Volvo 2005 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2005 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Parent Company AB Volvo

138 Volvo Group 2005

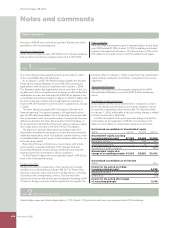

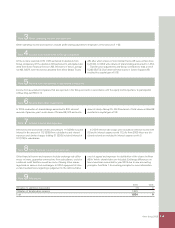

The valuation allowance for doubtful receivables amounted to 5 (5)

at the end of the year.

Of other receivables in 2004, 979 pertained to a receivable from

Renault SA. AB Volvo and Renault SA signed a settlement agree-

ment regarding the disagreement the companies have had since

2001 pertaining to Volvo’s acqusition of Renault V.I. According to

this settlement Renault SA transferred EUR 108 M to AB Volvo on

January 26, 2005.

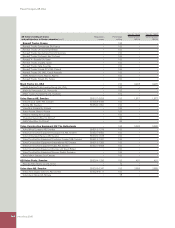

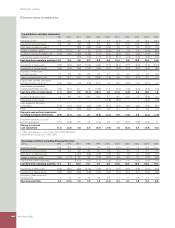

Note 13 Other short-term receivables

2004 2005

Accounts receivable 14 14

Prepaid expenses and accrued income 135 72

Other receivables 994 28

Total 1,143 114

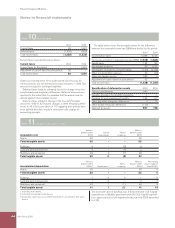

Note 14 Short-term investments in Group companies

Short-term investments in Group companies comprise deposits of 7,047 (6,558) in Volvo Treasury.

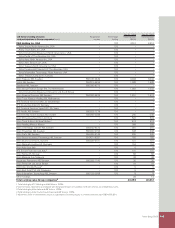

Note 15 Untaxed reserves

Value in Value in

The composition of, and changes balance sheet Allocations balance sheet

in, untaxed reserves: 2004 2005 2005

Accumulated additional depreciation

Land 3 – 3

Machinery and equipment 1 0 1

Total 4 0 4

Note 16 Provisions for pensions

Pro v is io ns for pensi on s and simil a r b e ne fi t s cor r e sp on d to th e act u-

ar i al ly ca l cu la te d valu e of o bl ig at io ns not insure d wit h thir d p a rt i es or

sec ur ed thr ou gh tra ns f er s of f un ds to p e nsi on foun da ti on s . The

am oun t of p en si ons fa lli ng due wit hi n one y e ar is inclu de d . AB Vol vo

ha s insure d the pens io n obli ga ti on s with thi rd parti e s . Of the amou nt

rep o rt e d , 0 (26) p e r ta in s to c on tr act u al obl ig at io ns wi thi n the fra me -

wor k of t he PRI (Pensi o n Re g is tr at i on Ins ti tu te) s ys t em . The

exc ha ng e in 200 5 of d efi ned- be ne fi t pe ns io n pla ns by defi n ed - co n-

tr ib u ti on pla n s for c e rt ai n seni or exec u ti v e s has resu l te d in a

de cr e a se of p r ov is io ns for pen si on s . For furthe r infor m at i on see

Not e 34 to t he con so li d at ed fi nan ci a l st a te me nts .

Th e Vol vo Pens io n Foun da t io n was for m ed in 1996 . Pl a n asse t s

am ou nt in g to 2 24 we re co nt r ib ut e d to t he fou nd at i on at its for m a-

tio n , cor r e sp o nd in g to t h e valu e of the p e ns io n obl ig at i on s at t ha t

tim e . Sin ce it s for m at io n , net con tr i bu t io ns of 25 ha ve be en mad e to

the fou nd at io n .

AB Volvo’s pen si on cos t s am ou nt ed to 93 (79).

Th e accu mul at ed be ne fi t obl ig at io n of a ll AB Vol vo’s pens io n obli -

gat io ns at year-e nd 20 05 amo un te d to 6 37, whi c h has bee n secu re d

in part t hr ou gh pro vi si on s for p e nsi ons an d i n part t hr ou gh fun ds in

pe nsi on foun da ti on s . Net asse t valu e in t he Pensi on Foun da ti on ,

ma rk ed to mar ket, a c cr ui ng to AB Vol vo was 53 high er tha n cor re -

sponding pension obligations .

Notes to fi nancial statements