based payments are applied for share-based pay-

ments granted after November 7, 2002.

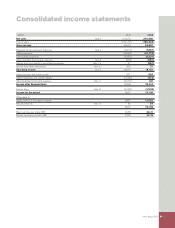

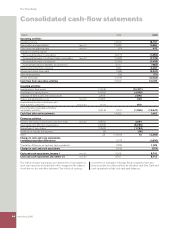

The enclosed income statements and other specifi cations prepared

in accordance with IFRS therefore include restatements and transi-

tion effects as follows:

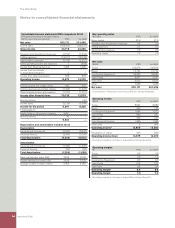

Capitalization and amortization of development costs

Effective on January 1, 2001, Volvo adopted the accounting stand-

ard RR 15 “Intangible Assets” under Swedish GAAP. According to

this accounting standard, expenditures relating to development of

new and existing products and software should be capitalized and

amortized over their estimated useful life. According to the transition

rules for RR 15, no retroactive application was permitted. According

to the transition rules for IFRS, the accounting standard IAS 38,

Intangible Assets, which is mainly similar to RR 15 regarding the

accounting for development costs, should be applied retroactively for

development costs incurred prior to 2001. The restatements and

transition effects attributable to this accounting change therefore

pertains to retroactive capitalization and amortization of develop-

ment costs incurred prior to 2001.

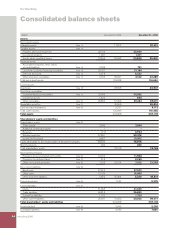

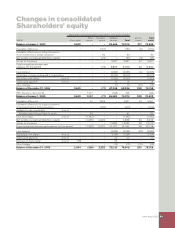

Minority interests

In accordance with IFRS, minority interests are presented as a sepa-

rate component of Shareholders’ equity and is included in the

income for the period in the income statement.

Non-amortization of intangible assets

with indefi nite useful lives

According to Swedish GAAP, all intangible assets have been amor-

tized over their estimated useful lives. In accordance with IFRS,

intangible assets considered to have indefi nite useful lives should

not be amortized. Such assets should rather be subject to an annual

impairment test. Volvo has determined that intangible assets with

indefi nite useful lives include only goodwill. Volvo has chosen not to

apply IFRS 3, retroactively in accodance with the IFRS transition

rules. The restatements and transition effects attributable to this

accounting change therefore pertain to reversal of goodwill amorti-

zation charged to the income statement under Swedish GAAP for

2004 and a corresponding increase of the carrying value of goodwill

at December 31, 2004, adjusted for currency translation differences.

Employee benefi ts

Effective on January 1, 2003, Volvo adopted RR 29 “Employee ben-

efi ts” under Swedish GAAP. RR 29 is similar to the IFRS accounting

standard IAS 19. The only difference between Swedish GAAP and

IFRS relates to the date of transition. In accordance with the transi-

tion rules of RR 29, actuarial gains and losses arising prior to Janu-

ary 1, 2003, were set to zero and charged to equity as of the transi-

tion date. In accordance with the IFRS transition rules, actuarial

gains and losses arising prior to January 1, 2004, could be set to

zero and charged to equity as of the transition date. The transition

effects attributable to the accounting change therefore pertain to

recognizing actuarial gains and losses that have arisen between

January 1, 2003 and January 1, 2004. Volvo has applied URA 43

according to the statement from the Swedish Financial Accounting

Standards Council in calculating the Swedish pension liabilities, in

addition to IAS 19.

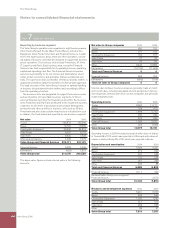

Investments in other companies

Volvo accounts for all investments in companies, except if these

investments are classifi ed as associated companies in accordance

with IAS 39, Financial Instruments: Recognition and Measurement.

Companies listed on a fi nancial exchange should be reported in the

balance sheet to market value. Under Swedish GAAP such invest-

ments have been carried at their cost of acquisition unless there has

been a permanent decrease in value. Under IAS 39, unrealized gains

and losses attributable to the fair value of investments are reported

in a separate component of shareholders’ equity except when a

decline in value is other than temporary. The transition effect on

January 1, 2005, attributable to this accounting change is mainly

related to Volvo’s investment in Deutz AG.

progress of the case (including progress after the date of the fi nan-

cial statements but before those statements are issued), the opin-

ions or views of legal counsel and other advisers, experience in simi-

lar cases, and any decision of Volvo’s management as to how Volvo

intends to respond to the litigation, claim or assessment. To the

extent the determinations at any time do not refl ect subsequent

developments or the eventual outcome of any claim, our future fi nan-

cial statements may be materially affected, with an adverse impact

upon our results of operation, fi nancial position and liquidity.