Volvo 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

90 Volvo Group 2005

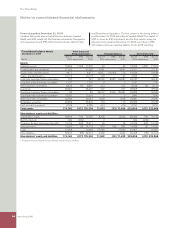

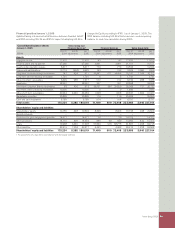

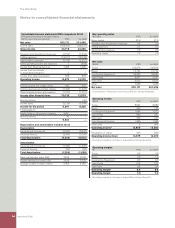

Notes to consolidated fi nancial statements

of the commitment. Estimated impairment losses are immediately

charged to income. The estimated net realizable value of the prod-

ucts at the end of the residual value commitments is monitored indi-

vidually on a continuing basis. In monitoring estimated net realizable

value of each product under a residual value commitment, manage-

ment makes consideration of current price-level of the used product

model, value of options, mileage, condition, future price deterioration

due to expected change of market conditions, alternative distribution

channels, inventory lead-time, repair and reconditioning costs,

handling costs and overhead costs in the used product divisions.

Provisions for residual value risk amount to 931.

Revenue recognition

Revenue from the sale of goods is recognized when signifi cant risks

and rewards of ownership have been transferred to external parties,

normally when the goods are delivered to the customers. If, however,

the sale of goods is combined with a buy-back agreement or a resid-

ual value guarantee, the sale is accounted for as an operating lease

transaction under the condition that signifi cant risks of the goods

are retained by Volvo. In certain cases Volvo enters into a buy-back

agreement or residual value guarantee after Volvo sold the product

to an independent party or in combination with an undertaking from

the customer that in the event of a buy-back to purchase a new

Volvo product. In such cases, there may be a question of judgement

regarding whether or not signifi cant risks and rewards of ownership

have been transferred to the customer. If it is determined that such

an assessment was incorrect, Volvo’s reported revenue and income

for the period will decline and instead be distributed over several

reporting periods.

Deferred taxes

Under IFRS, deferred taxes are recognized for temporary differ-

ences, which arise between the taxable value and reported value of

assets and liabilities as well as for unutilized tax-loss carryforwards.

Volvo records valuation allowances against deferred tax assets

where management does not expect such assets to be realized

based upon current forecasts. In the event that actual results differ

from these estimates or management adjusts these estimates in

future periods, changes in the valuation allowance may need to be

done that could materially impact our fi nancial position and the

income for the period. At December 31, 2005, a valuation allowance

of 2.972 was established for the value of deferred tax assets. Net of

this valuation allowance, deferred tax assets net of 10.216 were rec-

ognized in the Group’s balance sheet.

Inventory obsolescence

Inventories are reported at the lower of historical cost, in accordance

with the fi rst-in, fi rst-out method (FIFO), and net realizable value. The

estimated net realizable value includes management consideration

of out-dated articles, over-stocking, physical damages, inventory-

lead-time, handling and other selling costs. If the estimated net real-

izable value is lower than historical cost, a valuation allowance is

established for inventory obsolescence. The total inventory value, net

from inventory obsolescence allowance, is per December 31, 2005,

33.937.

Credit loss reserves

The establishment of credit loss reserves on customer fi nancing

receivables is dependent on estimates including assumptions

regarding past dues, repossession rates and the recovery rate on

the underlying collateral. At December 31, 2005, the total credit loss

reserves in Volvo Financial Services amounted to 2.17% of the total

credit portfolio, SEK 79 billions.

Pensions and other post-employment benefi ts

Provisions and costs for post-employment benefi ts, i.e. mainly pen-

sions and health-care benefi ts, are dependent on assumptions used

by actuaries in calculating such amounts. The appropriate assump-

tions and actuarial calculations are made separately for each popu-

lation in the respective countries of Volvo’s operations. The assump-

tions include discount rates, health care cost trends rates, infl ation,

salary growth, long-term return on plan assets, retirement rates,

mortality rates and other factors. Discount rate assumptions are

based on long-term high quality corporate bond and government

bond yields available at year-end. Health care cost trend assump-

tions are developed based on historical cost data, the near-term out-

look, and an assessment of likely long-term trends. Infl ation assump-

tions are based on an evaluation of external market indicators. The

salary growth assumptions refl ect the long-term actual experience,

the near-term outlook and assumed infl ation. Retirement and mortal-

ity rates are based primarily on offi cially available mortality statistics.

We review our actuarial assumptions on an annual basis and make

modifi cations to them when it is deemed appropriate to do so. Actual

results that differ from management’s assumptions are accumulated

and amortized over future periods and, therefore, generally affect the

recognized expense and recorded provisions in such future periods.

See Note 24 for more information regarding costs and assumptions

for post-employment benefi ts. At December 31, 2005 net provisions

for post-employment benefi ts amounted to 11.462.

Product warranty costs

Estimated costs for product warranties are charged to cost of sales

when the products are sold. Estimated warranty costs include con-

tractual warranty and goodwill warranty (warranty cover in excess of

contractual warranty or campaigns which is accepted as a matter of

policy or normal practice in order to maintain a good business rela-

tion with the customer). Warranty provisions are estimated with con-

sideration of historical claims statistics, the warranty period, the

average time-lag between faults occurring and claims to the com-

pany and anticipated changes in quality indexes. Differences

between actual warranty claims and the estimated claims generally

affect the recognized expense and provisions in future periods.

Refunds from suppliers, that decrease Volvo’s warranty costs, are

recognized to the extent these are considered to be virtually certain.

At December 31, 2005 warranty cost provisions amounted to 8.163.

Legal proceedings

Volvo only recognizes liabilities in the accounts where Volvo has a

present obligation from a past event, a transfer of economic benefi ts

is probable and Volvo can make a reliable estimate of what the

transfer might be. In instances such as these, a provision is calcu-

lated and recognized in the balance sheet. In instances where these

criteria are not met, a contingent liability may be disclosed in the

notes to the accounts. A contingent liability will be disclosed when a

possible obligation has arisen but its existence will only be con-

fi rmed by future events not wholly within Volvo’s control or in circum-

stances where an obligating event has occurred but it is not possible

to quantify the size or likelihood of that obligation crystallizing. Reali-

zation of any contingent liabilities not currently recognized or dis-

closed in the fi nancial statements could have a material effect on

Volvo’s fi nancial condition. Volvo regularly reviews signifi cant out-

standing legal cases following developments in the legal proceed-

ings in order to assess the need for provisions in our fi nancial state-

ments. Among the factors that Volvo considers in making decisions

on provisions are the nature of the litigation, claim or assessment,

the legal processes and potential level of damages in the jurisdiction

in which the litigation, claim or assessment has been brought, the